Regarding estate planning, a living trust form can be a valuable tool to manage and distribute your assets during your lifetime and after your death. This legal document helps you avoid the costly and public probate process, ensuring a smooth transition of your assets to your chosen beneficiaries.

A living trust specifies who will manage your assets (the trustee) and who will inherit them (the beneficiary). Additionally, it can ensure your assets are managed in case of incapacity and provide a way to manage property for minor children.

What is a Living Trust Form?

A living trust form, also known as a revocable trust or inter vivos trust, is a legal document that allows you to transfer ownership of your assets into a trust during your lifetime. The person who creates the trust is known as the grantor or settlor. The trust is managed by a trustee, who can be the grantor or another designated individual, and the assets are held for the benefit of the beneficiaries.

A living trust form is different from a will in that it takes effect during the grantor’s lifetime and can be updated or amended as circumstances change. It allows for the seamless transfer of assets to beneficiaries without the need for probate court involvement, which can be time-consuming and expensive.

Types of Living Trusts

There are several types of living trusts that you can consider when creating your estate plan:

- Revocable Trust: This type of trust can be changed or revoked by the grantor during their lifetime.

- Irrevocable Trust: Once established, this trust cannot be changed or revoked by the grantor.

- Asset Protection Trust: This trust is designed to protect assets from creditors and lawsuits.

- Charitable Trust: This trust is created to benefit a charitable organization or cause.

- Special Needs Trust: This trust is set up to provide for a loved one with special needs without affecting their eligibility for government benefits.

Each type of living trust has its own benefits and considerations, so it’s important to work with a legal professional to determine which type is best suited to your needs and goals.

Why Consider a Living Trust Form for Estate Planning?

There are several reasons why a living trust form may be a valuable addition to your estate planning strategy:

- Complex Asset Portfolio: If you have a diverse range of assets, a living trust can help streamline the distribution process.

- Privacy Concerns: If you prefer to keep your estate affairs private, a living trust can help avoid the public probate process.

- Incapacity Planning: A living trust can provide instructions for managing your assets in the event of your incapacity.

- Asset Protection: Certain types of living trusts can shield assets from creditors and legal claims.

By carefully considering your individual circumstances and goals, you can determine whether a living trust form aligns with your estate planning objectives.

What to Include in a Living Trust Form?

When creating a living trust form, it is essential to include comprehensive details to ensure that your wishes are carried out effectively:

Personal Information

Include your full legal name, address, and date of birth to clearly identify yourself as the grantor of the trust.

Trustee Designation

Name the individual or entity that will serve as the trustee of the trust and outline their responsibilities and powers.

Beneficiary Designation

Specify who will inherit the assets held in the trust and detail any conditions or restrictions on the distribution of assets.

Asset Inventory

List all assets that will be transferred into the trust, including real estate, investments, bank accounts, and personal property.

Asset Management Instructions

Provide clear guidelines on how the trustee should manage and distribute the assets held in the trust, including any specific wishes or preferences.

Contingency Plans

Include provisions for what should happen in the event of your incapacity or death, such as naming alternate trustees or beneficiaries.

By including these critical components in your living trust form, you can create a comprehensive document that reflects your intentions and protects your assets for future generations.

Specific Bequests

Detail any specific gifts or bequests you wish to make to individuals or organizations outside of the general distribution of assets.

Trust Terms and Conditions

Outline any specific terms or conditions that must be met for beneficiaries to receive their inheritance, such as reaching a certain age or completing a milestone.

Successor Trustee Appointment

Name a successor trustee who will take over the management of the trust if the original trustee is unable to fulfill their duties.

Revocation and Amendment Procedures

Specify the process for amending or updating the trust document as needed to reflect changes in your circumstances or wishes.

Trust Dissolution

Include instructions for how the trust should be dissolved and assets distributed if the trust is no longer needed or becomes invalid.

By incorporating these detailed provisions into your living trust form, you can ensure that your assets are managed and distributed according to your exact specifications.

How to Create a Living Trust Form

Creating a living trust form involves several steps to ensure that the document accurately reflects your wishes and protects your assets:

Evaluate Your Assets

Make a comprehensive list of all assets you wish to transfer into the trust, including real estate, financial accounts, personal property, and investments.

Select a Trustee

Choose a trustworthy individual or institution to serve as the trustee of the trust and manage your assets according to your instructions.

Draft the Trust Document

Work with an experienced estate planning attorney to draft a legally binding trust document that includes all necessary provisions and reflects your wishes accurately.

Transfer Assets

Transfer ownership of your assets into the trust by updating titles on property, changing beneficiary designations, and re-registering financial accounts in the name of the trust.

Review and Update

Regularly review and update your living trust form to ensure that it remains current and aligns with your goals and objectives as your circumstances change.

By following these steps and working closely with legal professionals, you can create a living trust form that effectively manages and distributes your assets in accordance with your wishes.

Tips for Managing a Living Trust

Effectively managing a living trust requires proper oversight and attention to detail to ensure that your assets are protected and distributed as intended:

Communication

Keep your beneficiaries informed about the existence of the trust, the role of the trustee, and any specific instructions or conditions regarding asset distribution.

Regular Reviews

Periodically review your living trust to ensure that it still aligns with your goals and intentions, making updates or amendments as needed to reflect changes in your circumstances.

Professional Guidance

Consult with estate planning attorneys, financial advisors, or trust administrators to receive expert guidance on managing your trust and ensuring compliance with legal requirements.

Asset Updates

Regularly update your trust document to reflect changes in your asset portfolio, including acquisitions, sales, or changes in value that may impact the distribution of assets.

By following these tips and maintaining proactive management of your living trust, you can ensure that your assets are protected and distributed in accordance with your wishes, providing peace of mind for you and your loved ones.

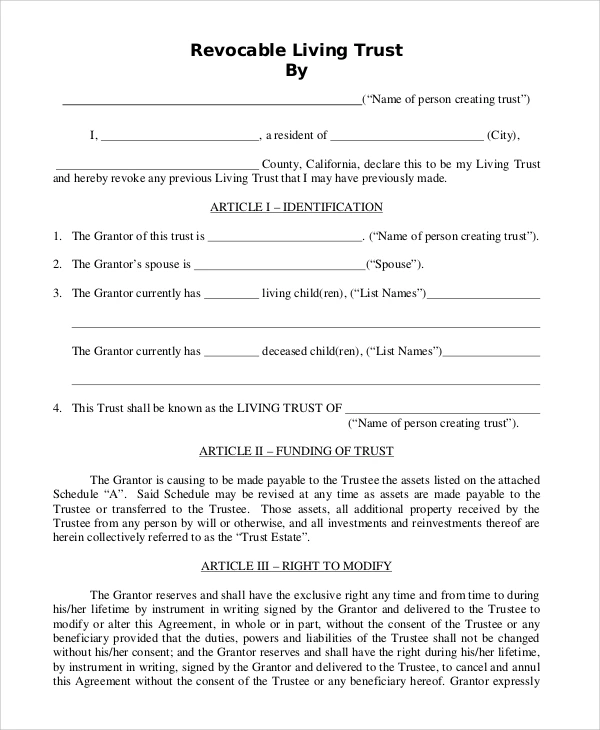

Living Trust Form Template

In conclusion, a Living Trust Form helps you organize and protect your assets while ensuring a smooth transfer to beneficiaries without probate delays.

Secure your legacy and provide peace of mind for your loved ones—download our Living Trust Form Template today to simplify your estate planning process!

Living Trust Form Template – WORD