Financial planning is crucial for individuals and families looking to make the best use of their money and achieve long-term financial goals. Whether you’re planning for investments, sending your children to college, buying a bigger home, leaving a legacy, or enjoying a comfortable retirement, having a solid financial plan in place can make all the difference.

In this article, we will explore the ins and outs of financial planning, why it’s important, what to include in your financial plan, how to get started, and some tips for success.

What is Financial Planning?

Financial planning is the process of setting goals, assessing your current financial situation, creating a plan to achieve those goals, and regularly monitoring and adjusting your plan as needed.

It involves looking at your income, expenses, assets, liabilities, and investment strategies to ensure that you are on track to meet your financial objectives.

Why is Financial Planning Important?

Financial planning is important for a variety of reasons.

Creating Financial Security

One of the key benefits of financial planning is creating financial security for yourself and your family. By having a solid financial plan in place, you can prepare for unexpected expenses, emergencies, and life events that may impact your finances. This can provide peace of mind knowing that you have a safety net in place to weather financial challenges.

Building Wealth

Financial planning can also help you build wealth over time by setting specific savings and investment goals. By creating a plan that outlines how much you need to save and invest each month to reach your financial goals, you can take concrete steps towards building wealth and achieving financial independence. With the power of compounding interest on your side, the earlier you start planning, the more time your investments have to grow.

Preparing for Retirement

Retirement planning is a critical component of financial planning. By estimating how much you will need for retirement and creating a plan to save for it, you can ensure that you have enough money to support yourself in your golden years. Whether you plan to retire early, travel the world, or simply enjoy a comfortable retirement at home, having a solid retirement plan in place can help you achieve your retirement dreams.

What to Include in Your Financial Plan?

When creating a financial plan, there are several key components to consider:

Financial Goals

Clearly defining your financial goals is the foundation of your financial plan. Whether it’s saving for a major purchase, paying off debt, or investing for the future, your goals should be specific, measurable, and achievable. By setting clear goals, you give yourself direction and motivation to stick to your plan.

Budget

Creating a budget is essential for managing your finances effectively. A budget helps you track your income and expenses, identify areas where you can cut back, and allocate money towards your savings and investment goals. By living within your means and following a budget, you can avoid overspending and build a solid financial foundation.

Debt Management

Debt can be a major obstacle to achieving your financial goals. As part of your financial plan, develop a strategy to pay off any outstanding debts and avoid accumulating new debt. By prioritizing high-interest debts, making extra payments when possible, and being mindful of your spending habits, you can work towards becoming debt-free and improving your financial health.

Emergency Fund

Building an emergency fund is an important part of financial planning. An emergency fund acts as a safety net to cover unexpected expenses, such as medical bills, car repairs, or job loss. Aim to save at least three to six months’ worth of living expenses in your emergency fund to protect yourself from financial setbacks.

Investment Strategy

Developing an investment strategy is key to growing your wealth over time. Consider your risk tolerance, investment goals, and time horizon when creating an investment portfolio that aligns with your financial objectives. Whether you prefer stocks, bonds, real estate, or other investment vehicles, diversifying your portfolio can help reduce risk and maximize returns.

Retirement Planning

Planning for retirement is essential to ensure that you have enough money to support yourself when you stop working. Estimate how much you will need for retirement based on your desired lifestyle and expenses, then create a savings plan to reach that goal. Consider contributing to retirement accounts such as a 401(k) or IRA to take advantage of tax benefits and employer matches.

How to Get Started with Financial Planning

Getting started with financial planning can feel overwhelming, but it doesn’t have to be. Here are some steps to help you kickstart your financial planning journey:

Set Financial Goals

Define your financial goals by asking yourself what you want to achieve in the short-term and long-term. Whether it’s buying a home, starting a business, or traveling the world, having clear goals will give you direction and motivation to create a plan.

Assess Your Current Financial Situation

Take stock of your current financial situation by looking at your income, expenses, assets, and debts. Understanding where you stand financially will help you set realistic goals and identify areas for improvement.

Create a Budget

Develop a budget that outlines your monthly income, expenses, and savings goals. Track your spending habits, identify areas where you can cut back, and allocate money towards your financial goals. By living within your means and following a budget, you can take control of your finances.

Build an Emergency Fund

Start building an emergency fund by setting aside savings for unexpected expenses or emergencies. Aim to save at least three to six months’ worth of living expenses in a high-yield savings account or money market fund. Having an emergency fund will give you peace of mind knowing that you have a financial cushion to fall back on.

Invest Wisely

Determine your risk tolerance and investment objectives to create an investment strategy that aligns with your goals. Consider diversifying your investment portfolio across different asset classes to reduce risk and maximize returns. Whether you’re a conservative investor or a risk-taker, there are investment options available to suit your preferences.

Monitor and Adjust Your Plan

Regularly review your financial plan and make adjustments as needed to stay on track. Life changes, such as job loss, marriage, or the birth of a child, may warrant updates to your plan. By staying proactive and flexible, you can adapt to changing circumstances and ensure that your financial goals remain achievable.

Seek Professional Advice

If you’re unsure where to start or feel overwhelmed by the financial planning process, consider seeking guidance from a financial planner or advisor. A professional can help you create a personalized financial plan tailored to your unique situation and goals. They can also provide expertise and insights to help you make informed decisions about your finances.

Tips for Successful Financial Planning

Here are some additional tips to help you succeed in your financial planning journey:

Start Early

The earlier you start planning for your financial future, the better off you’ll be in the long run. Time is a powerful ally when it comes to building wealth and achieving your financial goals, so don’t delay in creating a financial plan.

Be Realistic

Set achievable goals that align with your income, expenses, and lifestyle. Avoid setting unrealistic expectations or comparing yourself to others. Focus on your own financial journey and take small, consistent steps towards your goals.

Stay Disciplined

Stick to your budget, save consistently, and resist the temptation to overspend. Cultivate healthy financial habits such as automatic savings, tracking your expenses, and avoiding impulse purchases. By staying disciplined and sticking to your financial plan, you can make steady progress towards your goals.

Review Regularly

Regularly review your financial plan to track your progress and make adjustments as needed. Life is constantly changing, and your financial plan should evolve with it. Take the time to review your goals, budget, investments, and overall financial health regularly to ensure that you’re on track to meet your objectives.

Stay Informed

Stay up-to-date on financial news and trends that may impact your investments and financial decisions. Educate yourself about personal finance topics such as investing, taxes, insurance, and retirement planning. By staying informed, you can make well-informed decisions about your money and take advantage of opportunities to grow your wealth.

Seek Support

Don’t be afraid to seek support and guidance from friends, family, or financial professionals. Discussing your financial goals and challenges with others can provide valuable insights and accountability. Consider joining a financial planning group or seeking out a mentor who can offer guidance and support as you work towards your financial goals.

Celebrate Milestones

Celebrate your financial milestones along the way to stay motivated and encouraged. Whether you pay off a significant debt, reach a savings goal, or achieve an investment milestone, take the time to acknowledge your progress and reward yourself for your hard work. Celebrating small victories can keep you motivated to continue working towards your long-term financial goals.

Stay Flexible

Life is unpredictable, and your financial plan should be flexible enough to adapt to changing circumstances. Be prepared to adjust your plan as needed in response to unexpected events, market fluctuations, or changes in your personal or professional life. By remaining flexible and open to change, you can navigate financial challenges with confidence and resilience.

Seek Accountability

Hold yourself accountable to your financial goals by tracking your progress, staying disciplined, and seeking support when needed. Consider sharing your goals with a trusted friend or family member who can help keep you on track and provide encouragement along the way. Being accountable to others can help you stay focused and motivated to achieve your financial aspirations.

Practice Patience

Building wealth and achieving financial goals takes time, patience, and perseverance. Avoid the temptation to compare your financial progress to others or seek quick fixes for long-term financial challenges. By staying patient and committed to your financial plan, you can steadily move towards your goals and enjoy the journey along the way.

Embrace Financial Literacy

Invest in your financial education by reading books, taking courses, attending seminars, and staying informed about personal finance topics. The more you know about money management, investing, and financial planning, the better equipped you’ll be to make smart decisions about your finances. Embrace lifelong learning and strive to improve your financial literacy over time.

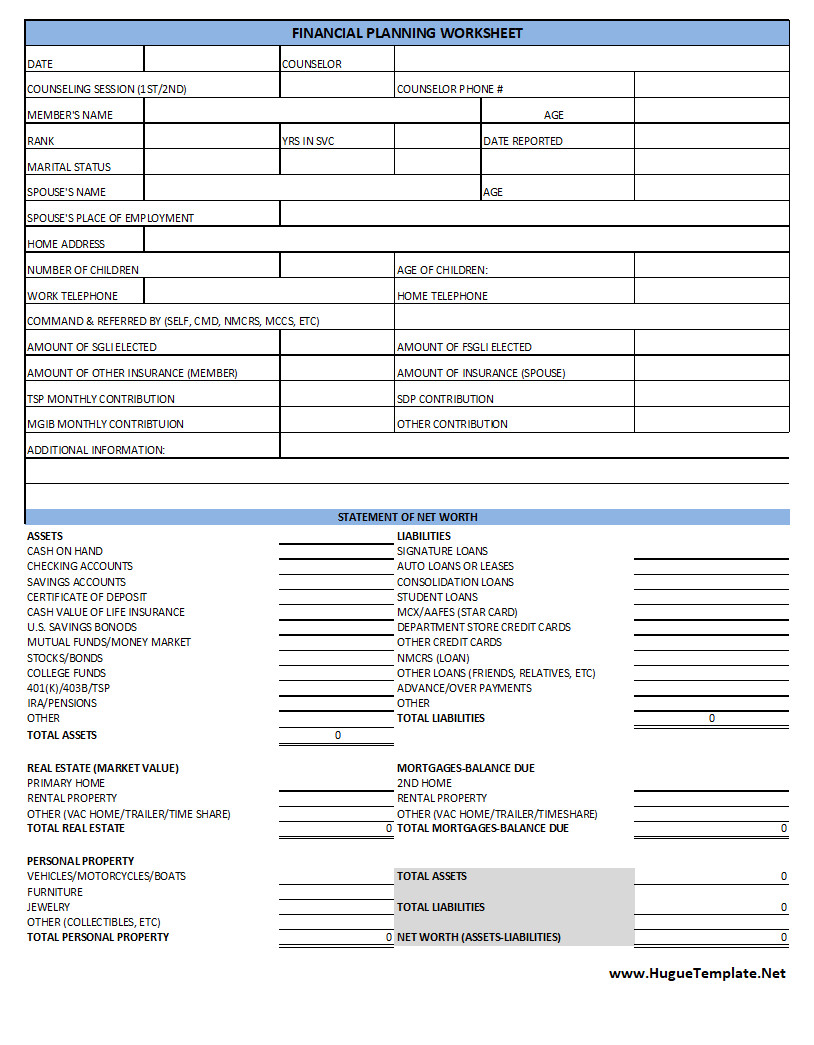

Free Financial Planning Template

In conclusion, a Financial Planning Template is a valuable tool for managing your income, expenses, and financial goals effectively. It helps you stay organized, make informed decisions, and work toward long-term stability.

Take control of your finances today—download our Financial Planning Template and start building your financial future!

Financial Planning Template – EXCEL