Creating a yearly budget is crucial for managing your finances effectively. An annual budget is essentially a detailed estimate of your expected income and expenses for the upcoming year. By setting a budget, you can track your financial goals, identify areas where you can save money, and ensure that you are living within your means.

In this comprehensive guide, we will explore the importance of creating an annual financial budget and provide you with 10 steps for setting a budget that works for you.

What Is a Yearly Budget?

A yearly budget, also known as an annual budget, is a financial plan that outlines your income and expenses for the upcoming year. It helps you allocate your resources in a way that aligns with your financial goals and priorities.

By creating a budget, you can track your spending, identify areas where you can cut costs, and save for future expenses.

The Importance of Creating an Annual Financial Budget

Setting a yearly budget is essential for achieving financial stability and reaching your long-term goals. Here are some key reasons why creating an annual financial budget is important:

1. Helps You Track Your Spending

One of the primary benefits of creating a yearly budget is that it allows you to track your spending habits. By monitoring your expenses, you can identify areas where you are overspending and make adjustments to your budget accordingly. This can help you avoid unnecessary debt and ensure that you are living within your means.

Tracking your spending can also help you see patterns in your expenses and identify areas where you can cut back to save more money. By understanding where your money is going, you can make more informed decisions about your spending habits.

2. Allows You to Set Financial Goals

With a yearly budget in place, you can set clear financial goals for the year ahead. Whether you want to save for a vacation, pay off debt, or build an emergency fund, having a budget can help you prioritize your financial objectives and track your progress towards achieving them.

Setting financial goals gives you a sense of purpose and direction with your money. It motivates you to stick to your budget and make choices that align with your long-term objectives, whether it’s saving for a down payment on a house or planning for retirement.

3. Provides a Roadmap for Your Finances

Creating an annual financial budget provides you with a roadmap for your finances. It helps you plan for future expenses, such as quarterly tax payments, annual insurance premiums, or holiday gifts. By anticipating these costs ahead of time, you can avoid financial surprises and ensure that you have enough money set aside to cover them.

Having a roadmap for your finances enables you to be proactive rather than reactive when managing your money. It gives you a sense of control over your financial future and helps you prepare for both expected and unexpected expenses.

4. Helps You Make Informed Financial Decisions

Having a yearly budget in place allows you to make informed financial decisions. Before making a large purchase or committing to a new expense, you can refer to your budget to see if it aligns with your financial priorities. This can help you avoid impulsive spending and stay on track towards your financial goals.

When you have a budget, you can weigh the pros and cons of financial decisions based on how they fit into your overall financial plan. It enables you to evaluate whether a purchase is necessary, whether it aligns with your goals, and whether you can afford it without jeopardizing your financial health.

5. Creates Accountability for Your Finances

When you have a yearly budget, you hold yourself accountable for your financial decisions. By regularly reviewing your budget and tracking your spending, you can see where your money is going and make adjustments as needed. This accountability can help you develop healthy financial habits and achieve long-term financial success.

Being accountable for your finances means taking ownership of your money management and making choices that align with your financial goals. It requires discipline, consistency, and a commitment to following your budget to ensure that you are on the right path towards financial stability.

6. Encourages Savings and Investments

A yearly budget can also help you prioritize saving and investing for the future. By allocating a portion of your income towards savings and investments, you can build a financial cushion for unexpected expenses, retirement, or other long-term goals. A budget can help you stay disciplined and committed to your savings goals.

Saving and investing are crucial components of building wealth and securing your financial future. With a budget in place, you can designate specific funds for savings accounts, retirement plans, or investment portfolios to grow your assets over time and achieve financial independence.

7. Reduces Financial Stress

By having a clear understanding of your income and expenses through a yearly budget, you can reduce financial stress and anxiety. Knowing where your money is going and having a plan in place can give you peace of mind and confidence in your financial decisions. This can lead to improved overall well-being and quality of life.

Financial stress can take a toll on your mental and emotional health, affecting your relationships, work performance, and overall happiness. With a budget, you can minimize the uncertainty surrounding your finances and feel empowered to take control of your money and your future.

8. Improves Your Financial Literacy

Creating and managing a yearly budget can improve your financial literacy and knowledge of personal finance. By actively engaging with your finances, tracking your spending, and making informed decisions, you can develop a better understanding of how money works and how to make it work for you. This increased financial literacy can empower you to take control of your financial future.

Financial literacy is the foundation of sound money management. By educating yourself about budgeting, saving, investing, and other financial concepts, you can make smarter financial decisions, avoid common pitfalls, and build a strong financial foundation for yourself and your family.

Steps for Setting a Budget

Now that you understand the importance of creating a yearly budget, let’s explore 10 steps for setting a budget that works for you:

1. Evaluate Your Income

Calculate your total monthly income, including salaries, bonuses, interest, and any other sources of income. Knowing how much money you have coming in each month is the first step in creating a budget that reflects your financial reality.

Income evaluation allows you to understand your financial capacity and set realistic expectations for your spending and saving habits. By accurately assessing your income, you can make informed decisions about how to allocate your money to meet your financial goals.

2. List Your Expenses

Make a list of all your monthly expenses, including fixed costs like rent and utilities, as well as variable expenses like groceries and entertainment. Categorize your expenses into needs (essential) and wants (discretionary) to prioritize your spending and identify areas where you can cut back.

Listing your expenses helps you see where your money is going and where you may be overspending. By categorizing your expenses, you can identify opportunities to reduce costs, reallocate funds, and make adjustments to stay within your budget constraints.

3. Identify Your Financial Goals

Determine your short-term and long-term financial goals, such as saving for a vacation, paying off debt, or investing for retirement. Your goals will drive your budgeting decisions and help you allocate your resources in a way that aligns with your priorities.

Setting clear financial goals gives you a sense of purpose and direction with your money. It motivates you to stick to your budget, make sacrifices when necessary, and stay focused on achieving milestones that are important to you and your financial well-being.

4. Create Categories for Your Budget

Divide your expenses into categories, such as housing, transportation, food, and entertainment, to better track your spending. Organizing your expenses into categories allows you to see where your money is going and identify areas where you may need to adjust your budget to meet your financial goals.

Category budgeting provides you with a clear overview of your spending patterns and allows you to allocate funds strategically based on your priorities. By separating expenses into specific categories, you can monitor your cash flow, identify trends in your spending habits, and make informed decisions about where to cut back or reallocate funds.

5. Allocate Your Income

Assign a portion of your income to each expense category, prioritizing essential costs like housing and utilities before discretionary spending. By allocating your income effectively, you can ensure that you have enough money to cover your needs while still making progress towards your financial goals.

Income allocation is a critical step in budgeting as it determines how your money is distributed among various expenses and savings goals. By prioritizing essential costs and allocating funds to different categories, you can balance your budget and avoid overspending in non-essential areas.

6. Track Your Spending

Monitor your expenses regularly to ensure that you are staying within your budget and adjust as needed to align with your financial goals. Tracking your spending allows you to see where your money is going, identify areas of overspending, and make necessary adjustments to stay on track with your budget.

Regularly tracking your spending helps you stay accountable to your budget and financial goals. By monitoring your expenses, you can make informed decisions about your spending habits, identify areas where you can save money, and ensure that you are making progress towards achieving your financial objectives.

7. Adjust Your Budget as Needed

Life changes, unexpected expenses, or new financial goals may require adjustments to your budget. Be flexible and willing to adapt your budget as circumstances change to ensure that your financial plan remains aligned with your current financial situation and goals.

Adapting your budget to changing circumstances is a natural part of the budgeting process. By being open to making adjustments as needed, you can effectively manage unexpected expenses, take advantage of new opportunities, and stay on track towards achieving your financial goals.

Challenges of Budgeting

While setting a yearly budget offers numerous benefits, it also comes with its challenges. Here are some common challenges that individuals may face when creating and following a budget:

1. Income Variability

One of the challenges of budgeting is dealing with income variability. If your income fluctuates from month to month, it can be challenging to create a budget that accurately reflects your financial reality and ensures that you can cover your expenses consistently.

To address income variability, consider creating a budget based on your average monthly income or establishing a budget range that accommodates fluctuations. Additionally, building an emergency fund can help you manage unexpected income changes and maintain financial stability.

2. Unexpected Expenses

Unexpected expenses can derail even the most well-planned budget. From car repairs to medical bills, unforeseen costs can put a strain on your finances and disrupt your budgeting efforts. It’s essential to account for unexpected expenses in your budget and have a contingency plan in place to cover them.

To prepare for unexpected expenses, consider setting aside a portion of your income for emergencies or creating a separate savings account specifically for unplanned costs. Having a buffer for unexpected expenses can help you stay on track with your budget and avoid financial setbacks.

3. Impulse Spending

Impulse spending is another common challenge when it comes to budgeting. Temptations to make unplanned purchases, dine out frequently, or splurge on non-essential items can undermine your budgeting efforts and lead to overspending.

To combat impulse spending, establish clear spending boundaries, create a designated “fun money” category in your budget for discretionary purchases, and practice mindful spending habits. By setting limits on impulse purchases and prioritizing your financial goals, you can curb spontaneous spending and stay within your budget constraints.

4. Lack of Discipline

A lack of discipline can hinder your budgeting success. It’s easy to deviate from your budget, overspend in certain areas, or neglect tracking your expenses when discipline wanes. Maintaining consistency, accountability, and motivation is essential to sticking to your budget and achieving your financial goals.

To overcome a lack of discipline, consider setting reminders to track your spending, reviewing your budget regularly, and seeking support from a friend, partner, or financial advisor. Accountability, consistency, and commitment are key to maintaining discipline and staying on course with your budgeting efforts.

5. Changing Financial Goals

As your financial situation evolves, your goals may change, requiring adjustments to your budget. Adapting your budget to accommodate new financial goals, revised priorities, or shifting circumstances can be challenging and may require flexibility and proactive planning.

When facing changing financial goals, reassess your budget, reallocate resources as needed, and update your financial plan to reflect your current objectives. Be willing to make adjustments, seek guidance from financial professionals, and stay proactive in managing your budget to ensure alignment with your evolving financial goals.

Strategies for Successful Budgeting

To overcome the challenges of budgeting and achieve financial success, consider implementing the following strategies:

1. Set Clear Financial Goals

Establish clear, specific, and achievable financial goals to guide your budgeting efforts. Whether you want to save for a down payment on a house, pay off debt, or build an emergency fund, having well-defined objectives can motivate you to stick to your budget and make smart financial choices.

Setting clear financial goals enables you to prioritize your spending, track your progress, and stay focused on what matters most to you. By aligning your budget with your goals, you can make intentional decisions about how you use your money and move closer to achieving your desired outcomes.

2. Create a Realistic Budget

Create a budget that reflects your financial reality and accounts for all sources of income and expenses. Be honest about your spending habits, income levels, and financial commitments to ensure that your budget is accurate, realistic, and sustainable in the long run.

A realistic budget provides you with a clear understanding of your financial situation and helps you make informed decisions about how to allocate your money effectively. By creating a budget that aligns with your income and spending patterns, you can set yourself up for financial success and achieve your goals more efficiently.

3. Track Your Spending Regularly

Consistently track your spending to stay on top of your budget and make adjustments as needed. Monitoring your expenses allows you to identify areas where you may be overspending, spot trends in your spending habits, and ensure that you are staying within your budget constraints.

Regular tracking of your spending enables you to stay accountable to your budget and financial goals. By reviewing your expenses regularly, you can make informed decisions about your money, adjust your budget as circumstances change, and maintain control over your financial health.

4. Use Budgeting Tools and Apps

Take advantage of budgeting tools and apps to streamline your budgeting process and make it easier to manage your finances. There are numerous online platforms, apps, and software programs available that can help you track your income and expenses, set financial goals, and stay organized with your budgeting efforts.

Utilizing budgeting tools and apps can simplify the budgeting process, automate certain tasks, and provide insights into your financial habits. By leveraging technology to manage your budget, you can save time, reduce manual effort, and gain a better understanding of your financial situation.

5. Review and Adjust Your Budget Regularly

Regularly review your budget and make adjustments as needed to ensure that it reflects your current financial situation and goals. Life changes, unexpected expenses, and shifting priorities may require modifications to your budget to keep it relevant and effective in helping you achieve your financial objectives.

Reviewing and adjusting your budget regularly allows you to stay flexible, responsive, and proactive in managing your finances. By staying vigilant and making necessary changes to your budget, you can adapt to changing circumstances, address new financial challenges, and stay on track towards your goals.

6. Celebrate Financial Milestones

Celebrate your financial milestones and achievements to stay motivated and reinforce positive financial habits. Whether you reach a savings goal, pay off a significant debt, or stick to your budget consistently, recognizing and celebrating your progress can boost your confidence, morale, and commitment to your financial journey.

Celebrating financial milestones provides you with a sense of accomplishment and motivates you to continue making progress towards your goals. By acknowledging your achievements, you can stay motivated, inspired, and focused on the positive impact of your budgeting efforts on your financial well-being.

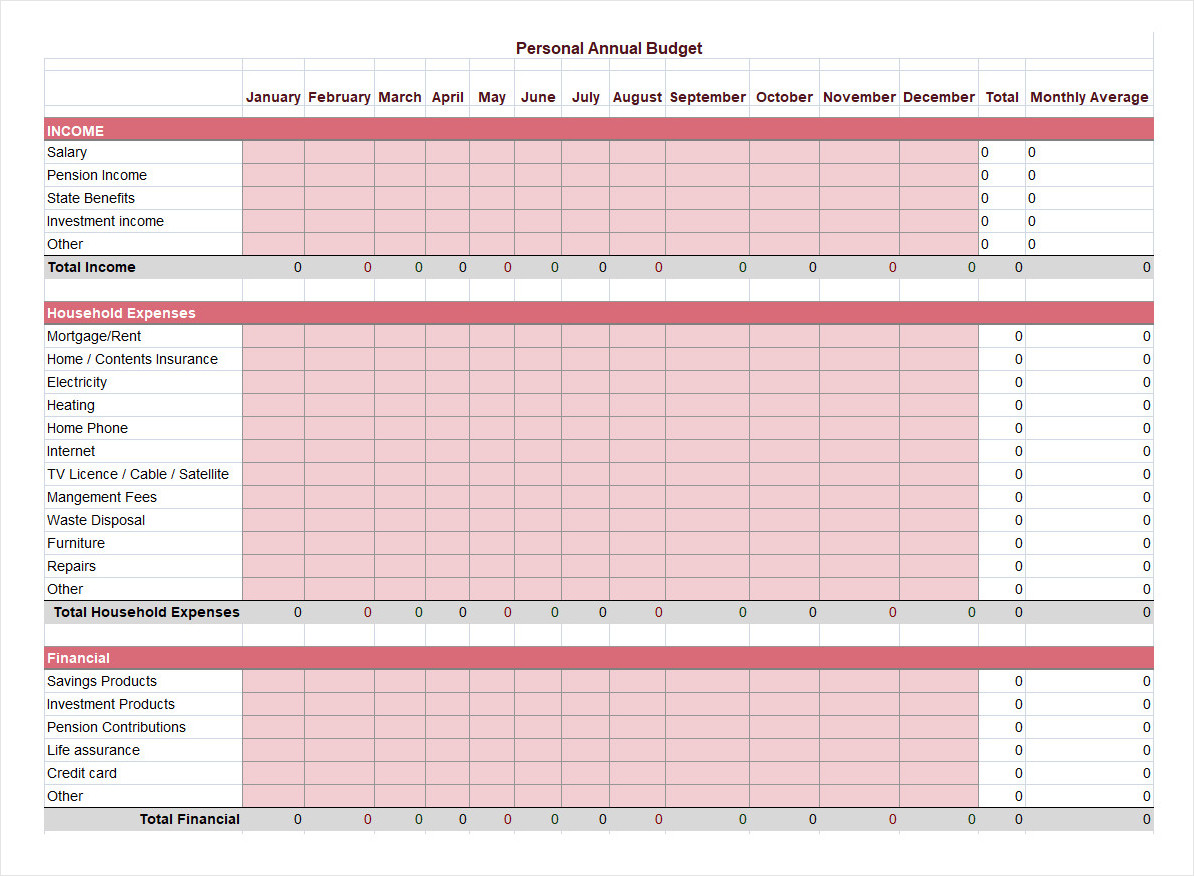

Yearly Budget Template

Setting a yearly budget is a powerful tool for managing your finances effectively and achieving your financial goals. By creating a detailed plan for your income and expenses, you can track your spending, prioritize your financial objectives, and build a solid foundation for long-term financial success.

Start using our free yearly budget template today to plan expenses effectively, manage your finances with clarity, and stay on track with your financial goals.

Yearly Budget Template – Excel