Cash flow forecasting is a crucial aspect of financial planning for businesses of all sizes. It involves predicting the amount of cash that will flow in and out of a business over a specific period. By accurately forecasting cash flow, businesses can make informed decisions about managing their finances, identifying potential cash shortages, and planning for growth opportunities.

In this guide, we will explore what cash flow forecasting is, why it is important, what to include in a cash flow forecast, how to create one, and tips for successful cash flow forecasting.

What is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating the amount of cash that will be received and spent by a business in the future. It helps businesses predict their financial position and plan for upcoming expenses, investments, and growth opportunities. By accurately forecasting cash flow, businesses can avoid cash shortages, make strategic financial decisions, and ensure they have enough liquidity to cover their expenses.

Cash flow forecasting typically involves analyzing past financial data, current market conditions, and future business plans to predict cash inflows and outflows. It allows businesses to anticipate potential cash shortfalls and take proactive measures to address them before they become critical.

Why is Cash Flow Forecasting Important?

Cash flow forecasting is essential for businesses to ensure financial stability and plan for the future. Some key reasons why cash flow forecasting is important include:

- Identifying Cash Shortages: Cash flow forecasting helps businesses identify potential cash shortages in advance, allowing them to take proactive measures to address them.

- Planning for Growth: By forecasting cash flow, businesses can plan for growth opportunities, investments, and expansions without risking financial instability.

- Managing Expenses: Cash flow forecasting enables businesses to anticipate and plan for upcoming expenses, ensuring they have enough liquidity to cover their financial obligations.

- Making Informed Decisions: Accurate cash flow forecasts provide businesses with valuable insights to make informed financial decisions and mitigate risks.

Overall, cash flow forecasting is a critical tool for businesses to maintain financial health, plan for the future, and make strategic decisions that drive growth and profitability.

What to Include in a Cash Flow Forecast

When creating a cash flow forecast, there are several key components to include to ensure accuracy and relevance:

- Sales Forecasts: Estimate the amount of revenue expected from sales over the forecast period.

- Accounts Receivable: Predict the timing of customer payments and outstanding invoices to forecast cash inflows.

- Expenses: Include all anticipated expenses, such as rent, utilities, payroll, and inventory purchases.

- Accounts Payable: Estimate the timing of vendor payments and outstanding bills to forecast cash outflows.

- Capital Expenditures: Account for any planned investments in assets or equipment that will impact cash flow.

- Loan Repayments: Include any scheduled loan repayments or interest payments that will affect cash flow.

By including these components in a cash flow forecast, businesses can create a comprehensive financial plan that accurately predicts their cash position and enables strategic decision-making.

How to Create a Cash Flow Forecast

Creating a cash flow forecast involves the following steps:

1. Start by gathering historical financial data, such as income statements, balance sheets, and cash flow statements.

2. Develop sales forecasts based on market trends, historical data, and future projections.

3. Estimate expenses for the forecast period, including fixed costs, variable costs, and one-time expenses.

4. Project accounts receivable and accounts payable based on payment terms and historical payment patterns.

5. Factor in any capital expenditures, loan repayments, or other cash outflows that will impact cash flow.

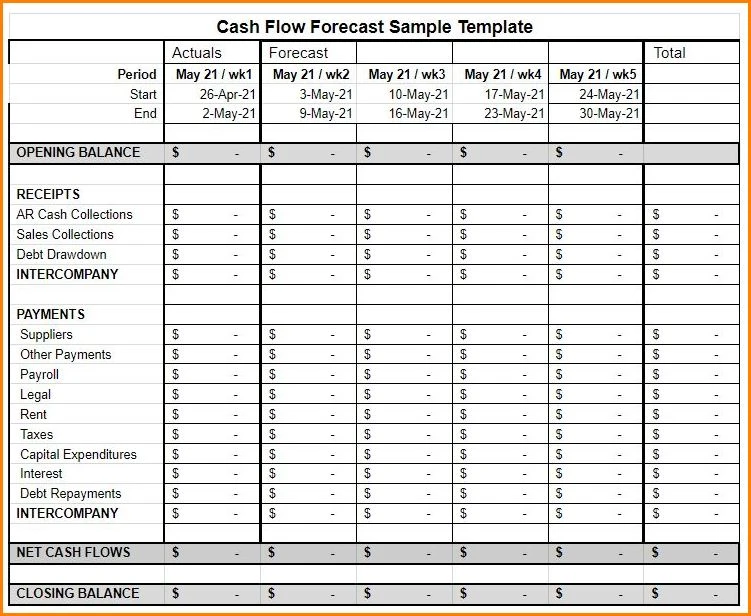

6. Compile all data into a cash flow forecast template or software program to calculate projected cash inflows and outflows.

7. Review the forecast regularly and adjust as needed to reflect changes in market conditions, business performance, or financial goals.

By following these steps, businesses can create a comprehensive cash flow forecast that provides valuable insights into their financial position and helps guide strategic decision-making.

Tips for Successful Cash Flow Forecasting

To ensure accurate and effective cash flow forecasting, consider the following tips:

- Use Realistic Assumptions: Base your forecasts on realistic assumptions about sales, expenses, and market conditions.

- Monitor Cash Flow Regularly: Review your cash flow forecast regularly and update it as needed to reflect changes in your business or market conditions.

- Consider Multiple Scenarios: Develop multiple scenarios for cash flow forecasting to prepare for different outcomes and risks.

- Seek Professional Advice: If you are unsure about creating a cash flow forecast, seek advice from a financial advisor or accountant to ensure accuracy and reliability.

- Integrate Cash Flow Forecasting into Your Business Strategy: Use cash flow forecasting as a strategic tool to guide decision-making, plan for growth, and mitigate financial risks.

By following these tips, businesses can enhance their cash flow forecasting process, improve financial planning, and ensure long-term financial stability and success.

Cash Flow Forecast Template – DOWNLOAD