When borrowing or lending money to family or friends, it can often feel awkward or uncomfortable. However, establishing a loan contract can help ensure that both parties are clear on the terms of the loan, reducing the risk of misunderstandings and disputes.

Whether you are borrowing money from a sibling or lending funds to a close friend, having a written agreement in place can provide peace of mind and protect your relationship.

What Is A Loan Contract?

A loan contract is a legally binding document that outlines the terms and conditions of a loan between two parties. It serves as a formal agreement that specifies the details of the loan, including the loan amount, interest rate (if applicable), repayment schedule, and any collateral that may be used to secure the loan.

By documenting these terms in writing, a loan contract provides clarity and accountability for both the borrower and the lender.

Why Is A Loan Contract Important?

Having a loan contract in place is essential for several reasons.

Building Trust and Accountability

One of the primary benefits of a loan contract is that it helps build trust and accountability between the parties involved. By clearly outlining the terms of the loan, both the borrower and lender can feel confident that they are on the same page and that each party understands their responsibilities. This transparency can help foster a sense of trust and reliability in the relationship.

Preventing Misunderstandings

Without a written agreement in place, misunderstandings can easily arise between family members or friends involved in a loan transaction. A loan contract helps prevent misinterpretations or miscommunications by clearly defining the terms of the loan, including the repayment schedule, interest rates, and any other relevant conditions. By having everything in writing, both parties have a reference point to refer back to if there are any questions or disputes.

Protecting the Relationship

Money can be a sensitive topic, especially when it comes to lending or borrowing from loved ones. A loan contract can help protect the relationship between family or friends by establishing boundaries and expectations upfront. By setting clear terms in writing, both parties can avoid potential conflicts or disagreements that may arise if the loan terms were not clearly defined. This can help preserve the bond between family members or friends and prevent financial disputes from causing rifts in relationships.

Key Parts Of A Loan Contract

When drafting a loan contract between family or friends, it’s important to include the following key elements:

Loan Amount

The loan amount is a critical component of the loan contract and should be clearly stated in the agreement. This amount represents the total sum of money that is being borrowed by the borrower and must be specified in the contract to avoid confusion or disagreements later on. Both parties should agree on the exact loan amount before finalizing the contract.

Repayment Terms

The repayment terms outline how and when the borrower will repay the loan to the lender. This section of the contract should detail the repayment schedule, including the frequency of payments (e.g., monthly, bi-weekly) and the total duration of the repayment period. It should also specify the method of repayment (e.g., bank transfer, cash) and any penalties for late payments.

Interest Rate

If the loan agreement includes an interest rate, this should be clearly stated in the contract. The interest rate represents the cost of borrowing money and should be agreed upon by both parties before finalizing the contract. The contract should specify whether the interest rate is fixed or variable and how it will be calculated over the repayment period.

Collateral

In some cases, a loan contract may require collateral to secure the loan. Collateral is an asset that the borrower offers as security in case they are unable to repay the loan. Common forms of collateral may include real estate, vehicles, or valuable possessions. The contract should specify the collateral being used and outline the process for transferring ownership in the event of default.

Consequences of Default

In the unfortunate event that the borrower is unable to repay the loan on time, the contract should clearly outline the consequences of default. This may include late fees, additional interest charges, or legal action to recover the outstanding amount. By specifying the consequences of default in the contract, both parties are aware of the potential outcomes if the borrower fails to meet their obligations.

Signatures

Both parties should sign the loan contract to indicate their agreement to the terms and conditions outlined in the document. Signatures serve as proof that both the borrower and lender have read and understood the contents of the contract and have agreed to abide by its terms. Having signatures on the contract makes it a legally binding agreement that can be enforced in case of a dispute.

How To Write A Loan Contract Between Family Or Friends

When creating a loan contract with a family member or friend, it’s important to approach the process with care and consideration. Here are some steps to help you draft a clear and comprehensive agreement:

Communicate Openly

Open and honest communication is key when negotiating a loan contract with a family member or friend. Before drafting the agreement, have a candid discussion about the terms of the loan, including the loan amount, repayment schedule, interest rates, and any other relevant details. Make sure both parties are in agreement before moving forward with the contract.

Document Everything

It’s crucial to document all aspects of the loan agreement in writing to avoid any misunderstandings or disputes later on. Write down the loan amount, repayment terms, interest rates, collateral (if applicable), consequences of default, and any other provisions that are relevant to the agreement. Having a written record will provide clarity and protection for both parties.

Seek Legal Advice

Consider consulting a legal professional, such as a lawyer or financial advisor, to review the loan contract before finalizing it. A legal expert can ensure that the contract is legally enforceable and complies with relevant laws and regulations. They can also offer valuable guidance on how to structure the agreement to protect both parties and minimize potential risks.

Review and Revise

Before signing the loan contract, take the time to review the document carefully with the other party. Make sure that all the terms and conditions are accurately reflected in the agreement and that both parties are in agreement. If there are any discrepancies or concerns, make revisions as needed to ensure that the contract accurately reflects the intentions of both parties.

What Should I Do If My Family Member Or Friend Can’t Repay The Loan On Time?

In the unfortunate event that your family member or friend is unable to repay the loan on time, it’s important to handle the situation with sensitivity and understanding. Here are some steps you can take:

Discuss the Issue

Initiate an open and honest conversation with the borrower to understand their financial situation and why they are unable to repay the loan on time. Approach the discussion with empathy and offer support to help them find a solution to their financial challenges.

Modify the Repayment Plan

If the borrower is facing financial difficulties, consider modifying the repayment plan to make it more manageable for them. This could involve extending the repayment period, adjusting the payment schedule, or renegotiating the interest rates to accommodate their circumstances. Be flexible and willing to work together to find a solution that works for both parties.

Consider Mediation

If you’re unable to resolve on your own, consider seeking the help of a mediator to facilitate a fair agreement. A mediator can help facilitate communication between the parties and guide them towards a mutually acceptable solution. Mediation can be a valuable tool for resolving disputes amicably and preserving the relationship between family members or friends.

Legal Action

If all attempts to resolve the issue have been unsuccessful and the borrower is still unable to repay the loan, you may need to consider taking legal action as a last resort. Consult with a legal professional to explore your options for recovering the outstanding loan amount through legal means. This could involve filing a lawsuit against the borrower to enforce the terms of the loan contract and recoup the money owed.

Preserving the Relationship

While it can be challenging to navigate financial issues with family or friends, it’s important to prioritize preserving the relationship throughout the process. Approach the situation with empathy and understanding, recognizing that financial difficulties can be a sensitive topic. Communicate openly and honestly with the borrower to find a resolution that is fair and equitable for both parties.

Learning from the Experience

If the borrower is unable to repay the loan on time, it can be a learning opportunity for both parties. Reflect on the experience and consider what lessons can be gleaned from the situation. Think about how you can approach lending money in the future to mitigate risks and prevent similar issues from arising. Use the experience as a chance to improve communication and financial management within your relationships.

Seeking Financial Counseling

If the borrower is struggling to repay the loan due to financial challenges, encourage them to seek professional financial counseling or advice. A financial counselor can provide guidance on managing debts, budgeting effectively, and improving financial literacy. By equipping the borrower with the necessary resources and support, you can help them address their financial situation and work towards becoming more financially stable.

Revisiting the Loan Contract

If the borrower is unable to repay the loan on time, revisit the terms of the loan contract to determine the best course of action. Consider whether any modifications can be made to the repayment plan to accommodate the borrower’s financial circumstances. Communicate openly with the borrower to find a solution that is mutually agreeable and helps alleviate their financial burden.

Forgiving the Debt

In some cases, forgiving the debt may be the best course of action if the borrower is genuinely unable to repay the loan. While forgiving the debt may involve a financial loss for the lender, it can also help preserve the relationship and provide emotional relief for both parties. If forgiving the debt is a viable option, approach the decision with compassion and understanding.

Setting Boundaries

After experiencing challenges with lending money to a family member or friend, it may be necessary to set boundaries for future financial transactions. Consider establishing clear guidelines for lending money, including the types of loans you are comfortable offering, the repayment terms, and any conditions or requirements for the loan. By setting boundaries, you can protect yourself and your relationships from potential financial strain.

Communicating Expectations

When lending money to family or friends, it’s essential to communicate your expectations clearly from the beginning. Be upfront about the terms of the loan, including the repayment schedule, interest rates, and any other conditions. By setting clear expectations, you can avoid misunderstandings and ensure that both parties are on the same page regarding the loan agreement.

Seeking Alternative Solutions

If your family member or friend is unable to repay the loan on time, explore alternative solutions that may help address their financial challenges. This could involve offering financial assistance in other ways, such as helping them create a budget, connecting them with resources for financial support, or assisting them in finding additional sources of income. Be proactive in seeking solutions that can alleviate their financial burden.

Maintaining Empathy

Throughout the loan process and any challenges that may arise, it’s crucial to maintain empathy and understanding towards the borrower. Financial difficulties can be stressful and overwhelming, and approaching the situation with compassion can help strengthen your relationship and foster trust. Practice active listening, show empathy towards their circumstances, and work together to find a solution that benefits both parties.

Resolving Conflicts Amicably

If conflicts or disagreements arise during the loan repayment process, strive to resolve them amicably and constructively. Approach the situation with a willingness to listen, understand the other person’s perspective, and find common ground. Communication is key in resolving conflicts, so make an effort to address any issues openly and honestly to reach a mutually acceptable solution.

Reflecting on Personal Boundaries

After experiencing challenges with lending money to family or friends, take the time to reflect on your personal boundaries and financial limits. Consider what types of loans you are comfortable offering, how much risk you are willing to take on, and what conditions you need to set to protect yourself and your relationships. By establishing clear boundaries, you can navigate future financial transactions with greater confidence and clarity.

Learning from the Experience

Every experience, including lending money to family or friends, provides an opportunity for growth and learning. Take the time to reflect on the experience and consider what lessons you can take away from it. Think about how you can improve your approach to lending money in the future, what safeguards you can put in place to protect yourself, and how you can strengthen your relationships through transparency and communication.

Loan Contract Template Between Friends

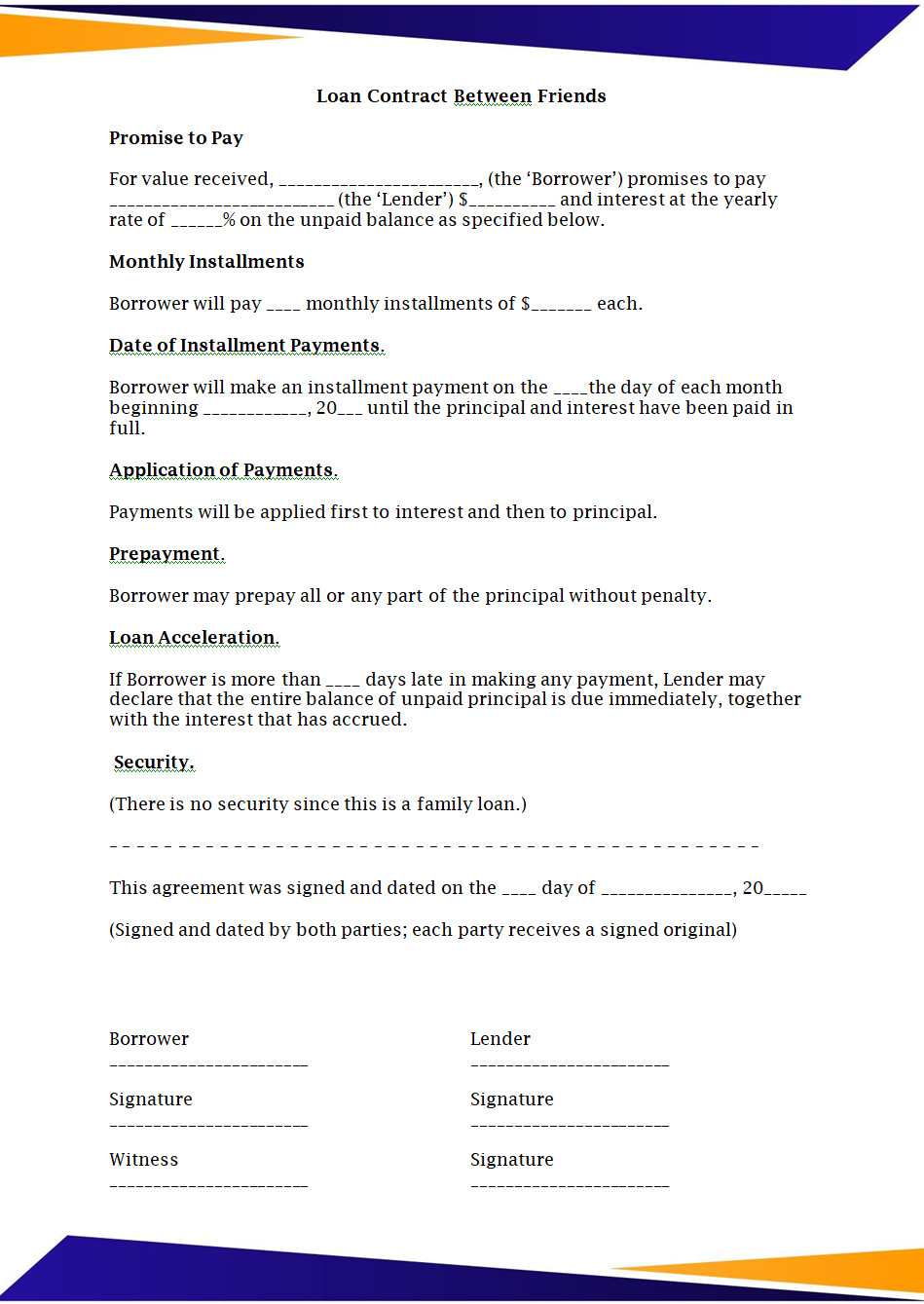

A loan contract between friends is a simple yet important document that outlines the terms of a personal loan to prevent misunderstandings and protect the friendship. It includes details such as the loan amount, repayment schedule, interest (if any), and signatures of both parties. This template ensures transparency and accountability while keeping the agreement friendly and fair.

Download and use our loan contract template between friends today to lend or borrow money with confidence, clarity, and mutual trust.

Loan Contract Between Friends – WORD