Are you looking for a simple and easy way to track your income and expenses? A simple income statement might be just what you need. An income statement is a financial document that shows your company’s revenue and expenses over a specific period of time. It can help you understand your financial health, identify areas where you can cut costs, and make informed decisions about your business.

In this guide, we will explore what a simple income statement is, why it is important, how to create one, examples of income statements, and tips for successful financial management.

What is a Simple Income Statement?

A simple income statement is a document that summarizes your company’s revenue and expenses for a specific period of time. It typically includes information such as sales revenue, cost of goods sold, operating expenses, and net income.

This document can help you track your financial performance, make informed decisions about your business, and plan for the future.

Why Use a Simple Income Statement?

There are several reasons why using a simple income statement is important for your business.

- First, it can help you track your revenue and expenses, allowing you to identify areas where you can cut costs and increase profits.

- Second, an income statement can help you understand your financial health and make informed decisions about your business.

- Finally, having a clear picture of your financial performance can help you plan for the future and set realistic financial goals.

How to Create a Simple Income Statement

Creating a simple income statement is easy and can be done using a spreadsheet program like Microsoft Excel or Google Sheets. Here are the steps to create your income statement:

- Gather your financial data: Collect information on your revenue, expenses, and other financial transactions for the period you want to create the income statement for.

- Open a spreadsheet program: Open Microsoft Excel or Google Sheets to create your income statement.

- Create the income statement layout: Label the columns for revenue, expenses, and net income. Input your financial data into the appropriate cells.

- Calculate the totals: Use formulas to calculate the totals for each section of the income statement.

- Review and analyze: Review your income statement to ensure accuracy and analyze the data to make informed decisions about your business.

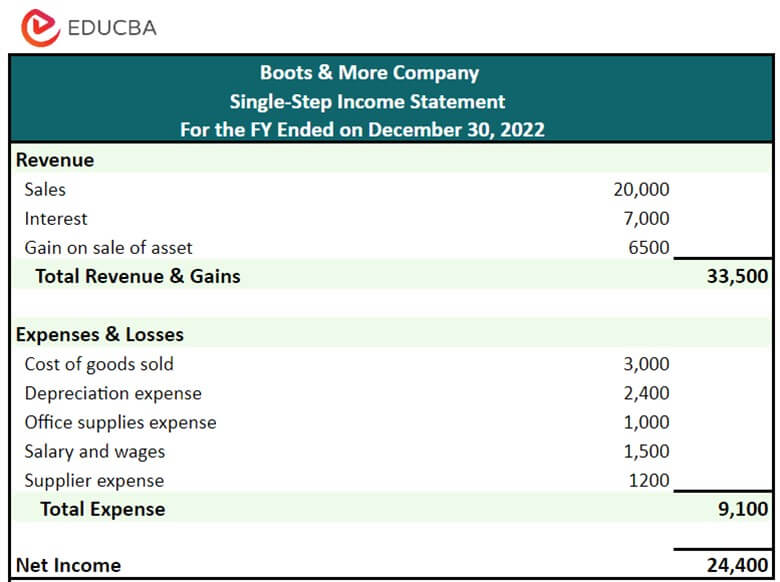

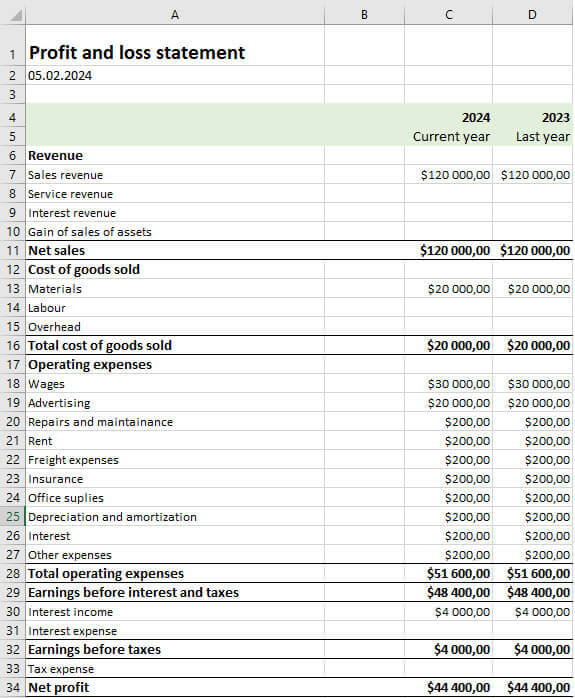

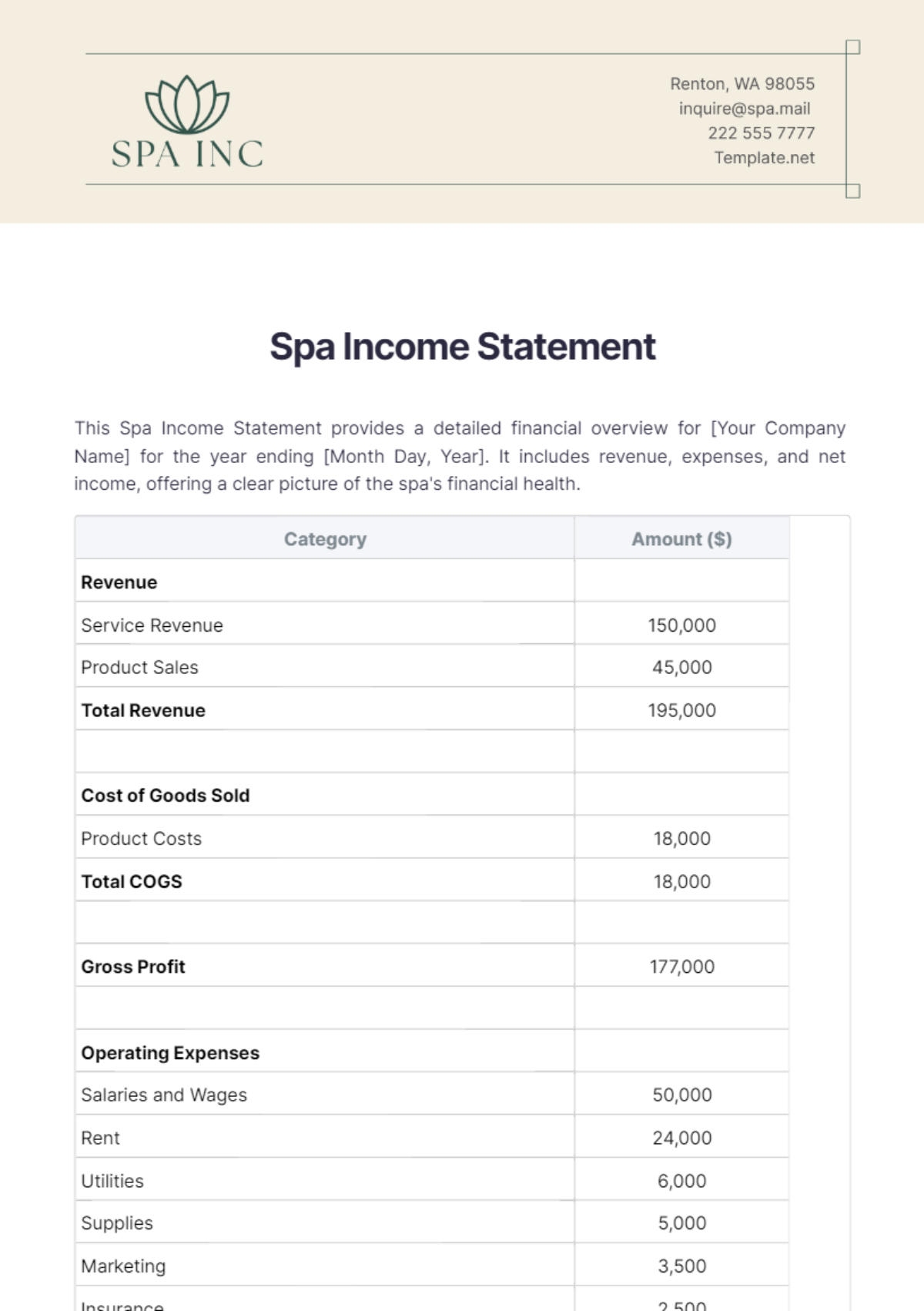

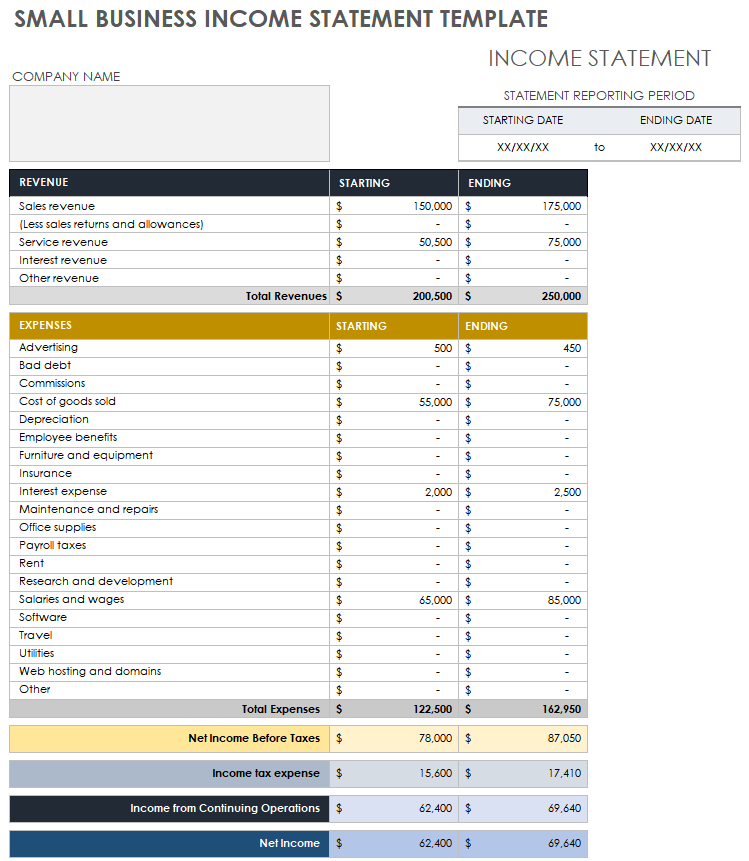

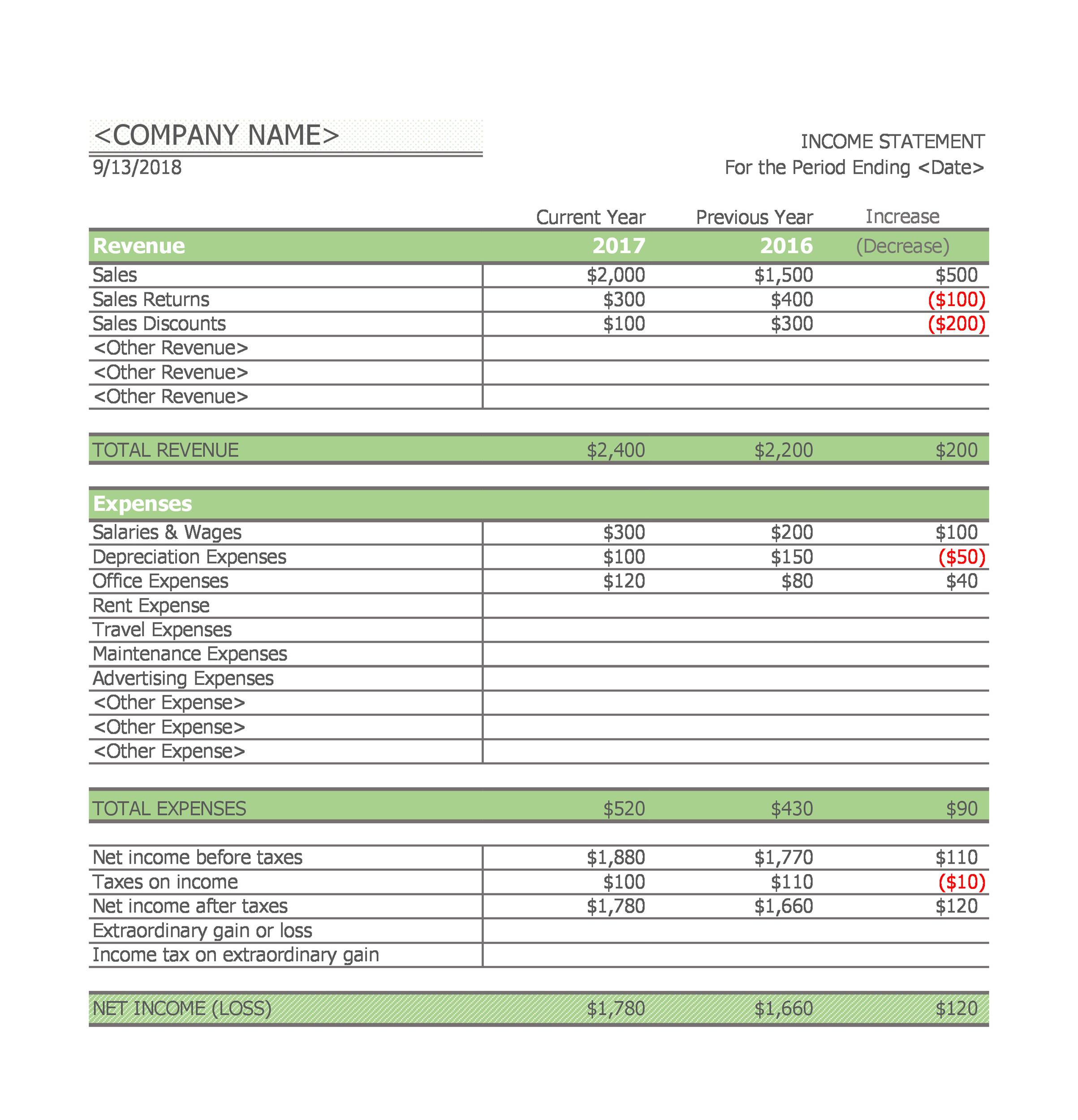

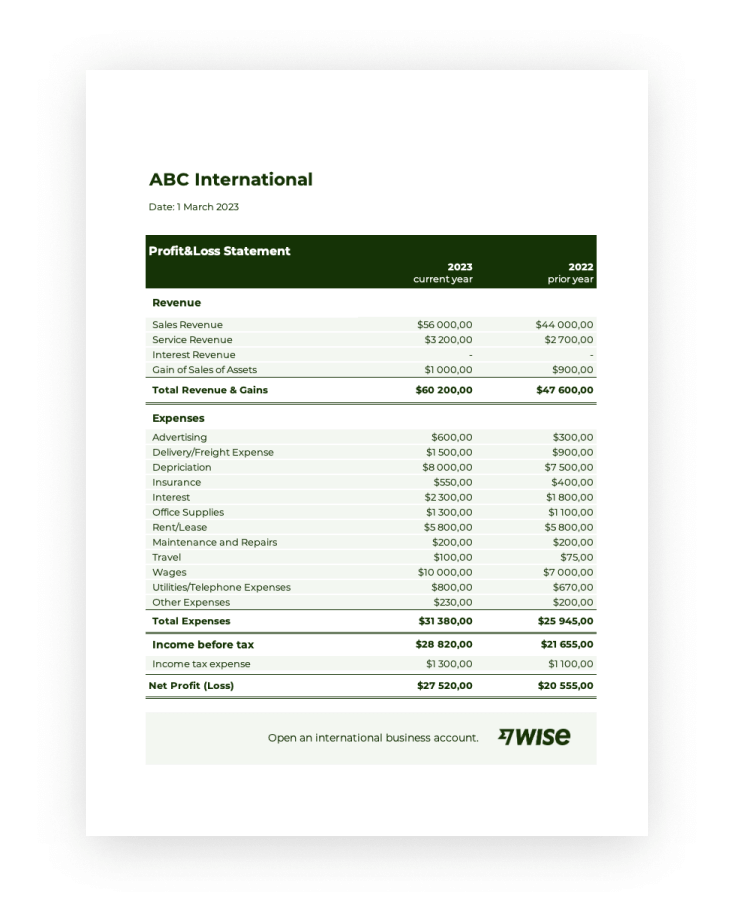

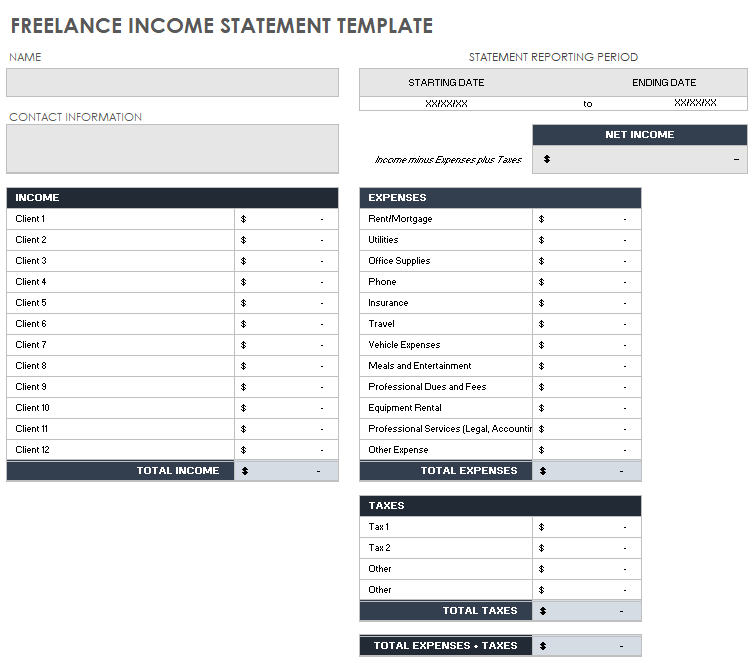

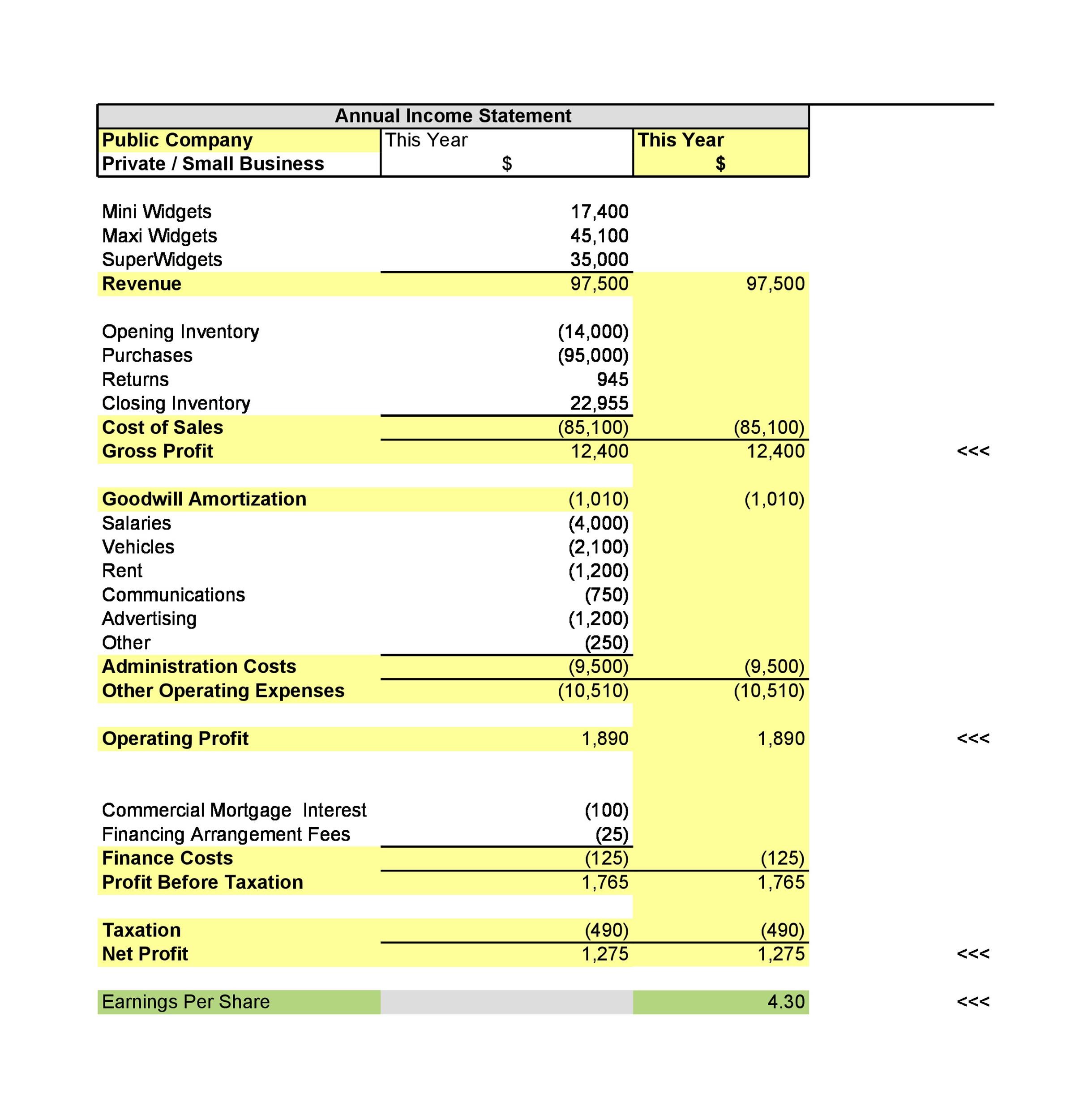

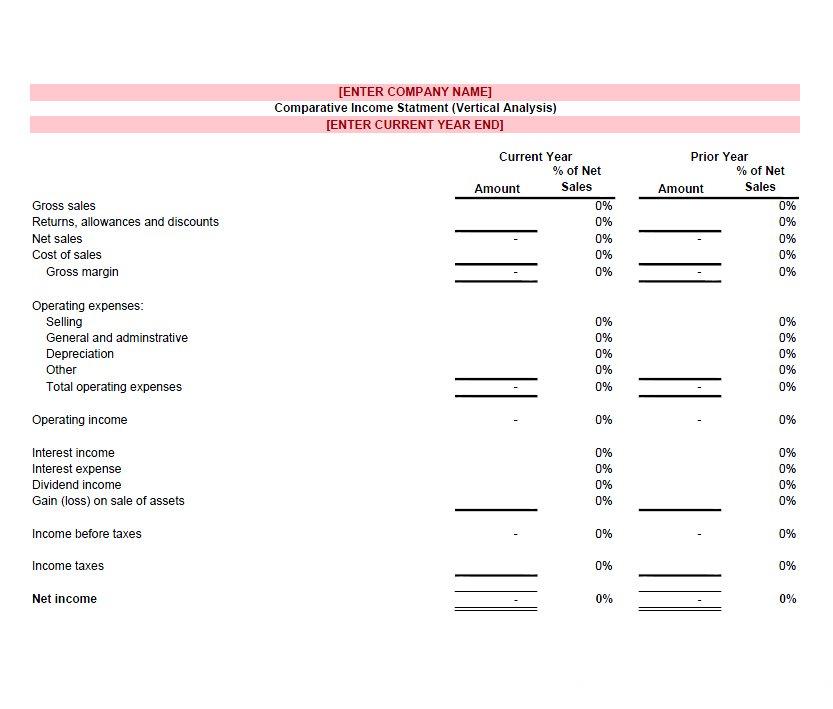

Examples of Simple Income Statements

Here are examples of simple income statements for a fictional company:

Tips for Successful Financial Management

Here are some tips for successful financial management using a simple income statement:

- Regularly update your income statement: Update your income statement regularly to track your financial performance and make informed decisions about your business.

- Compare your income statements: Compare your income statements over different periods to identify trends and areas for improvement.

- Seek professional advice: If you are unsure about creating or analyzing your income statement, seek advice from a financial advisor or accountant.

- Set financial goals: Use your income statement to set realistic financial goals for your business and track your progress towards achieving them.

- Use your income statement to make informed decisions: Use the information in your income statement to make informed decisions about your business, such as cutting costs, increasing prices, or investing in new opportunities.

By using a simple income statement, you can gain valuable insights into your company’s financial performance, make informed decisions about your business, and plan for the future. Take the time to create and analyze your income statement regularly to ensure the financial health and success of your business.

Simple Income Statement Template – Download