Managing your monthly expenses is a crucial part of maintaining financial stability. By tracking your income and spending, you can gain a better understanding of your financial situation, identify where your money is going, and manage your finances more effectively to achieve your financial goals, whether that’s saving for the future or paying off debt.

Tracking your expenses allows you to compare your budgeted amounts with your actual spending, make informed decisions about your finances, spot areas where you can cut costs, and stay accountable for your financial decisions.

What are Monthly Expenses?

Monthly expenses refer to the recurring costs you incur on a regular basis to maintain your lifestyle. These can include rent or mortgage payments, utilities, groceries, transportation, insurance premiums, debt payments, and other necessary expenses.

Tracking your monthly expenses involves keeping a record of all your spending throughout the month to get a clear picture of where your money is going.

Why Track Monthly Expenses?

Tracking your monthly expenses is essential for several reasons:

Understanding Your Financial Health

By tracking your expenses, you can gain valuable insights into your financial health. Understanding how much money you have coming in versus going out can help you make informed decisions about budgeting and saving for the future. It allows you to see where adjustments may be needed to improve your financial stability.

Identifying Spending Patterns

Tracking your expenses reveals your spending patterns and habits. You may discover areas where you consistently overspend or where you can cut back to save more money. Recognizing these patterns empowers you to make conscious choices about your spending and prioritize your financial goals.

Setting Realistic Budgets

By comparing your budgeted amounts with your actual spending, you can assess whether your financial goals are realistic and achievable. Tracking your expenses helps you create a budget that aligns with your income and desired outcomes, allowing you to plan for expenses while avoiding unnecessary debt.

Monitoring Debt Repayment

For individuals with debt obligations, tracking monthly expenses is crucial for managing debt repayment. By keeping a close eye on your spending, you can allocate funds towards debt payments and track your progress in reducing debt over time. This proactive approach can lead to faster debt elimination and financial freedom.

Improving Financial Discipline

Tracking monthly expenses fosters financial discipline by holding you accountable for your financial decisions. When you regularly monitor your spending and review your budget, you become more aware of your financial habits and can make adjustments to ensure your money is allocated towards your priorities.

What to Include in Your Monthly Expense Tracking?

When tracking your monthly expenses, it’s important to include all sources of income and every expense, no matter how small. Here are some key items to include in your monthly expense tracking:

Comprehensive Income Tracking

Include all sources of income, such as salary, bonuses, freelance work, rental income, or any additional funds received during the month. Tracking your income accurately provides a clear picture of your financial resources available for expenses and savings.

Detailed Fixed Expenses Tracking

Fixed expenses are recurring costs that remain constant each month, such as rent or mortgage payments, insurance premiums, subscription services, and loan repayments. By meticulously tracking these expenses, you can ensure they are accounted for in your budget planning.

Categorization of Variable Expenses

Variable expenses encompass discretionary spending on items like dining out, entertainment, personal care, and shopping. Categorizing these expenses allows you to analyze your spending patterns and prioritize areas where adjustments can be made to align with your financial goals.

Debt Repayment Monitoring

Include all debt payments in your expense tracking, including credit card balances, student loans, car loans, and any other outstanding debts. Monitoring debt repayment ensures that you allocate sufficient funds towards reducing debt and progressing towards financial freedom.

Savings Contributions Tracking

Don’t forget to track your savings contributions, whether towards an emergency fund, retirement account, or other financial goals. Monitoring your savings ensures that you prioritize building financial security and long-term wealth accumulation.

Emergency and Irregular Expenses Tracking

Account for unforeseen or irregular expenses in your tracking, such as medical bills, home repairs, car maintenance, or other unexpected costs. Setting aside funds for emergencies prevents financial strain when unexpected expenses arise.

How to Track Your Monthly Expenses

There are several ways to track your monthly expenses, depending on your preference and lifestyle. Here are some popular methods:

Manual Expense Tracking

One method of tracking expenses is through manual entry, where you record each expense in a notebook or spreadsheet. This hands-on approach provides a detailed overview of your spending habits and allows for personalized categorization of expenses.

Expense Tracking Apps

Utilize expense tracking apps available on smartphones or computers to streamline the process of monitoring your expenses. These apps often categorize expenses automatically, generate spending reports, and offer budgeting tools to help you stay on top of your financial management.

Online Banking Tools

Many banks provide online banking tools that categorize your transactions and offer insights into your spending patterns. By utilizing these tools, you can easily track your expenses, set budget limits, and receive alerts for unusual or high-cost transactions.

Spreadsheets and Budgeting Software

Excel spreadsheets or budgeting software like Mint or YNAB (You Need a Budget) offer customizable solutions for tracking expenses and creating budgets. These tools provide visual representations of your financial data, allowing for comprehensive analysis and informed decision-making.

Receipt Organization Systems

If you prefer a physical record of your expenses, consider organizing receipts by category in folders or envelopes. This method enables you to track spending in real-time and serves as a tangible reminder of your financial transactions.

Tips for Effective Expense Tracking

Here are some tips to help you track your monthly expenses effectively:

Establish Clear Budget Goals

Prior to tracking your expenses, define clear budget goals based on your financial priorities and objectives. Whether it’s saving for a major purchase, reducing debt, or building an emergency fund, align your spending with your long-term financial aspirations.

Regularly Review Your Expenses

Set aside time each week or month to review your expenses and assess your progress towards budget goals. Regularly analyzing your spending patterns allows for timely adjustments and ensures that you remain on track with your financial plan.

Utilize Technology for Automation

Take advantage of technology to automate expense tracking and budgeting processes. Use apps, software, or online tools that simplify financial management tasks, saving you time and providing accurate insights into your financial health.

Monitor Your Debt-to-Income Ratio

Keep track of your debt-to-income ratio by comparing your monthly debt payments to your total income. A low debt-to-income ratio signifies healthy financial habits and indicates that you are effectively managing debt repayment alongside other expenses.

Practice Frugal Spending Habits

Cultivate frugal spending habits by identifying areas where you can reduce expenses without sacrificing quality of life. Cut back on non-essential purchases, seek discounts or deals, and prioritize value-driven spending to optimize your budget.

Seek Professional Financial Advice

If you encounter challenges in managing your expenses or achieving financial goals, consider seeking guidance from a financial advisor. An expert can provide tailored strategies, offer insights on budget optimization, and help you navigate complex financial decisions.

Stay Committed to Your Financial Goals

Maintain commitment to your financial goals by staying disciplined in your expense tracking and budgeting efforts. Celebrate small milestones, stay motivated by visualizing your progress, and remain dedicated to achieving long-term financial stability.

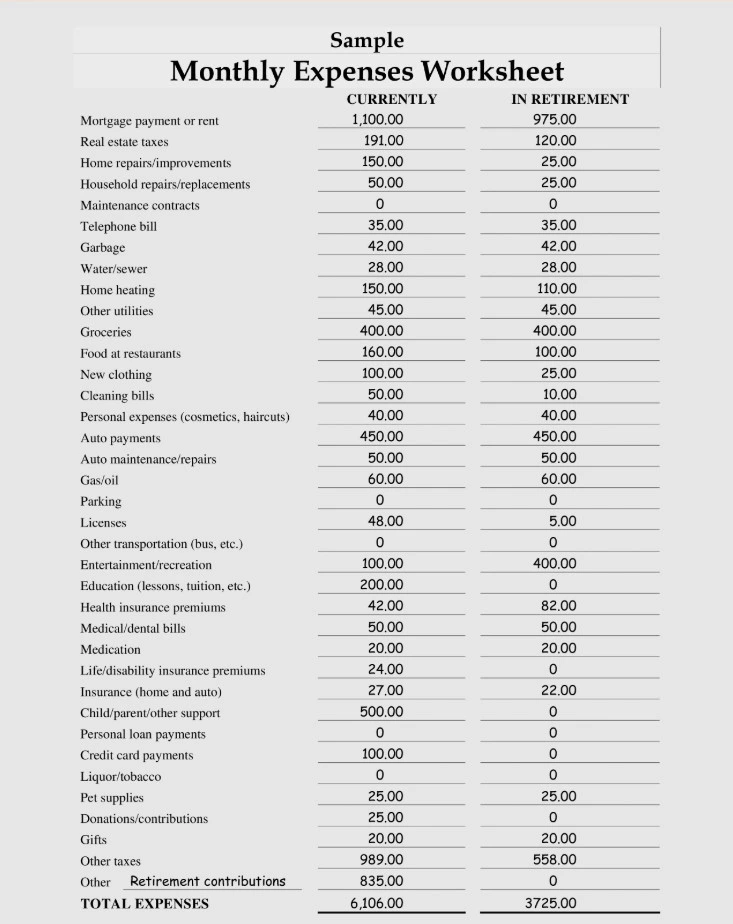

Free Monthly Expenses Template

In conclusion, a monthly expenses tracker helps you track spending, manage budgets, and stay on top of your financial goals with ease.

Take control of your finances and make smarter money decisions—download our Monthly Expenses Template today to start managing your budget effectively!

Monthly Expenses Template – DOWNLOAD