Managing debt can be overwhelming, especially when it comes to repaying a loan. A loan payment schedule is a detailed roadmap that outlines the amount and timing of each payment, helping borrowers understand their financial obligations, plan their budget, and track their debt repayment progress.

This schedule also provides insight into how much of each payment goes towards the principal and interest, giving borrowers a clear understanding of the loan’s amortization.

What is a Loan Payment Schedule?

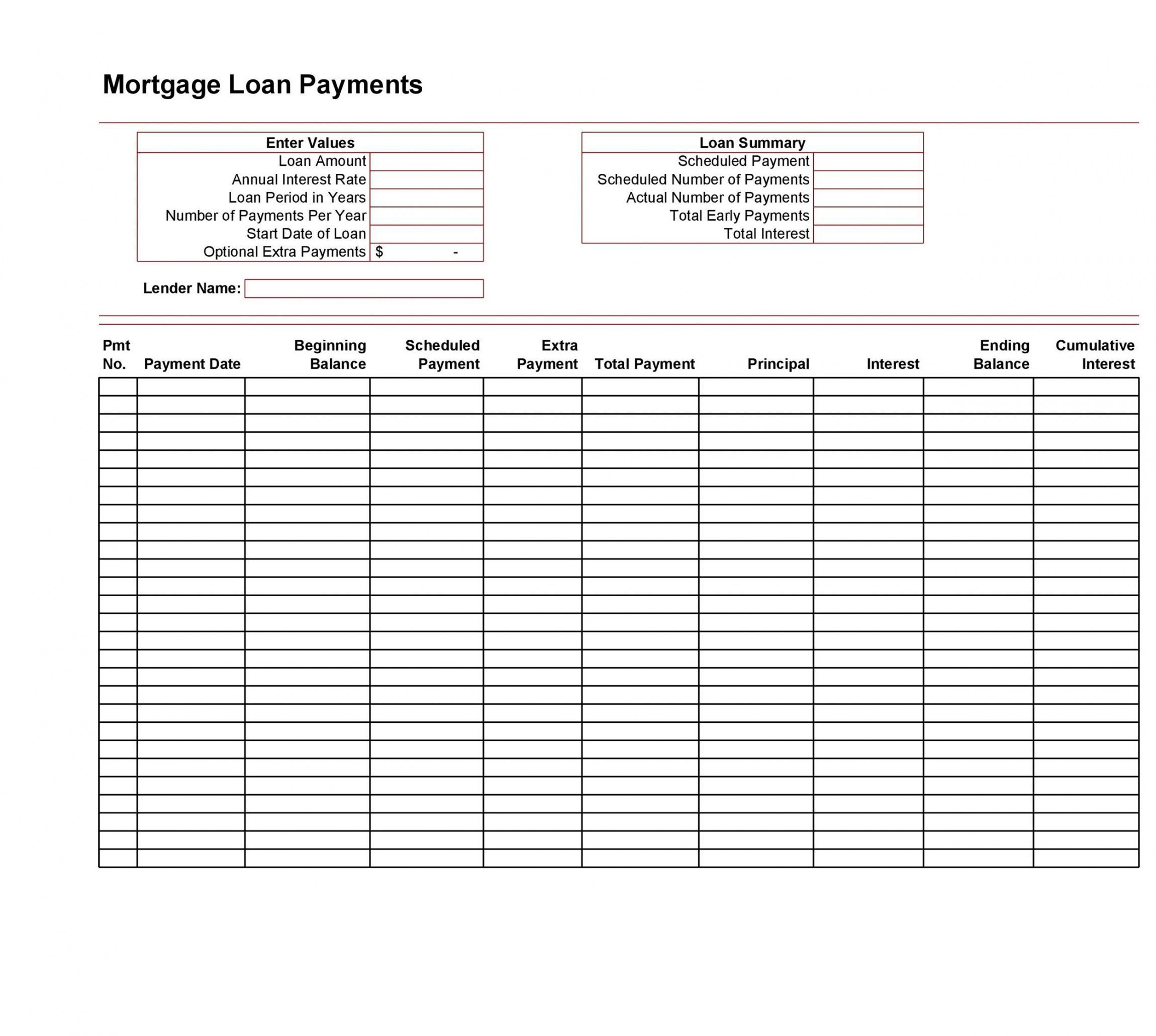

A loan payment schedule is a document that lays out the specific details of a loan repayment plan. It includes information such as the total amount borrowed, the interest rate, the term of the loan, and the monthly payment amount.

The schedule breaks down each payment, showing how much goes towards the principal balance and how much goes towards interest.

Why Use a Loan Payment Schedule?

Having a loan payment schedule is crucial for borrowers to stay organized and on track with their loan repayment. It allows individuals to see the big picture of their financial obligations and plan accordingly.

By having a clear roadmap of when payments are due and how much is owed, borrowers can better manage their budget and avoid missing payments.

How to Create a Loan Payment Schedule

Creating a loan payment schedule is relatively simple. Start by gathering all the necessary information about the loan, including the total amount borrowed, the interest rate, and the term of the loan.

Use a loan calculator or spreadsheet software to calculate the monthly payment amount based on this information. Break down each payment to show how much goes towards the principal and how much goes towards interest.

1. Determine the Total Loan Amount

Begin by identifying the total amount borrowed, which is the principal balance of the loan. This is the amount that needs to be repaid over the term of the loan.

2. Calculate the Interest Rate

Understand the interest rate of the loan, as this will determine how much interest is accrued on the outstanding balance each month.

3. Determine the Loan Term

Know the term of the loan, which is the length of time over which the loan will be repaid. This can range from a few months to several years.

4. Calculate Monthly Payments

Use a loan calculator or spreadsheet software to calculate the monthly payment amount based on the total loan amount, interest rate, and loan term.

5. Break Down Each Payment

Create a detailed breakdown of each payment, showing how much goes towards the principal balance and how much goes towards interest. This will help borrowers understand how their payments are allocated.

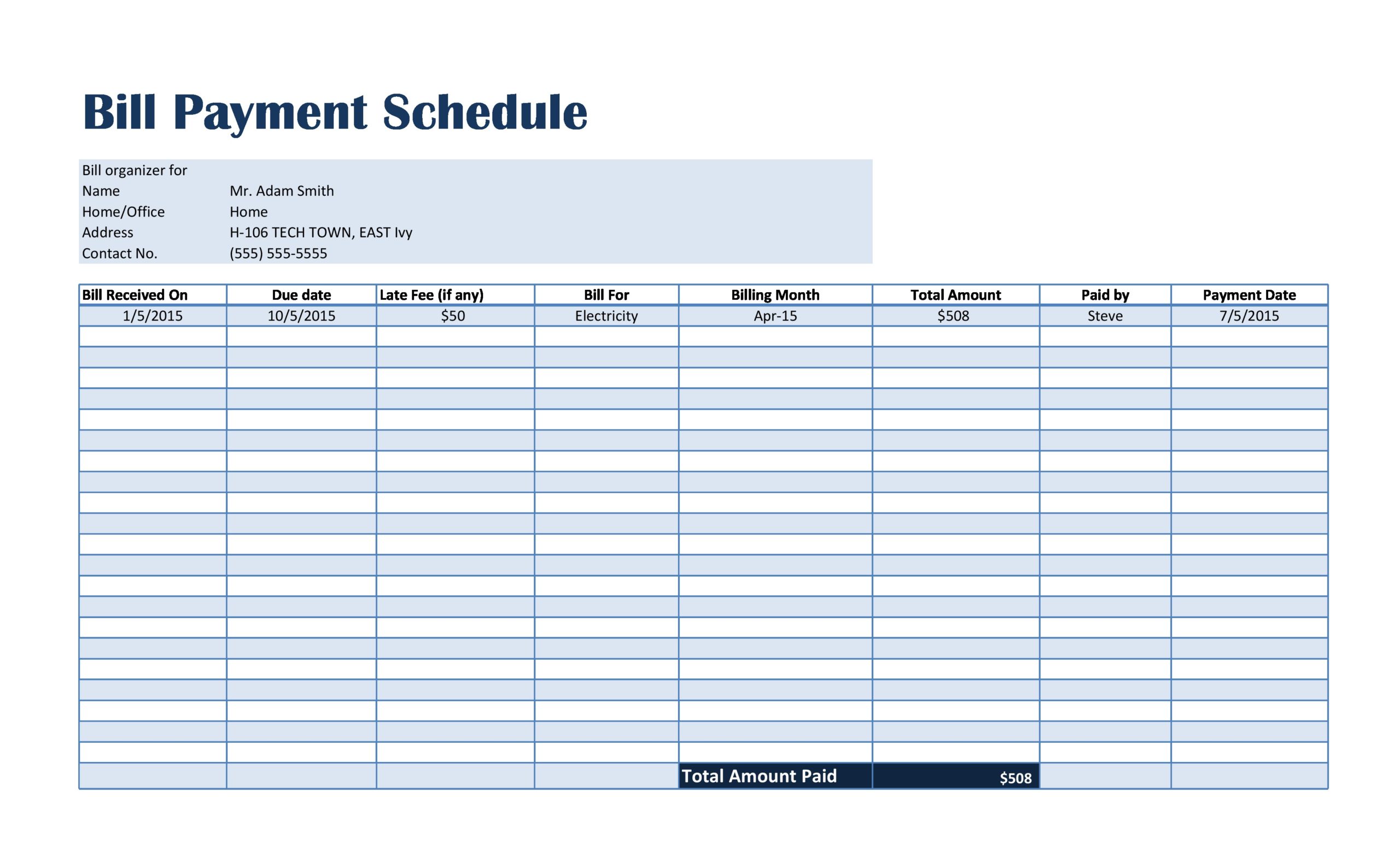

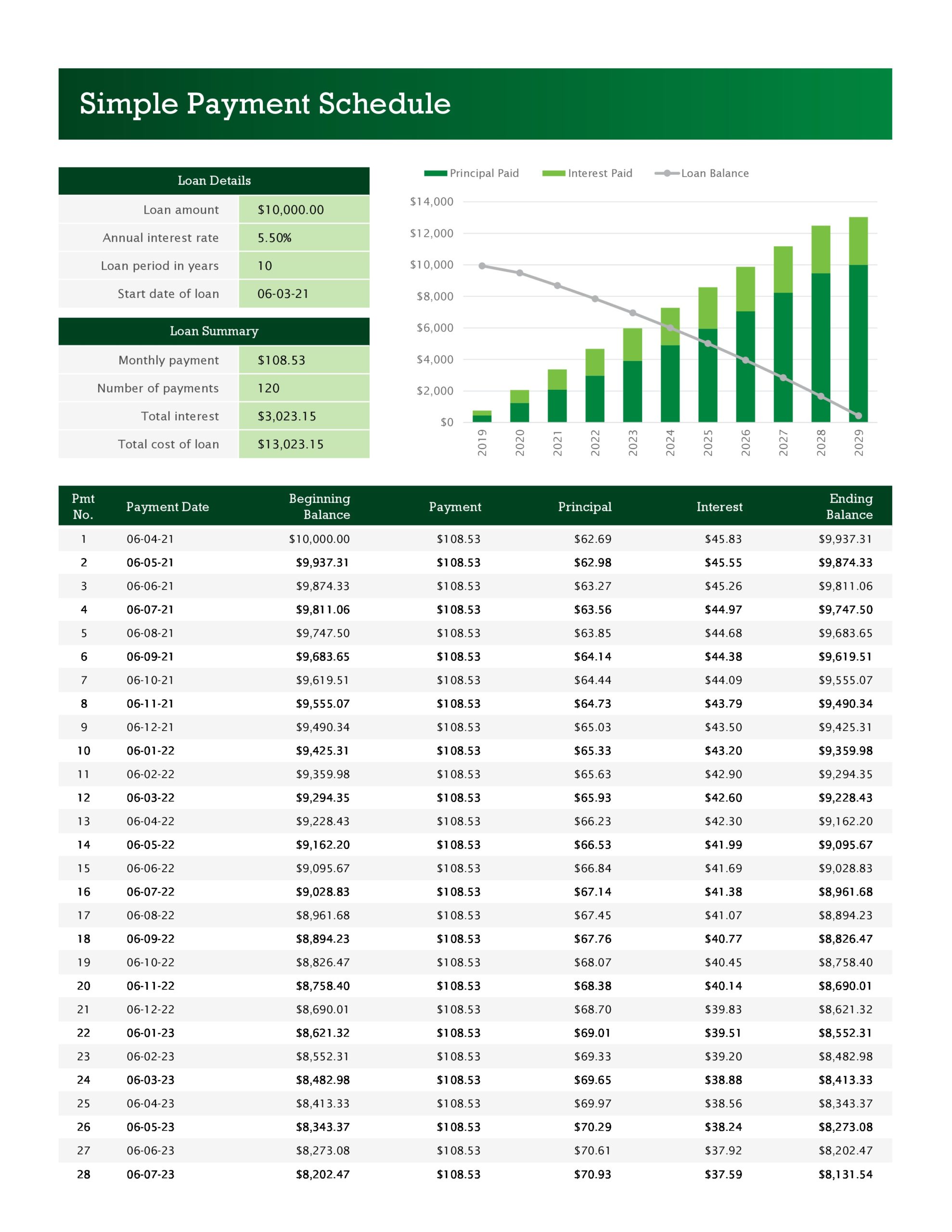

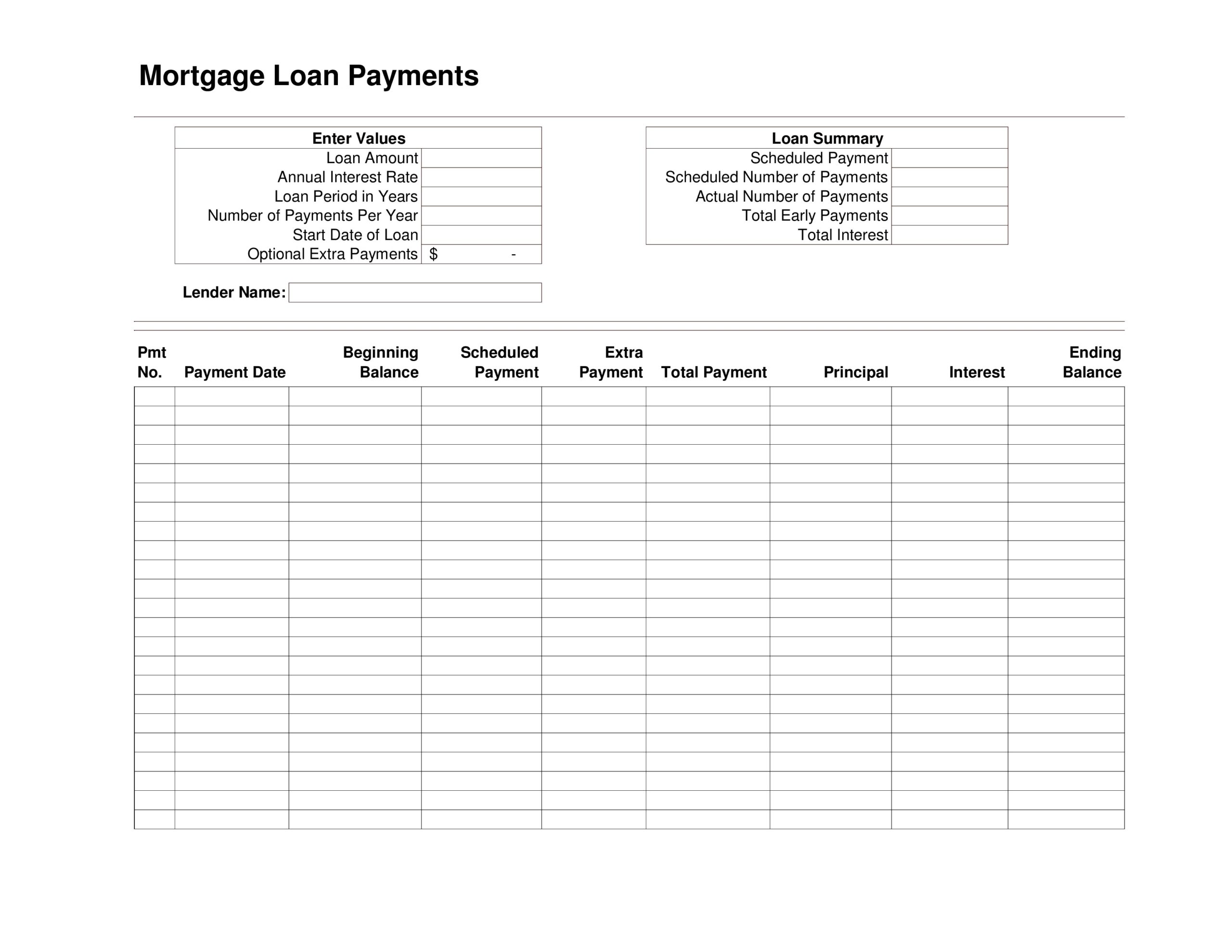

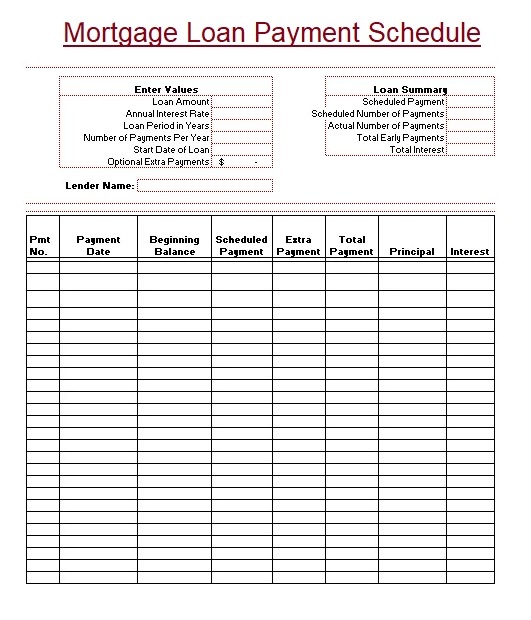

Examples of Loan Payment Schedules

Tips for Successful Loan Repayment

- Stick to the Schedule. Make timely payments according to the schedule to avoid late fees and penalties.

- Pay Extra When Possible. If financially feasible, consider making extra payments towards the principal balance to pay off the loan faster.

- Monitor Progress. Keep track of your debt repayment progress by regularly reviewing your loan payment schedule.

- Communicate with Lenders. If you encounter financial difficulties, communicate with your lenders to explore alternative repayment options.

- Update the Schedule. Update your loan payment schedule as needed to reflect any changes in your financial situation or loan terms.

Loan Payment Schedule Template – Download