Keeping track of bills, due dates, and payment status can be a challenging task for many individuals. Late fees can quickly add up, leading to unnecessary expenses that could have been avoided with better organization.

This is where a bill organizer comes in handy, providing a centralized record of all your financial commitments to help you stay on top of your budget and improve your financial discipline.

What is a Bill Organizer?

A bill organizer is a tool designed to help individuals keep track of their bills, due dates, and payment status in one centralized location. It provides a structured way to monitor expenses, track income, and ensure that all payments are made on time.

By using a bill organizer, you can avoid late fees, improve your financial discipline, and gain a clear overview of your financial commitments.

Why Use a Bill Organizer?

There are several reasons why using a bill organizer can be beneficial for managing your financial obligations:

- Avoid Late Fees: By keeping all your bills organized and tracking their due dates, you can ensure that payments are made on time, avoiding costly late fees.

- Improve Financial Discipline: A bill organizer helps you develop better financial habits by providing a structured way to monitor your expenses and income.

- Stay on Top of Budgeting: With a clear overview of your financial commitments, you can better manage your budget and allocate funds accordingly.

- Reduce Stress: By knowing exactly when bills are due and their payment status, you can reduce the stress associated with managing multiple financial obligations.

- Track Expenses: A bill organizer allows you to track your expenses over time, giving you insights into where your money is going and where you can potentially cut costs.

What to Include in a Bill Organizer?

When setting up a bill organizer, there are a few key components to include to ensure it effectively helps you manage your financial obligations:

Bills and Due Dates

The first step in setting up a bill organizer is to list all your bills and their respective due dates. This ensures that you are aware of when each payment is due and can plan accordingly to avoid late fees.

When including bills and due dates in your organizer, be sure to include all recurring expenses such as rent or mortgage payments, utilities, insurance, credit card bills, and any other regular payments you have.

Payment Status

Alongside listing your bills and due dates, it is essential to track the payment status of each bill in your organizer. This allows you to see at a glance which bills have been paid and which are still outstanding.

By keeping track of the payment status of each bill, you can avoid missed payments and ensure that all your financial obligations are met on time. This can help you improve your credit score and overall financial health.

Income Tracking

In addition to listing your bills, due dates, and payment status, it is crucial to include a section for tracking your income sources in the bill organizer. This allows you to compare your income to your expenses and ensure that you have enough funds to cover all your financial commitments.

When tracking your income, be sure to include all sources of income, including wages, bonuses, investments, rental income, or any other money you receive regularly. This comprehensive view of your income can help you make informed financial decisions.

Budget Planning

To effectively manage your financial obligations, it is essential to include a budget planning section in your bill organizer. Allocate funds for each bill and expense category to ensure that you have enough money set aside for all your payments.

When planning your budget, consider your income, expenses, savings goals, and any other financial priorities you may have. By setting a budget and tracking your spending, you can make adjustments as needed to stay within your financial means.

Expense Categories

Another important component to include in your bill organizer is expense categories. Categorizing your expenses can help you identify areas where you may be overspending and make adjustments to improve your financial health.

Common expense categories to include in your organizer may be housing, transportation, food, utilities, entertainment, and savings. By categorizing your expenses, you can see where your money is going and make more informed decisions about your spending habits.

How to Use a Bill Organizer

Using a bill organizer is simple and straightforward, but it requires consistency and dedication to reap its benefits. Here are some steps to effectively use a bill organizer:

Set Up Your Organizer

The first step in using a bill organizer is to gather all your bills, due dates, and payment information. Input this information into the organizer to create a centralized record of your financial commitments.

When setting up your organizer, be sure to include all bills, payment due dates, payment amounts, and any other relevant information. This will ensure that you have a comprehensive view of your financial obligations.

Regularly Update Your Information

To make the most out of your bill organizer, it is essential to regularly update your information. Make it a habit to input new bills, payments, and income sources as they occur to ensure that your organizer remains current.

By regularly updating your information, you can stay on top of your financial commitments and make informed decisions about your money management. Consistency is key to effectively using a bill organizer.

Check Your Organizer Daily

One of the best practices for using a bill organizer is to check it daily. Review your organizer each day to see which bills are due, their payment status, and any upcoming payments you need to prepare for.

Checking your organizer daily can help you avoid missing payment deadlines and ensure that all your bills are paid on time. This can improve your financial discipline and reduce the risk of incurring late fees.

Adjust Your Budget as Needed

As you use your bill organizer, you may find that your budget needs adjustments. Monitor your expenses and income to identify areas where you may need to make changes to stay within your financial means.

By regularly reviewing your budget and making adjustments as needed, you can ensure that you are on track to meet your financial goals. Flexibility and adaptability are key to effective budget management.

Review Your Organizer Weekly

In addition to checking your organizer daily, it is also beneficial to review it weekly. Take time each week to review your bills, payments, income, and expenses to see how your financial situation is progressing.

Weekly reviews of your organizer can help you identify patterns in your spending habits, areas where you may be overspending, and opportunities toimprove your financial management. By taking a proactive approach to reviewing your organizer weekly, you can make strategic decisions about your money and work towards achieving your financial goals.

Tips for Using a Bill Organizer

To make the most out of your bill organizer and maximize its benefits, consider the following tips:

Set Reminders

Use reminders or alerts in your bill organizer to notify you of upcoming due dates. Setting reminders can help you stay on top of your payment schedule and avoid missing deadlines, reducing the risk of late fees.

By utilizing reminders effectively, you can ensure that you never forget about an important payment and maintain good financial standing with your creditors. Take advantage of this feature to streamline your bill payment process.

Go Paperless

Consider using digital bill organizers or apps for easier access and organization of your financial information. Going paperless can help you declutter your space, reduce the risk of losing important documents, and have all your financial information at your fingertips.

Digital bill organizers often offer additional features such as automatic payment reminders, budget tracking, and expense categorization. Explore different options to find the one that best fits your needs and preferences.

Automate Payments

Set up automatic payments for recurring bills to reduce the risk of missed payments. Automating your payments can help you avoid late fees, ensure that all your bills are paid on time, and free up time for other financial tasks.

By automating your payments, you can have peace of mind knowing that your financial obligations are being met without the need for manual intervention. Just be sure to monitor your accounts regularly to confirm payments are processed correctly.

Monitor Your Credit Score

Keep track of your credit score and how your bill payments impact it. Your credit score is a crucial factor in your financial health and can affect your ability to secure loans, credit cards, or favorable interest rates.

By monitoring your credit score through your bill organizer, you can see how your payment history, outstanding debts, and credit utilization impact your score. This awareness can help you make better financial decisions and improve your creditworthiness over time.

Seek Professional Help if Needed

If managing your finances becomes overwhelming or if you need guidance on complex financial matters, consider seeking help from a financial advisor or counselor. Financial professionals can provide expert advice, create personalized financial plans, and offer strategies to help you reach your financial goals.

Working with a professional can give you peace of mind, clarity about your financial situation, and tools to improve your financial well-being. Don’t hesitate to seek help if you feel unsure about managing your finances effectively.

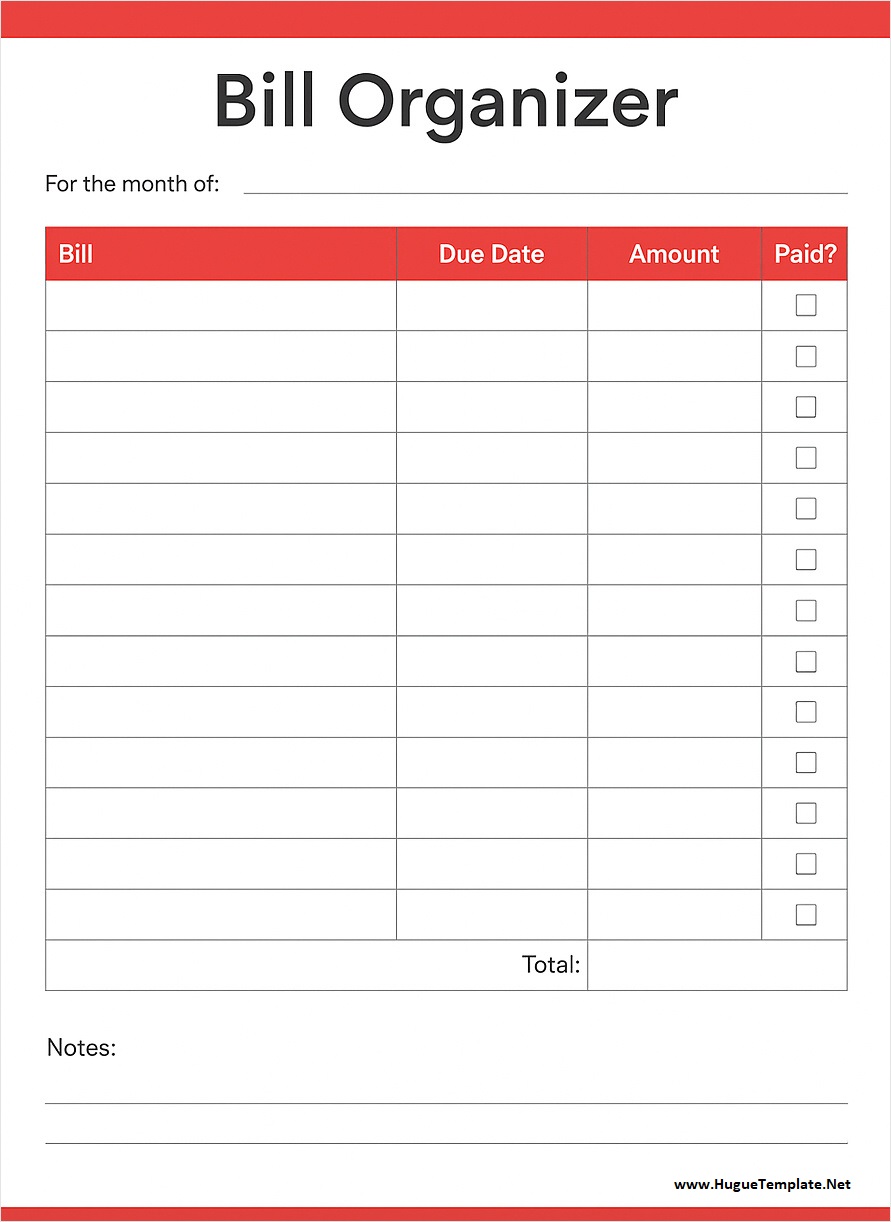

Free Bill Organizer Template

A Bill Organizer helps you keep track of all your bills, payments, and due dates in one easy-to-read document. It’s perfect for managing monthly expenses, avoiding late fees, and maintaining financial organization. This template typically includes sections for bill names, due dates, amounts, payment methods, and status (paid/unpaid).

Download and use our Free Bill Organizer Template to stay on top of your finances, track recurring payments, and plan your monthly budget efficiently.

Bill Organizer Template – DOWNLOAD