Creating a business budget is like mapping out a financial roadmap for your company. It involves planning, controlling, and monitoring income and expenses to achieve specific financial goals.

A well-crafted budget can help ensure profitability, allocate resources efficiently, and support informed decision-making for both short-term stability and long-term growth. By preventing overspending and underperformance, a budget acts as a benchmark to track progress, identify risks, and guide strategic financial choices.

What is a Business Budget?

A business budget is a detailed financial plan that outlines the expected income and expenses for a specific period, typically a year. It serves as a tool to help businesses forecast their financial performance, set targets, and make informed decisions about resource allocation.

A budget can include revenue projections, cost estimates, cash flow analysis, and investment plans.

Why is Business Budgeting Important?

Business budgeting is crucial for several reasons:

- Financial Planning: A budget helps businesses set financial goals and create a roadmap to achieve them.

- Control and Monitoring: By tracking income and expenses, businesses can identify variances and take corrective actions to stay on track.

- Profitability: A well-managed budget can help businesses maximize profits by optimizing revenue and minimizing costs.

- Resource Allocation: Budgeting allows businesses to allocate resources efficiently, ensuring that funds are used for the most critical activities.

- Informed Decision-Making: With a budget in place, businesses can make strategic financial decisions based on data and analysis.

What to Include in a Business Budget?

When creating a business budget, it is essential to include the following components:

- Revenue Forecast: Estimate the income your business expects to generate from sales, services, or other sources.

- Expense Projections: Identify all costs associated with running your business, including fixed expenses (rent, utilities) and variable expenses (inventory, marketing).

- Cash Flow Analysis: Project the cash inflows and outflows to ensure that your business has enough liquidity to meet its financial obligations.

- Capital Budget: Plan for investments in assets such as equipment, technology, or facilities that will help your business grow.

How to Create a Business Budget

Follow these steps to create an effective business budget:

1. Set Financial Goals

Define the financial objectives you want to achieve through budgeting, such as increasing revenue, reducing costs, or improving cash flow. Establish clear, measurable goals that align with your business strategy and vision to guide your budgeting process effectively.

2. Gather Financial Data

Collect information on your past financial performance, market trends, and industry benchmarks to inform your budget assumptions. Use historical data, financial statements, market research, and other sources to analyze trends, identify patterns, and make informed decisions about your budget projections.

3. Estimate Income and Expenses

Use historical data, market research, and input from key stakeholders to forecast your business’s revenue and costs for the budget period. Consider factors such as sales forecasts, pricing strategies, cost drivers, and market dynamics to develop accurate income and expense projections that support your financial goals.

4. Allocate Resources

Determine how you will allocate resources to different areas of your business to achieve your financial goals effectively. Prioritize spending, allocate funds strategically, and align resources with key business initiatives to maximize performance, efficiency, and profitability.

5. Monitor and Adjust

Regularly review your budget performance, identify variances, and make adjustments as needed to stay on track. Use financial reports, budget versus actual analysis, and performance metrics to track progress, measure outcomes, and make informed decisions to optimize your budgeting process.

6. Communicate and Collaborate

Involve key stakeholders in the budgeting process to ensure alignment, engagement, and accountability. Communicate budget goals, expectations, and outcomes effectively, and encourage collaboration, feedback, and input from all stakeholders to enhance the success and effectiveness of your budgeting efforts.

Tips for Successful Business Budgeting

Follow these tips to create and maintain a successful business budget:

- Be Realistic: Base your budget on accurate data and realistic assumptions to avoid overestimating revenue or underestimating expenses. Consider historical trends, market conditions, and business dynamics when setting budget targets and projections.

- Review Regularly: Monitor your budget performance regularly and make adjustments as needed to stay on track. Review financial reports, analyze variances, and assess outcomes to ensure that your budget remains aligned with your business goals and objectives.

- Involve Key Stakeholders: Collaborate with department heads, managers, and key employees to gather input, insights, and feedback on your budgeting process. Engage stakeholders in goal setting, decision-making, and accountability to enhance the effectiveness and success of your budgeting efforts.

- Use Budgeting Software: Consider using budgeting software or tools to streamline the budgeting process, improve accuracy, and enhance efficiency. Utilize budgeting software to automate calculations, generate reports, and analyze data to optimize your budgeting process and outcomes.

- Plan for Contingencies: Include a buffer for unexpected expenses or revenue fluctuations in your budget to account for unforeseen events or changes in the business environment. Plan for contingencies, create reserves, and prepare for risks to ensure financial stability and resilience in challenging times.

- Seek Professional Advice: Consult with financial experts, advisors, or consultants to get guidance, insights, and expertise on creating a robust budget that aligns with your business goals and objectives. Consider outsourcing budgeting tasks or seeking external support to enhance the quality and effectiveness of your budgeting efforts.

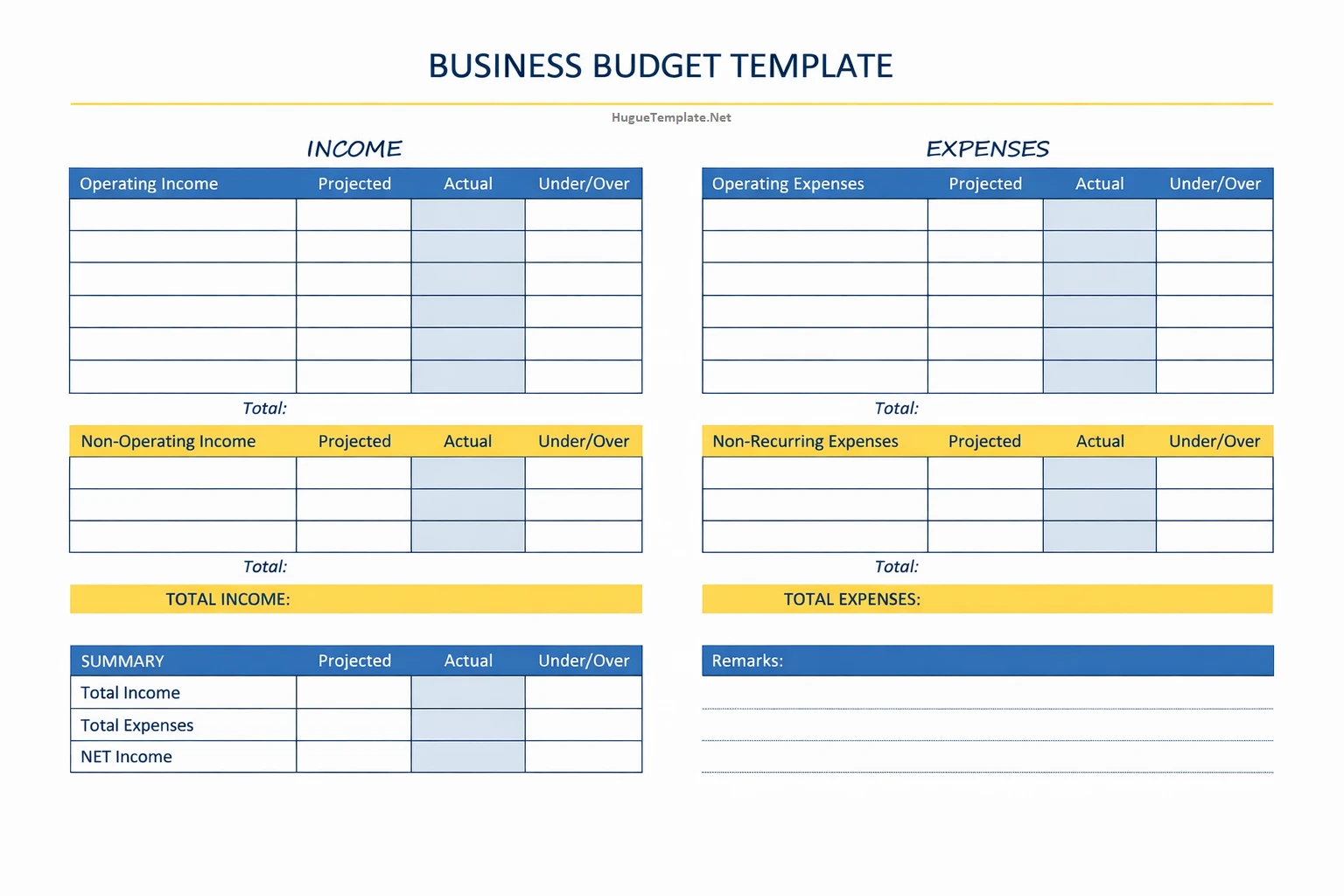

Business Budget Template – DOWNLOAD