Are you considering buying or selling a business? If so, it is crucial to have a legally binding framework in place to ensure a smooth and transparent transaction.

A business purchase agreement serves as this framework, outlining the terms and conditions of the sale, the assets and liabilities involved, and the responsibilities of both parties. By clearly defining these key details, a business purchase agreement safeguards the interests of both the buyer and the seller, minimizing the risk of disputes and misunderstandings.

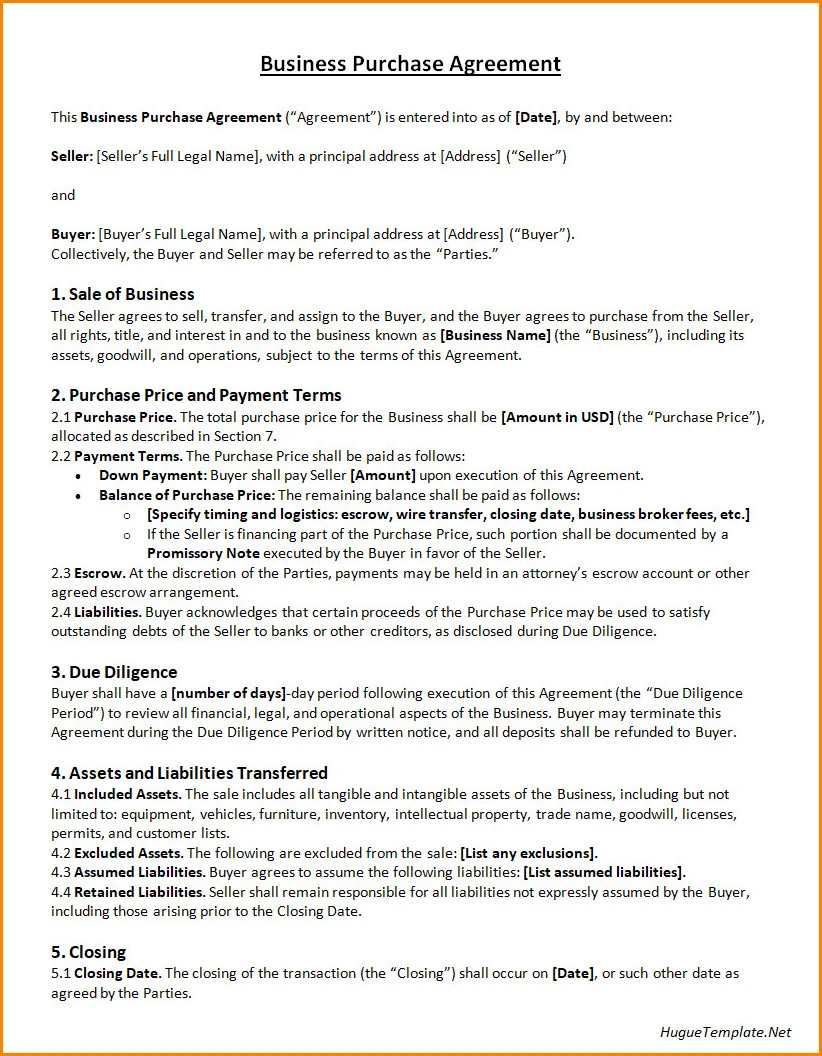

What is a Business Purchase Agreement?

A business purchase agreement is a legal document that outlines the terms and conditions of a business sale and transfer. It outlines the rights and obligations of both the buyer and the seller, ensuring that both parties have a clear understanding of the transaction.

This agreement serves as a protective document, outlining key details such as the purchase price, payment terms, and the allocation of assets and liabilities. By formalizing these key elements, a business purchase agreement provides a solid foundation for the sale process and helps to prevent potential disputes.

The Importance of a Business Purchase Agreement

A business purchase agreement plays a vital role in a business sale transaction by providing clarity and protection for both parties involved. Here are some key reasons why having a business purchase agreement is essential:

Ensuring Legal Compliance

One of the primary reasons for having a business purchase agreement is to ensure legal compliance. This document outlines the terms of the sale clearly and concisely, ensuring that both parties understand their rights and obligations. By adhering to legal requirements and regulations, the agreement provides a solid foundation for the transaction and reduces the risk of disputes or legal challenges in the future.

Protecting Your Interests

A business purchase agreement is designed to protect the interests of both the buyer and the seller. By clearly defining the terms of the sale, including the purchase price, payment terms, and assets and liabilities, the agreement provides a safeguard against potential disputes or misunderstandings. This protection extends to both parties, ensuring that their rights are upheld and their interests are preserved throughout the sale process.

Establishing Clear Expectations

Another key aspect of a business purchase agreement is its ability to establish clear expectations for both parties. By outlining the rights and responsibilities of each party, including the timeline for the sale, the allocation of assets, and any post-sale obligations, the agreement sets a clear path for the transaction. This clarity helps to prevent misunderstandings and ensures that both parties are on the same page from the outset.

Preventing Disputes

Disputes can often arise in business transactions, especially when the terms of the sale are not clearly defined. A business purchase agreement helps to prevent disputes by setting out the terms of the sale in writing. This document acts as a roadmap for the transaction, guiding both parties through the process and reducing the likelihood of disagreements or conflicts. If a dispute does arise, the agreement provides a mechanism for resolving issues in a structured and efficient manner.

Building Trust and Confidence

By having a comprehensive business purchase agreement in place, both parties can build trust and confidence in the transaction. The agreement demonstrates a commitment to transparency and fairness, showing that each party’s interests are being protected. This level of trust and confidence is essential in any business transaction, as it helps to foster a positive working relationship and ensures that the sale process runs smoothly.

Creating a Legal Framework

One of the primary functions of a business purchase agreement is to create a legal framework for the sale and transfer of a business. This framework outlines the terms and conditions of the transaction, including the purchase price, payment terms, and the assets and liabilities involved. By formalizing these details in a written agreement, both parties can rest assured that their rights are protected and that the transaction is legally binding.

Establishing Rights and Obligations

A business purchase agreement clearly establishes the rights and obligations of both the buyer and the seller. This document outlines each party’s responsibilities throughout the sale process, including the transfer of assets, payment terms, and post-sale obligations. By defining these rights and obligations upfront, the agreement helps to prevent misunderstandings and ensures that both parties are aware of their commitments.

Setting Clear Terms

Clarity is key in any business transaction, and a business purchase agreement helps to set clear terms for the sale. By detailing the purchase price, payment terms, assets and liabilities, and closing date, the agreement leaves no room for ambiguity or uncertainty. This level of clarity is essential for a smooth and successful transaction, as it ensures that both parties are in agreement on all aspects of the sale.

Providing Legal Recourse

If a dispute arises during or after the sale process, a business purchase agreement provides a legal recourse for resolving the issue. The agreement outlines the procedures for addressing disagreements, such as mediation, arbitration, or litigation, ensuring that any disputes are resolved in a timely and efficient manner. This legal recourse gives both parties peace of mind knowing that there is a mechanism in place for resolving conflicts.

Minimizing Risk

Business transactions can be complex and risky, but a well-drafted business purchase agreement helps to minimize that risk. By clearly defining the terms of the sale, including the purchase price, payment terms, and assets and liabilities, the agreement reduces the likelihood of misunderstandings or disputes. This risk mitigation is essential for both parties, as it protects their interests and ensures a successful and seamless transaction.

Who Should Draft a Business Purchase Agreement?

Drafting a business purchase agreement requires a thorough understanding of the legal and financial aspects of the transaction. It is advisable to seek the assistance of a qualified legal professional, such as a business attorney or a corporate lawyer, to help you draft a comprehensive and legally binding agreement.

A legal expert can ensure that the agreement complies with relevant laws and regulations, addresses all necessary provisions, and protects your interests throughout the sale process.

What Should Be Included in a Business Purchase Agreement?

A well-crafted business purchase agreement should include the following key components:

Identification of the Parties

The agreement should clearly identify the buyer and the seller, including their legal names, addresses, and contact information. This ensures that both parties are accurately represented in the agreement and establishes who is responsible for fulfilling the terms of the transaction.

Purchase Price

The agreement should specify the purchase price of the business and outline the payment terms, including any deposits or installment payments. This component is crucial as it establishes the financial terms of the transaction and ensures that both parties are in agreement on the price of the business.

Assets and Liabilities

The agreement should detail the assets and liabilities included in the sale, such as inventory, equipment, real estate, contracts, debts, and obligations. This component ensures that both parties are aware of what is being transferred as part of the sale and helps to prevent disputes over ownership rights.

Closing Date

The agreement should establish a closing date for the transaction, outlining the timeline for completing the sale and transferring ownership. This component provides a clear deadline for the transaction and helps to ensure that both parties are prepared for the transfer of assets and liabilities.

Representations and Warranties

The agreement should include representations and warranties from both parties regarding the condition of the business, its assets, and any disclosures related to the sale. This component provides assurances to the buyer regarding the state of the business and protects the seller from potential claims after the transaction is complete.

Non-Compete and Confidentiality Agreements

The agreement may include non-compete and confidentiality provisions to protect the interests of both parties after the sale is completed. These provisions help to prevent the seller from competing against the business they have sold and ensure that sensitive information remains confidential.

Dispute Resolution Mechanisms

The agreement should outline the procedures for resolving any disputes that may arise during or after the sale process, such as mediation, arbitration, or litigation. This component provides a roadmap for resolving conflicts and helps to ensure that any disagreements are addressed in a fair and timely manner.

What Financial Terms Should Be Included in a Business Purchase Agreement?

In addition to the key components mentioned above, a business purchase agreement should also include specific financial terms to ensure clarity and transparency in the transaction. Some financial terms that should be included in the agreement are:

Payment Terms

The agreement should specify the payment terms, including the total purchase price, any deposits or down payments, and the schedule for installment payments. This component establishes how the purchase price will be paid and ensures that both parties are in agreement on the payment terms.

Adjustments

The agreement should address any adjustments to the purchase price based on the final valuation of the business, such as adjustments for inventory levels or outstanding debts. This component ensures that the purchase price accurately reflects the value of the business at the time of the sale.

Earn-Out Provisions

If the purchase price is contingent on the future performance of the business, the agreement should include earn-out provisions outlining how additional payments will be calculated. This component provides a mechanism for the buyer to pay additional amounts based on the business’s future success.

Allocation of Purchase Price

The agreement should allocate the purchase price among the various assets included in the sale to determine the tax implications for both parties. This component helps to ensure that the purchase price is allocated correctly for tax purposes and that both parties understand their tax obligations related to the sale.

Financing Terms

If the buyer is financing the purchase through a loan or seller financing, the agreement should outline the terms of the financing arrangement, including interest rates, payment schedules, and security interests. This component establishes the terms of the financing agreement and ensures that both parties understand their financial obligations related to the purchase.

Business Purchase Agreement Template – DOWNLOAD