Are you looking to maintain closer control over your spending, manage your finances on a more granular level, and provide flexibility to adjust to unexpected costs? If so, then adopting a weekly budget may be the solution you’ve been searching for.

By breaking down your budget weekly, you can track expenses more frequently, prevent small overspending habits from accumulating over a month, and easily identify and correct mistakes early on. This approach is particularly useful for those who are paid weekly or bi-weekly, as it aligns your budget with your pay cycle, making it simpler to plan, save, and adapt to financial changes.

What is a Weekly Budget?

A weekly budget is a financial plan that outlines your income and expenses weekly. Unlike traditional monthly budgets, which can sometimes feel overwhelming or difficult to stick to, a weekly budget allows you to break down your finances into smaller, more manageable chunks.

By tracking your spending week by week, you can gain a better understanding of where your money is going and make adjustments as needed.

Why Choose a Weekly Budget?

There are several reasons why opting for a weekly budget can be beneficial for your financial well-being:

Increased Control Over Your Finances

By monitoring your finances weekly, you gain greater control over your spending habits and can make timely adjustments to prevent overspending. This level of control can help you avoid accumulating debt, build savings more effectively, and achieve your financial goals with greater ease.

Alignment with Your Pay Cycle

For individuals who are paid weekly or bi-weekly, a weekly budget aligns your budgeting efforts with your income schedule. This alignment makes it easier to plan for recurring expenses, allocate funds towards savings goals, and ensure that you have enough money to cover your bills throughout the month.

Improved Financial Awareness

Tracking your expenses every week enhances your financial awareness and accountability. By regularly reviewing your spending patterns, you can identify areas where you may be overspending, make adjustments to your budget, and cultivate healthier financial habits over time.

Adaptability to Changing Financial Circumstances

A weekly budget offers the flexibility to adapt to unexpected financial changes or emergencies. Whether faced with a sudden expense or a drop in income, a weekly budget allows you to quickly reassess your financial situation, reallocate funds as needed, and maintain financial stability during challenging times.

What to Include in Your Weekly Budget?

When creating a weekly budget, it’s essential to include the following components:

Income

Begin by calculating your total weekly income from all sources, including your primary job, side gigs, investments, or any other sources of revenue. Having a clear understanding of your income is the foundation of a successful budgeting strategy.

Fixed Expenses

List out all of your essential fixed expenses that occur every week, such as rent or mortgage payments, utilities, insurance premiums, and loan repayments. These fixed expenses are non-negotiable and should be prioritized in your budget.

Variable Expenses

Identify your variable expenses, including groceries, transportation costs, entertainment, dining out, and other discretionary spending categories. These expenses may fluctuate from week to week, so it’s important to allocate a realistic budget for each category.

Savings Goals

Allocate a portion of your income towards savings goals, such as an emergency fund, retirement savings, or a specific financial milestone you’re working towards. Setting aside money for savings ensures that you’re building a financial safety net for the future.

Debt Repayment

If you have outstanding debts, such as credit card balances or loans, include a section in your budget for debt repayment. Prioritize paying off high-interest debts to reduce financial stress and free up more funds for savings and other financial goals.

Emergency Fund

Building an emergency fund is essential for financial security. Allocate a portion of your weekly budget towards an emergency fund to cover unexpected expenses or financial setbacks. Having a robust emergency fund can help you navigate unforeseen circumstances without derailing your financial progress.

How to Stick to Your Weekly Budget

While creating a weekly budget is a great first step, sticking to it requires discipline and commitment. Here are some tips for successfully maintaining your weekly budget:

Track Your Expenses Diligently

Keep a detailed record of all your expenses throughout the week, including small purchases and miscellaneous expenses. Tracking your spending diligently will help you stay accountable and identify areas where you may be overspending.

Set Realistic Goals and Prioritize

Establish realistic financial goals and prioritize your spending based on your needs and objectives. By aligning your budget with your values and priorities, you’ll be more motivated to stick to your budget and make meaningful progress towards your goals.

Review and Adjust Regularly

Regularly review your budget at the end of each week to assess your progress and identify any deviations from your plan. Be prepared to make adjustments to your budget as needed based on your spending patterns and financial goals.

Automate Savings and Bill Payments

Take advantage of automation tools to streamline your savings contributions and bill payments. Setting up automatic transfers to your savings account and automating recurring bills can help you stay on track with your financial commitments and avoid missing payments.

Use Cash Envelopes for Discretionary Spending

Consider using the cash envelope system for your discretionary spending categories, such as entertainment or dining out. Allocate a specific amount of cash to each category at the beginning of the week and use only that cash for your purchases. This tactile approach can help you stay within budget and curb impulsive spending.

Celebrate Small Wins

Recognize and celebrate your achievements when you successfully stick to your weekly budget or reach a financial milestone. Celebrating small wins can help you stay motivated, build positive financial habits, and reinforce your commitment to long-term financial success.

Tips for Successful Financial Management

In addition to creating a weekly budget and sticking to it, consider implementing the following tips for successful financial management:

1. Establish Clear Financial Goals

Define specific and achievable financial goals that align with your values and aspirations. Whether it’s saving for a major purchase, paying off debt, or building an emergency fund, having clear goals will keep you focused and motivated.

2. Build an Emergency Fund

Prioritize building an emergency fund to cover unexpected expenses or financial emergencies. Aim to save at least three to six months’ worth of living expenses in your emergency fund to safeguard your financial stability.

3. Monitor Your Credit Score

Regularly monitor your credit score and report to ensure that there are no errors or discrepancies that could negatively impact your creditworthiness. A good credit score is essential for accessing favorable lending terms and opportunities for financial growth.

4. Invest in Your Future

Consider investing in long-term assets, such as stocks, bonds, or real estate, to grow your wealth and secure your financial future. Consult with a financial advisor to develop an investment strategy that aligns with your risk tolerance and financial goals.

5. Seek Financial Education

Continuously educate yourself on personal finance topics to enhance your financial literacy and make informed decisions about your money. Attend workshops, read books, or take online courses to expand your knowledge and skills in managing your finances effectively.

6. Practice Mindful Spending

Avoid impulsive purchases and practice mindful spending by carefully evaluating your needs versus wants before making a purchase. Consider implementing a cooling-off period for major expenses to prevent buyer’s remorse and ensure that your purchasing decisions align with your budget and financial goals.

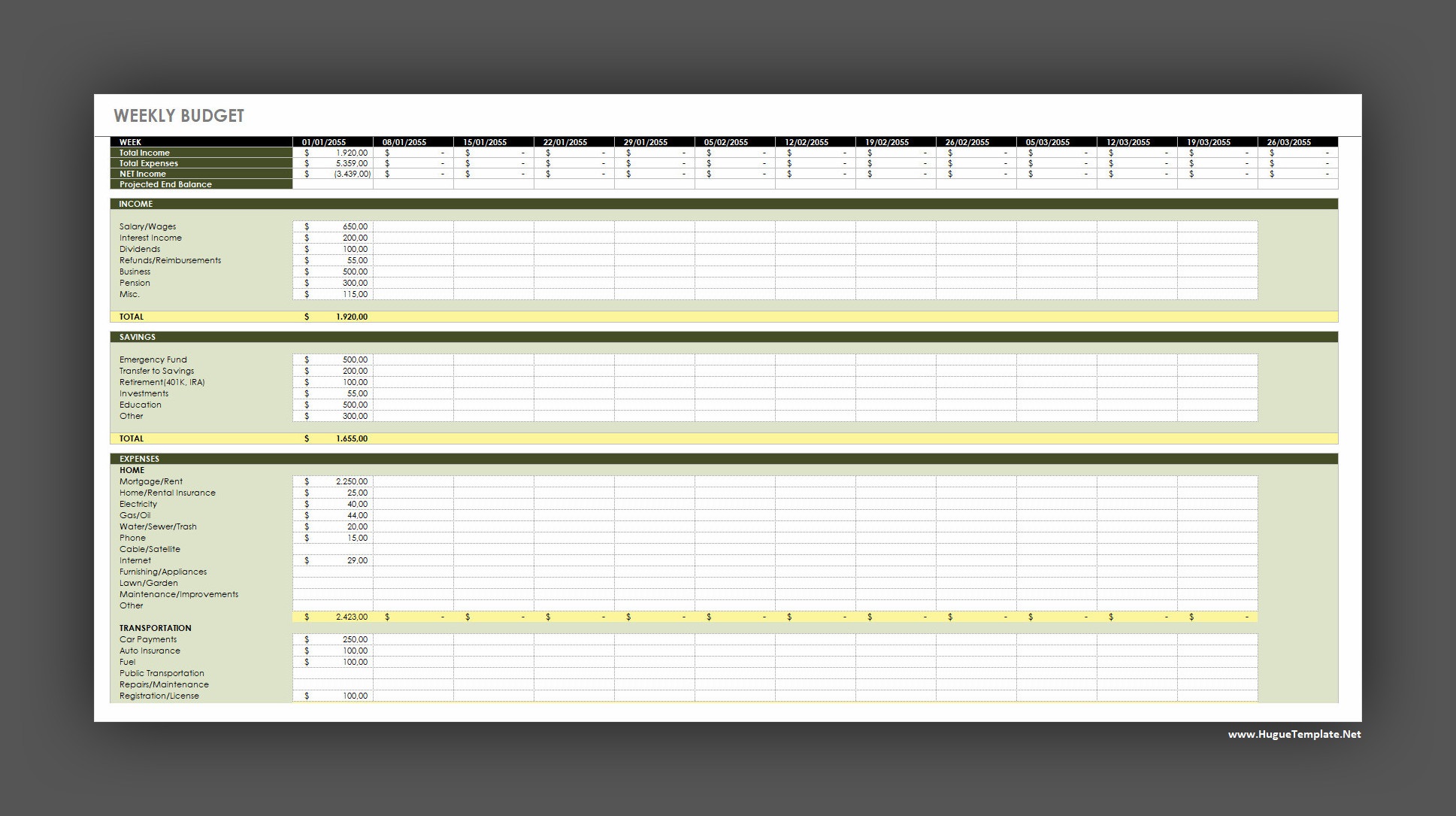

Weekly Budget Template

A weekly budget helps you track income and expenses, stay in control of your finances, and work toward your savings goals. It provides a clear picture of your spending habits and supports smarter money management.

Download our free Weekly Budget Template today and start planning your finances with confidence.

Weekly Budget Template – Excel