When taking out a loan, it’s important to understand the repayment structure and track your progress towards paying it off. A monthly amortization schedule can help you do just that. This schedule shows how a loan is repaid over time, detailing each monthly payment and how it’s allocated between principal and interest.

By using this tool, borrowers can gain a clearer understanding of their loan’s repayment structure, track their progress towards payoff, and plan their finances accordingly.

What is a monthly amortization schedule?

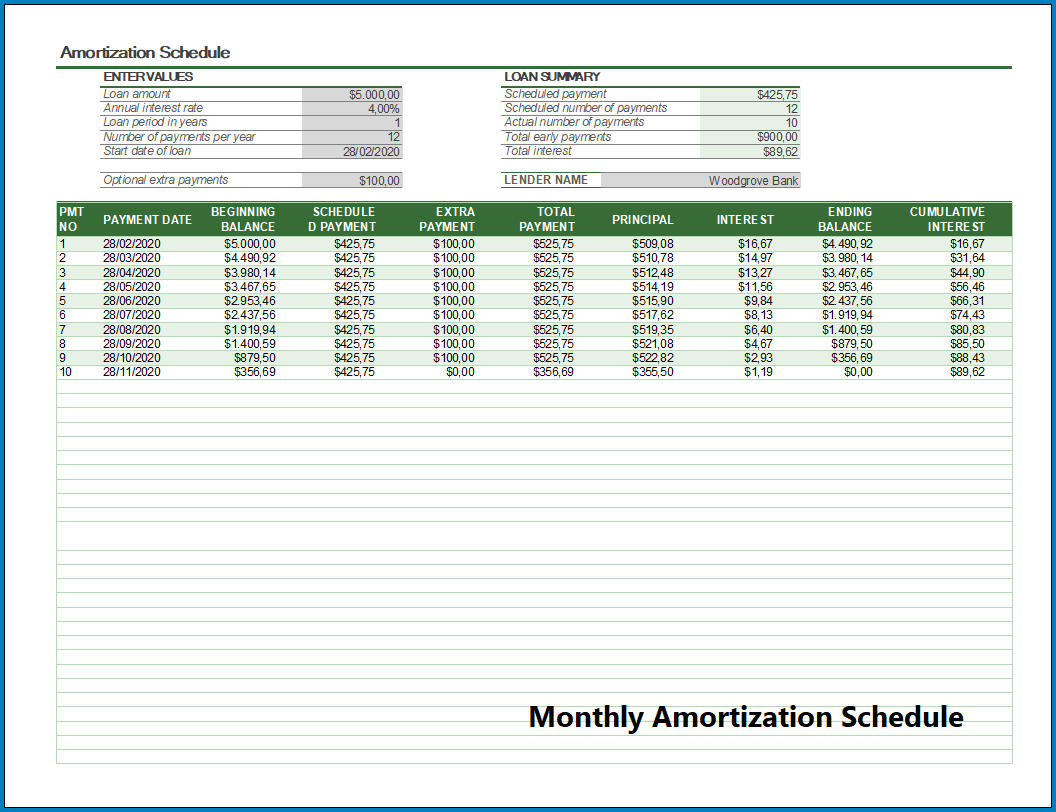

A monthly amortization schedule is a document that outlines the repayment structure of a loan. It breaks down each monthly payment into its principal and interest components, providing borrowers with a clear understanding of how their payments are being allocated. This schedule is typically created by lenders and provided to borrowers at the start of their loan term.

The schedule includes the loan amount, interest rate, loan term, and the number of payments required to pay off the loan. It also shows the monthly payment amount, the portion allocated to principal, and the portion allocated to interest for each payment.

Why is a monthly amortization schedule important?

A monthly amortization schedule is important for several reasons:

- Understanding the loan’s repayment structure: By reviewing the schedule, borrowers can see how their monthly payments are applied to both principal and interest. This helps them understand how their loan balance decreases over time.

- Tracking progress towards payoff: The schedule shows the remaining balance after each payment, allowing borrowers to track their progress towards paying off the loan. This can be motivating and help borrowers stay on track with their payments.

- Planning finances accordingly: By knowing the exact amount of each monthly payment, borrowers can plan their finances accordingly. They can budget for the payment and ensure they have enough funds to cover it each month.

How to create a monthly amortization schedule

Creating a monthly amortization schedule is relatively simple. Here’s how you can do it:

- Gather loan details: Collect all the necessary information about your loan, including the loan amount, interest rate, and loan term.

- Calculate the monthly payment: Use a loan amortization calculator or a spreadsheet program to calculate the monthly payment amount based on the loan details.

- Break down the payment: Determine the portion of each payment that goes towards principal and interest. This can also be calculated using a loan amortization calculator or a spreadsheet program.

- Create a table: Use a word processing program or a spreadsheet program to create a table that lists each monthly payment, the amount applied to principal, the amount applied to interest, and the remaining balance after each payment.

- Format and print: Format the table to your liking, making sure it’s easy to read and understand. Once you’re satisfied with the layout, print the schedule.

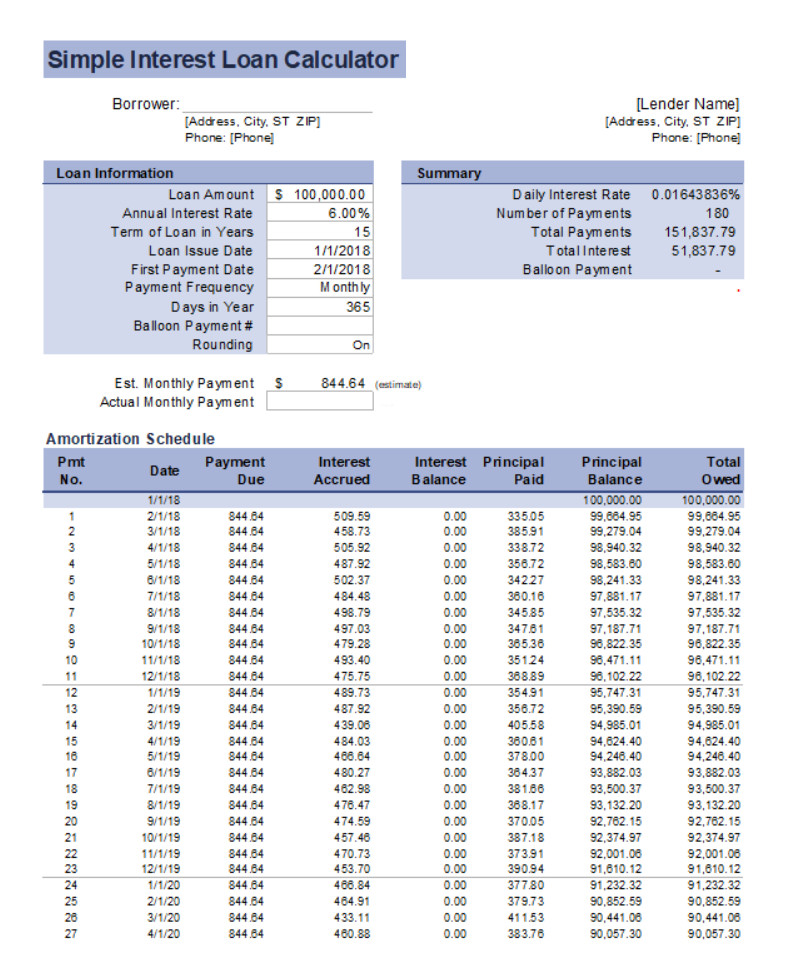

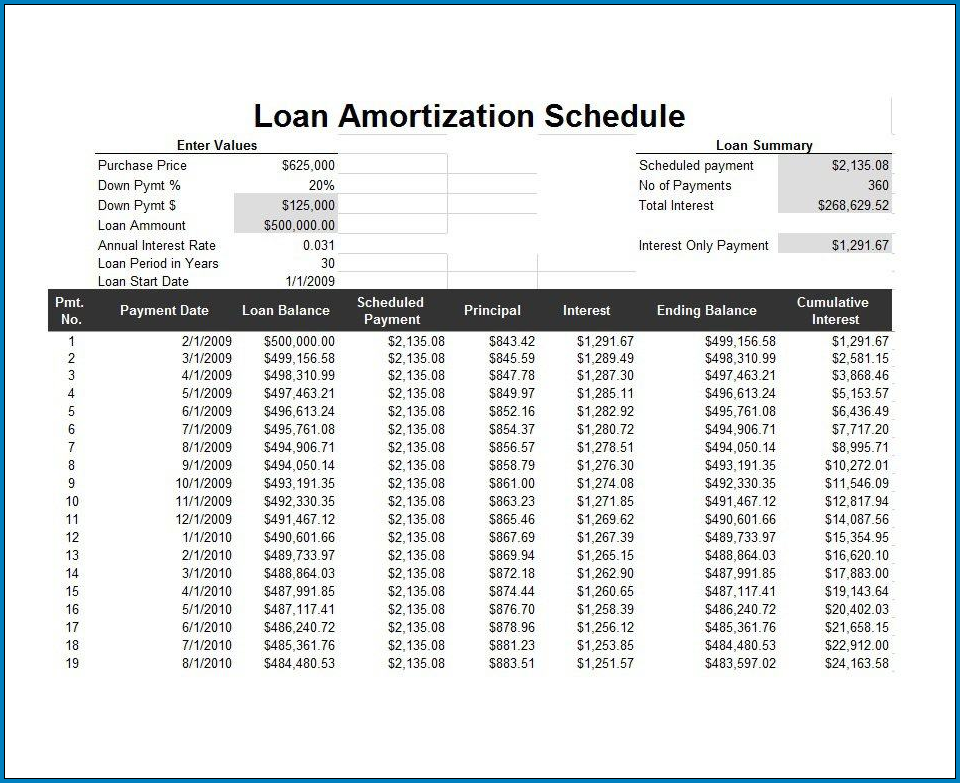

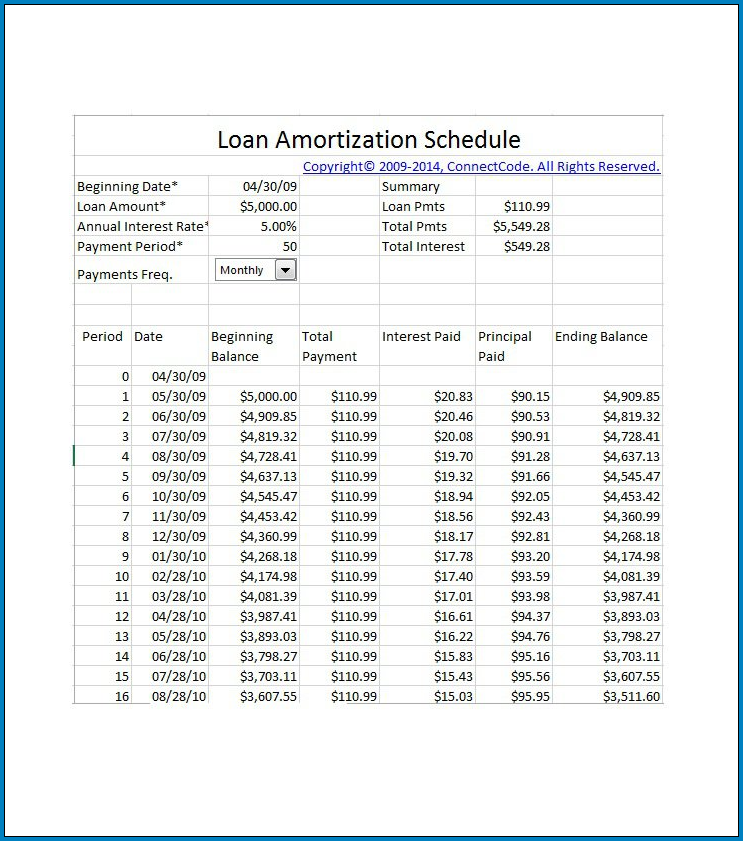

Examples of monthly amortization schedules

Here are a few examples of what a monthly amortization schedule might look like:

Tips for the successful use of a monthly amortization schedule

Here are some tips to make the most of your monthly amortization schedule:

- Review the schedule regularly: Take the time to review your schedule regularly to understand how your payments are reducing your loan balance over time.

- Track your progress: Use the schedule to track your progress towards paying off the loan. Celebrate each milestone and stay motivated to reach your goal.

- Consider making extra payments: If possible, consider making extra payments towards your loan. This can help you pay off the loan faster and save on interest charges.

- Update the schedule as needed: If you make any changes to your loan, such as refinancing or adjusting the term, update your schedule to reflect the new details.

- Seek professional advice if needed: If you’re having trouble understanding your schedule or need assistance with your loan, don’t hesitate to seek advice from a financial professional.

- Use the schedule as a financial planning tool: The schedule can also be used as a financial planning tool. It can help you budget for your monthly payment and plan for other financial goals.

- Keep the schedule in a safe place: Store your schedule in a safe place where you can easily access it. This will ensure you can refer to it whenever needed.

Conclusion

A monthly amortization schedule is a valuable tool for borrowers to understand their loan’s repayment structure, track their progress towards payoff, and plan their finances accordingly.

By using this schedule, borrowers can gain a clearer understanding of their loan’s terms and stay on track with their payments. Whether you’re taking out a mortgage, car loan, or personal loan, creating and using a monthly amortization schedule can be beneficial for managing your debt effectively.

Monthly Amortization Schedule Template – Download