When navigating the world of insurance, things can get a bit overwhelming. One term that often comes up in various industries is a “certificate of insurance.” But what exactly does it mean, and why is it important?

In this comprehensive guide, we will break down everything you need to know about certificates of insurance, from what they are to why they matter.

What is a Certificate of Insurance?

A certificate of insurance is a document that serves as proof of insurance coverage. It is typically issued by an insurance company or broker and provides details about the insurance policy held by a specific individual or entity.

This document is often requested by third parties, such as clients or business partners, to ensure that the insured party has adequate insurance coverage in place.

Why are Certificates of Insurance Important?

Certificates of insurance play a crucial role in risk management and liability protection. By providing proof of insurance coverage, these documents help to mitigate potential risks and protect parties involved in business transactions.

They also ensure that all parties are aware of the insurance coverage in place, helping to prevent any misunderstandings or disputes in the future.

What to Include in a Certificate of Insurance

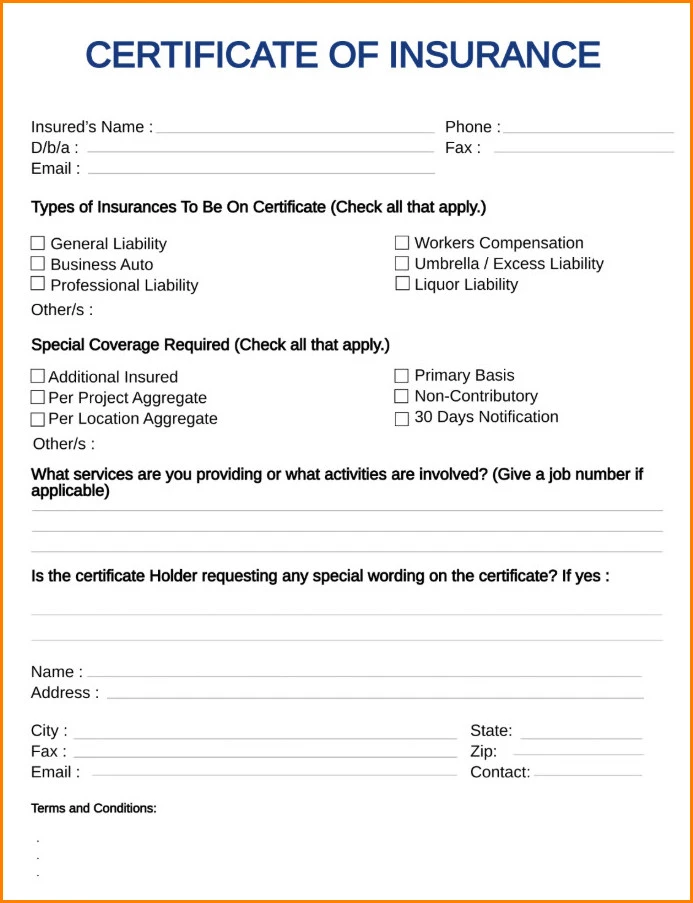

When reviewing a certificate of insurance, there are several key pieces of information to look for:

- Policyholder Information. This includes the name and contact information of the insured party.

- Insurance Company Details. The name and contact information of the insurance company providing coverage.

- Policy Details. Information about the type of insurance coverage, policy limits, effective dates, and any exclusions.

- Additional Insureds. Any additional parties that are covered under the insurance policy.

- Policy Endorsements. Any changes or modifications to the standard policy terms.

- Agent/Broker Information. Contact details for the insurance agent or broker who issued the certificate.

How to Obtain a Certificate of Insurance

If you need a certificate of insurance, you can typically request one from your insurance provider or broker. They will be able to generate a certificate with the necessary details and provide it to you in a timely manner. It’s important to ensure that the certificate contains all the required information and meets the specific requirements of the requesting party.

Tips for Successful Certificate of Insurance Management

Managing certificates of insurance can be a complex task, especially for businesses that deal with multiple clients and contracts. Here are some tips to help streamline the process:

- Centralize Documentation. Keep all certificates of insurance in a centralized location for easy access and reference.

- Stay Organized. Create a system for tracking certificate expiration dates and renewal requirements.

- Review Carefully. Thoroughly review all certificates to ensure they meet the requirements and accurately reflect the coverage in place.

- Communicate Effectively. Clearly communicate insurance requirements to vendors, contractors, and other parties to avoid any misunderstandings.

- Regularly Update Information. Stay on top of policy changes and updates to ensure that all certificates are current and accurate.

- Seek Professional Assistance. Consider working with a risk management professional to help with certificate management and compliance.

Conclusion

Certificates of insurance are a vital part of the insurance process, providing proof of coverage and protection for all parties involved in business transactions. By understanding what certificates of insurance are, why they are important, and how to manage them effectively, you can navigate the complexities of insurance with confidence and peace of mind.

Certificate of Insurance Template – DOWNLOAD