Managing debt can be overwhelming, but having a clear plan in place can help alleviate some of the stress. A debt schedule is a useful tool that can assist you in organizing and tracking your debts.

In this guide, we will explore a debt schedule, why it is important, how to create one, examples of different debt schedules, and tips for successful debt management.

What is a Debt Schedule?

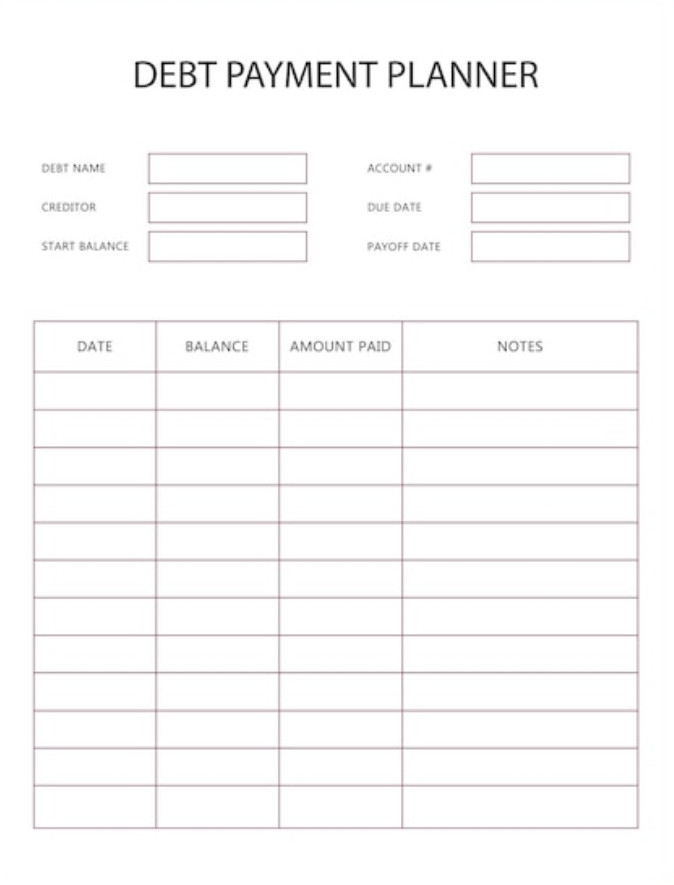

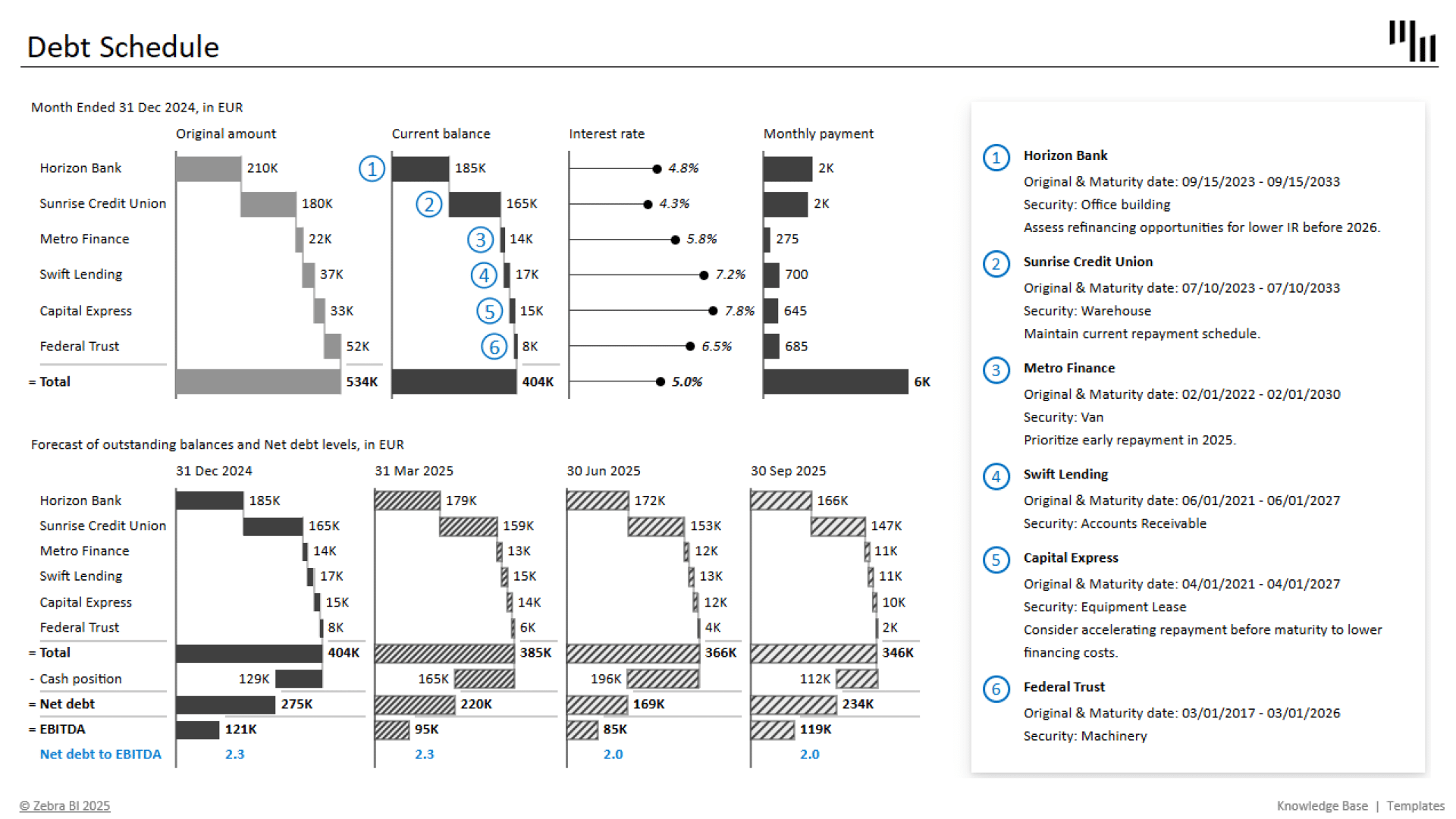

A debt schedule is a document that outlines all of your debts in one convenient location. It typically includes details such as the creditor’s name, the total amount owed, the interest rate, the minimum monthly payment, and the due date.

This schedule allows you to see a snapshot of your debts and helps you prioritize which debts to pay off first.

Why Debt Schedule Important?

A debt schedule is important because it provides you with a clear overview of your financial obligations. By having all of your debts listed in one place, you can easily track your progress as you work towards paying off your debts.

Additionally, a debt schedule can help you identify any patterns or trends in your spending habits and highlight areas where you can cut back to put more money towards paying off your debts.

How to Create a Debt Schedule

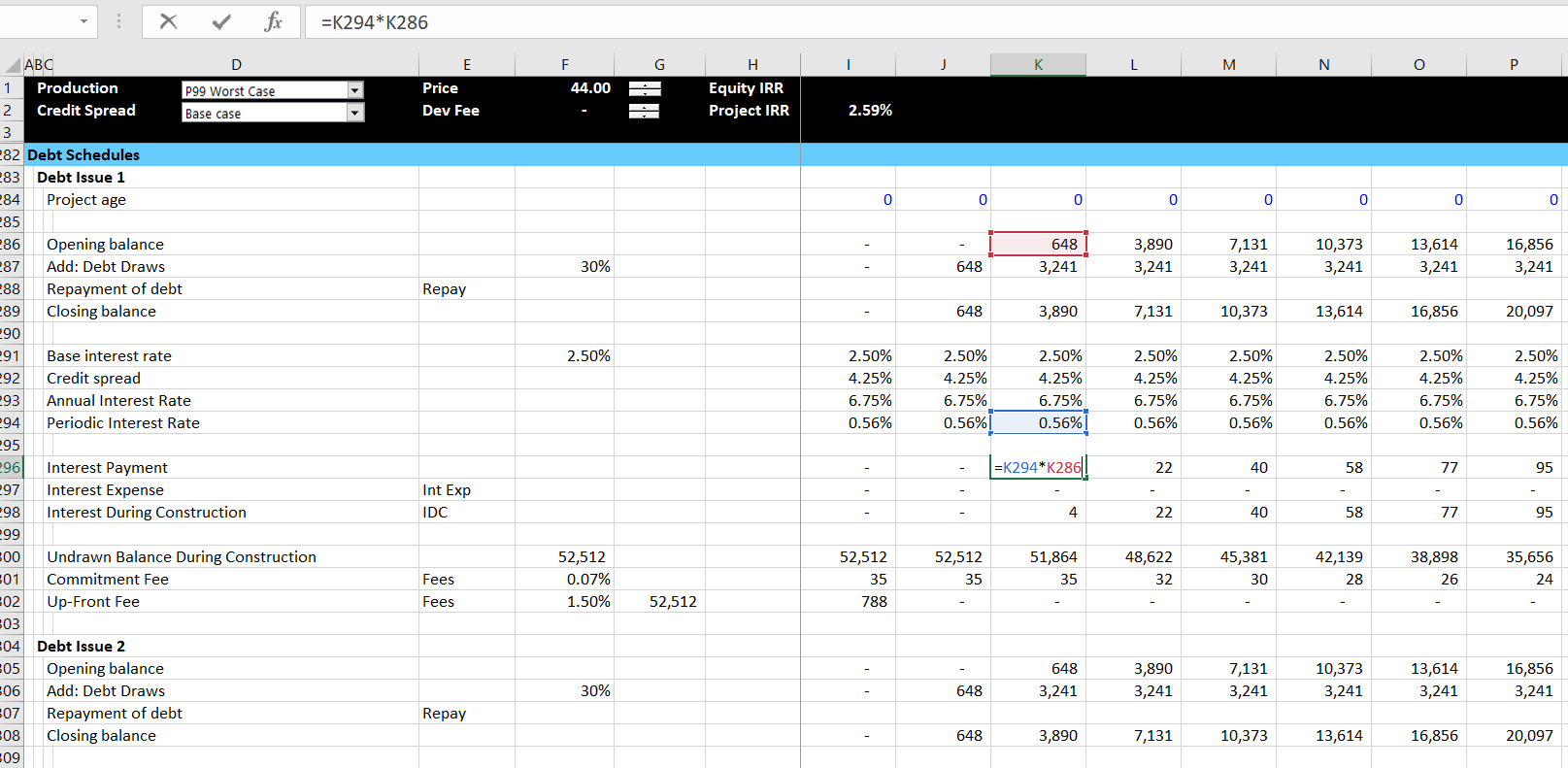

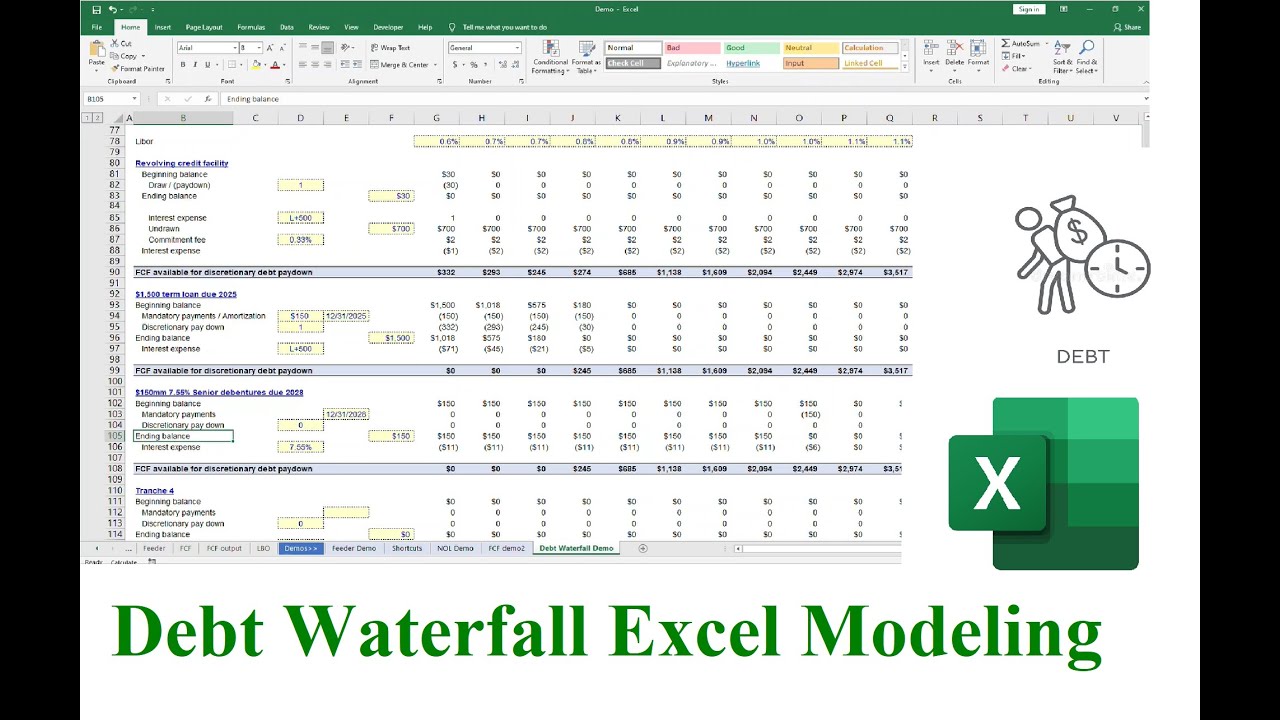

Creating a debt schedule is simple and can be done using a spreadsheet program like Microsoft Excel or Google Sheets. Here are the steps to create your debt schedule:

- Gather Information: Collect all of your debt information, including the creditor’s name, total amount owed, interest rate, minimum monthly payment, and due date.

- Open a Spreadsheet: Open a new spreadsheet in Excel or Google Sheets.

- Create Columns: Label columns for each piece of debt information, such as creditor name, total amount owed, interest rate, minimum monthly payment, and due date.

- Input Data: Input the information for each of your debts into the corresponding columns.

- Calculate Totals: Use formulas to calculate the total amount owed, the total minimum monthly payment, and the total interest paid.

- Update Regularly: Make sure to update your debt schedule regularly as you make payments and pay off debts.

Examples of Debt Schedules

There are many different ways to format a debt schedule, depending on your preferences and needs. Here are a few examples of common debt schedule formats:

Tips for Successful Debt Management

Managing debt can be challenging, but with the right tools and strategies, you can take control of your finances and work towards becoming debt-free. Here are some tips for successful debt management:

- Create a Budget: Establish a budget that outlines your income and expenses, allowing you to see where your money is going each month.

- Pay More Than the Minimum: Whenever possible, try to pay more than the minimum monthly payment on your debts to accelerate your debt payoff.

- Automate Payments: Set up automatic payments for your debts to ensure that you never miss a payment deadline.

- Seek Professional Help: If you are struggling to manage your debts, consider seeking assistance from a financial advisor or credit counselor.

- Celebrate Milestones: Celebrate small victories along the way as you pay off each debt, keeping you motivated to continue on your debt-free journey.

In Conclusion

A debt schedule is a valuable tool for anyone looking to take control of their finances and pay off their debts. By creating a debt schedule, you can track your progress, prioritize your debts, and work towards achieving financial freedom.

Remember to update your debt schedule regularly, explore different formatting options, and implement effective debt management strategies to reach your financial goals.

Debt Schedule Template – Download