A cash flow statement is a vital financial document that provides crucial information about the movement of cash in and out of a business. It is a key tool for assessing the financial health of a company and plays a significant role in decision-making processes.

In this article, we will explore what, why, what to include, how to, and tips for successful cash flow statements.

What is a Cash Flow Statement?

A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. It provides insight into how a company generates and uses cash over a specific period, typically broken down into operating activities, investing activities, and financing activities.

This document helps stakeholders understand the liquidity and solvency of a business.

Why is a Cash Flow Statement Important?

Cash flow statements are crucial for businesses as they provide valuable information about the financial health of a company. They help in assessing the ability of a business to generate cash and meet its financial obligations.

By analyzing cash flow statements, stakeholders can make informed decisions about investments, credit extension, and overall financial strategy.

What to Include in a Cash Flow Statement

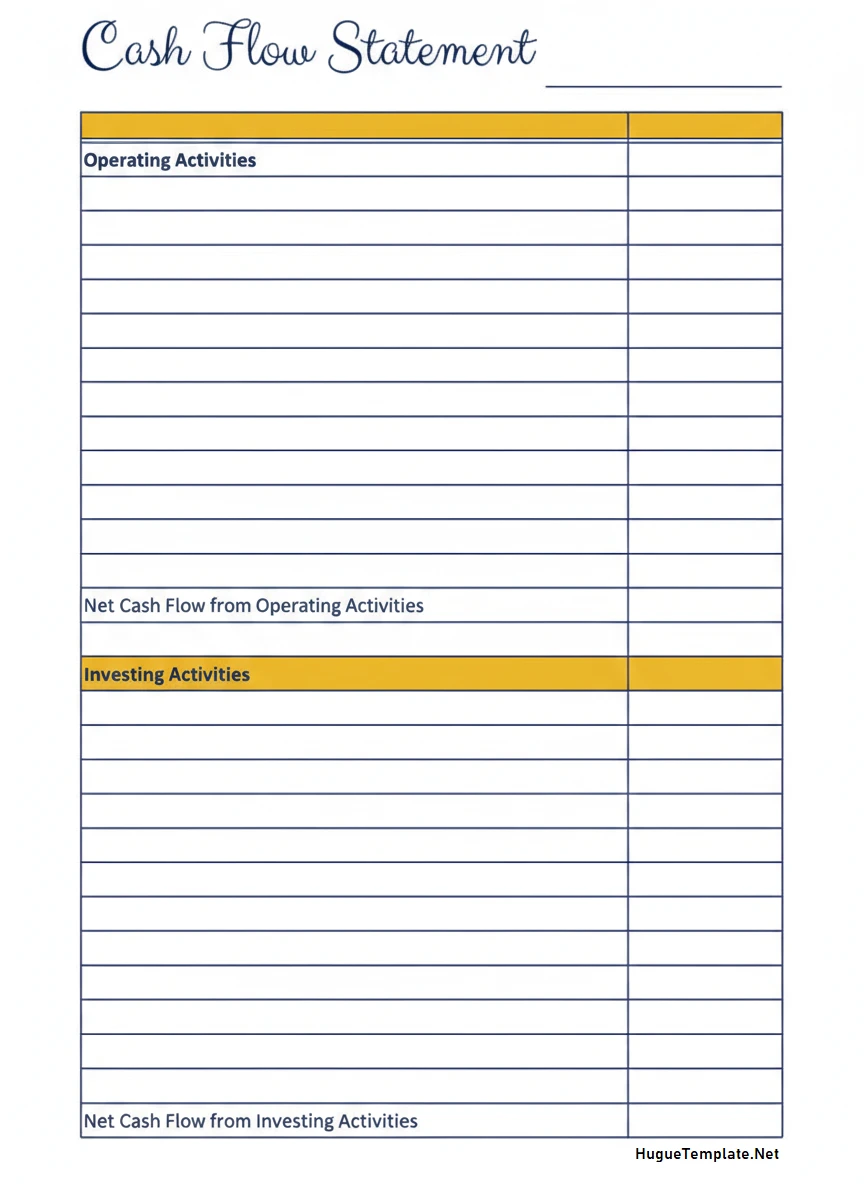

A standard cash flow statement includes three main sections: operating activities, investing activities, and financing activities. Operating activities represent the core business activities that generate revenue, while investing activities include the purchase and sale of assets. Financing activities cover the inflow and outflow of cash related to the company’s capital structure.

- Operating Activities: Include cash received from customers, payments to suppliers, and operating expenses.

- Investing Activities: Include cash spent on acquiring or selling assets like property, equipment, or investments.

- Financing Activities: Include cash received from or paid to investors, lenders, or shareholders.

How to Prepare a Cash Flow Statement

Preparing a cash flow statement involves analyzing the company’s financial records and categorizing cash flows into the three main activities. It is important to accurately record all cash transactions and ensure that the statement complies with accounting standards. Companies can use accounting software or hire a professional accountant to assist in creating a comprehensive cash flow statement.

Tips for Successful Cash Flow Statements

- Regular Monitoring: Review and update the cash flow statement regularly to track changes in cash flow patterns.

- Accuracy is Key: Ensure that all cash transactions are accurately recorded to provide an accurate representation of the company’s financial position.

- Use Cash Flow Forecasts: Create cash flow forecasts to predict future cash flow trends and plan accordingly.

- Seek Professional Advice: If unsure about preparing a cash flow statement, seek guidance from financial experts or accountants.

- Utilize Technology: Use accounting software and tools to streamline the process of creating and analyzing cash flow statements.

- Communicate with Stakeholders: Share the cash flow statement with relevant stakeholders to keep them informed about the company’s financial performance.

In Conclusion

In conclusion, a cash flow statement is a critical financial document that provides valuable insights into a company’s financial health. By understanding what, why, what to include, how to, and tips for successful cash flow statements, businesses can effectively manage their cash flow and make informed decisions to ensure long-term success. Companies need to prioritize the preparation and analysis of cash flow statements to maintain financial stability and growth.

Cash Flow Statement Template – DOWNLOAD