Debt collection letters are an essential part of the debt recovery process. These letters are sent by creditors or collection agencies to individuals or businesses who owe money. The purpose of these letters is to remind the debtor of the outstanding debt and to request payment.

In this comprehensive guide, we will cover everything you need to know about debt collection letters, including what they are, why they are important, what to include in a debt collection letter, how to effectively use them, and tips for successful debt recovery.

What are Debt Collection Letters?

Debt collection letters are formal written communications sent by creditors or collection agencies to debtors who have not paid their debts on time. These letters serve as a reminder to debtors of their financial obligations and request payment.

Debt collection letters typically include details such as the amount owed, the due date, and any additional fees or interest that may have accrued. They also usually outline the consequences of not paying the debt, such as legal action or credit score damage.

Why are Debt Collection Letters Important?

Debt collection letters play a crucial role in the debt recovery process. They help creditors or collection agencies communicate with debtors clearly and formally, outlining the terms of the debt and the consequences of non-payment. These letters also serve as a paper trail in case legal action is required in the future.

Additionally, debt collection letters can help debtors understand the seriousness of the situation and prompt them to take action to resolve their debt.

What to Include in a Debt Collection Letter

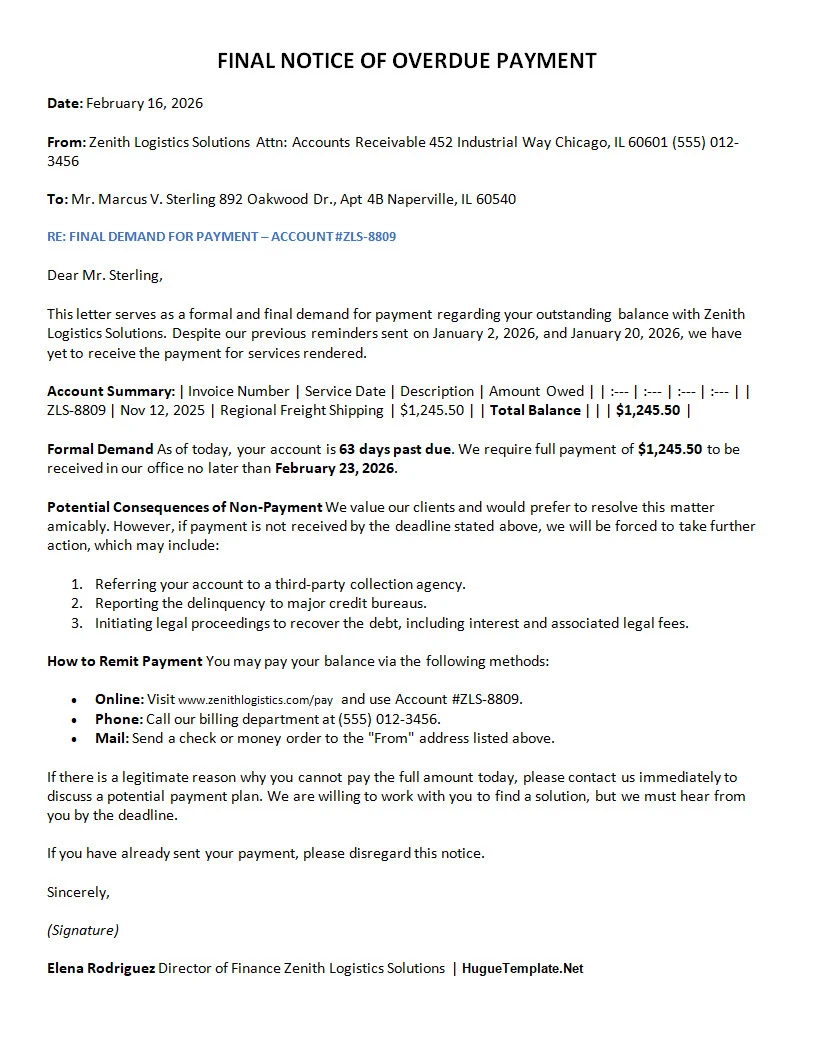

When creating a debt collection letter, it is important to include specific information to effectively communicate with the debtor. Here are some key elements to include in a debt collection letter:

- Account Information: Include details such as the debtor’s name, account number, and outstanding balance.

- Payment Due Date: Clearly state the deadline by which the debtor must make a payment.

- Payment Options: Provide information on how the debtor can make a payment, such as online, by phone, or by mail.

- Consequences of Non-Payment: Outline the potential consequences of not paying the debt, such as legal action or credit score damage.

- Contact Information: Include contact details for the creditor or collection agency in case the debtor has questions or needs assistance.

How to Effectively Use Debt Collection Letters

To effectively use debt collection letters, it is important to follow some best practices. Here are some tips to help you make the most of your debt collection letters:

- Be Clear and Concise: Keep your letter straightforward and easy to understand to avoid confusion.

- Use Professional Language: Maintain a professional tone in your letter to establish credibility and authority.

- Follow Legal Guidelines: Make sure your debt collection letter complies with all relevant laws and regulations.

- Personalize the Letter: Address the debtor by name and personalize the letter to increase the chances of a response.

- Offer Payment Options: Provide the debtor with multiple ways to make a payment to make it easier for them to settle the debt.

Tips for Successful Debt Recovery

Debt collection letters are just one tool in the debt recovery process. Here are some additional tips to help you successfully recover debts:

- Follow Up: Send multiple reminders if the debtor does not respond to the initial letter.

- Negotiate Payment Plans: Work with the debtor to create a payment plan that is manageable for them.

- Consider Outsourcing: If you are struggling to recover debts, consider hiring a professional debt collection agency to assist you.

- Document Everything: Keep detailed records of all communications with the debtor in case legal action is necessary.

- Stay Persistent: Don’t give up on recovering the debt, even if it takes time and effort.

In conclusion, debt collection letters are a valuable tool for creditors and collection agencies to communicate with debtors and recover outstanding debts. By following best practices and using these letters effectively, you can increase your chances of successfully recovering debts and maintaining positive relationships with your clients.

Debt Collection Letter Template – DOWNLOAD