What is a Blank Check Template?

A blank check template is a digital representation of a physical check that provides a framework for filling in specific details such as the payee’s name, amount, date, and signature.

These templates serve as a convenient tool for individuals and organizations to create personalized checks without the need for complex software or design skills.

Why Do You Need a Check Template?

Check templates are essential tools for simplifying the check-writing process and ensuring accuracy in financial transactions. Whether you are an individual managing personal finances or a business owner handling multiple payments, check templates offer a convenient solution for creating professional-looking checks.

Convenience and Efficiency

Check templates provide a convenient and efficient way to generate checks without the need for manual writing or expensive check printing services. With a template, users can quickly input the necessary information and print the check, saving time and streamlining the payment process.

Professionalism and Accuracy

Using a check template helps maintain a professional appearance in financial transactions by ensuring that all essential details are correctly filled out. With pre-formatted fields for the payee name, amount, and signature, check templates minimize errors and enhance accuracy in check writing.

Cost-Effectiveness

Check templates offer a cost-effective alternative to ordering custom checks from banks or third-party printing services. By using a template, individuals and businesses can save money on check printing costs while still achieving a high level of customization and personalization.

Types of Checks

Various types of checks can be created using blank check templates, each serving specific purposes and functions. Understanding the different types of checks can help users determine the most appropriate template for their needs.

Personal Checks

Personal checks are commonly used for individual financial transactions, such as paying bills, rent, or making personal purchases. Personal checks typically include the account holder’s name, the recipient’s name, the payment amount, and a signature line.

Business Checks

Business checks are specifically designed for commercial transactions and expenses. These checks often include additional information such as the company name, address, and logo, making them suitable for official business payments to vendors, suppliers, and employees.

Payroll Checks

Payroll checks are issued by employers to employees as payment for their services. These checks contain details such as the employee’s name, payment amount, and any deductions for taxes or benefits. Payroll checks are essential for maintaining accurate payroll records and complying with labor laws.

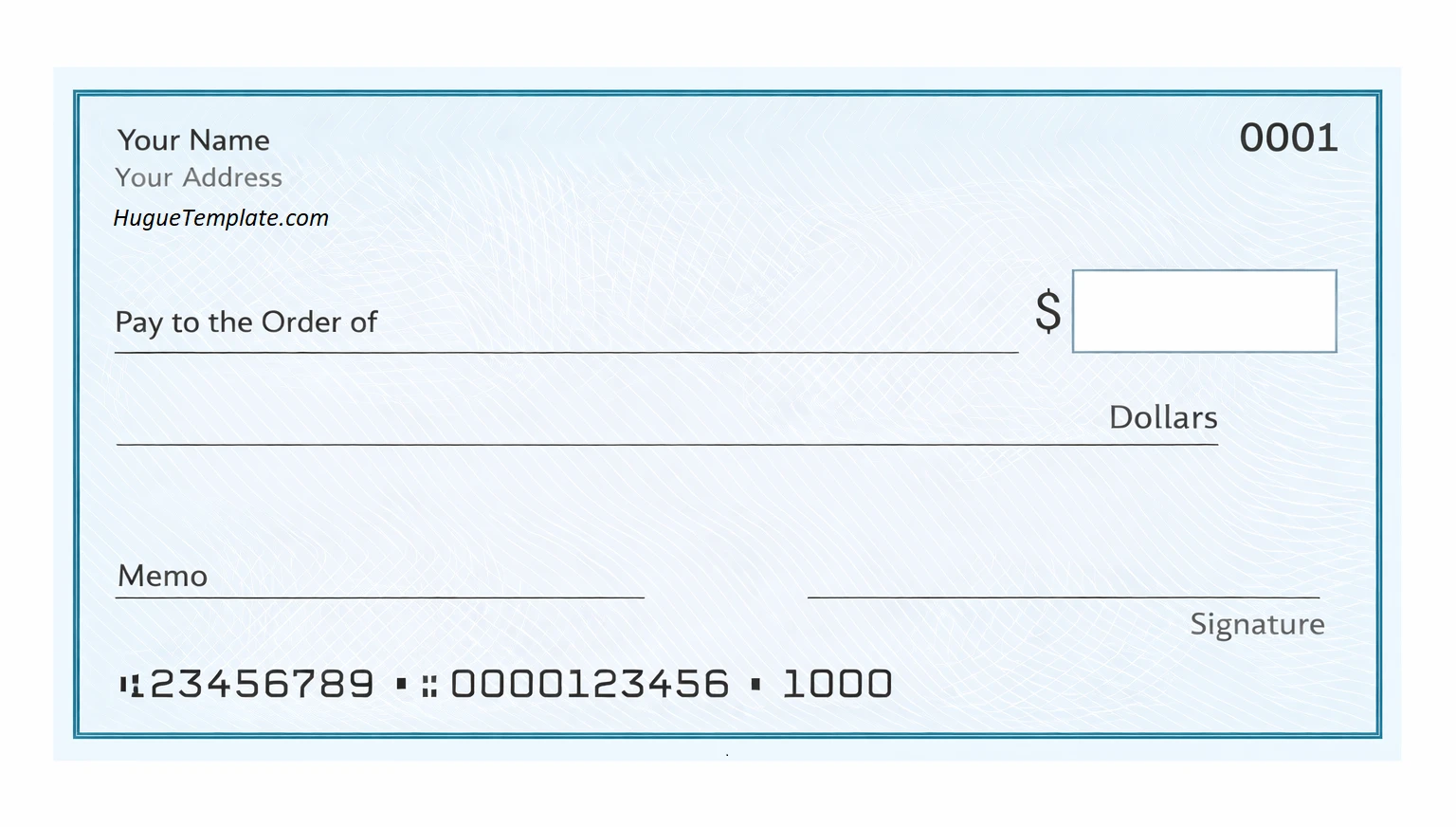

Components of a Blank Check Template for Printing

A typical blank check template for printing consists of several key components that are essential for creating a complete and accurate check. Understanding these components is crucial for effectively using a blank check template.

Payee Name

The payee name is the individual or entity to whom the check is made payable. It is essential to accurately fill in the payee name to ensure that the payment is directed to the intended recipient. A blank check template usually includes a designated space for the payee’s name.

Amount

The amount field on a check template is where the numerical and written amounts of the payment are entered. It is crucial to double-check the amount to prevent errors or discrepancies. The amount field typically includes separate sections for the numerical amount and the written amount in words.

Date

The date field on a check template indicates the date on which the check is issued. It is important to fill in the date accurately to ensure that the payment is processed in a timely manner. Including the date also helps in keeping track of payment schedules and transactions.

Memo

The memo line on a check template allows the user to include additional information or notes related to the payment. While the memo is optional, it can be used to provide context or reference for the transaction. Including a memo can help both the payer and payee identify the purpose of the payment.

Signature Line

The signature line on a check template is where the check writer signs to authorize the payment. The signature is a crucial security feature that verifies the authenticity of the check and ensures that it is valid. It is important to sign the check only after verifying all the information and details.

Tips for Using Blank Check Templates

When using blank check templates, it is important to follow certain guidelines and best practices to ensure the security and accuracy of the checks generated. Incorporating these tips can help users maximize the benefits of using check templates.

Double-Check Information

Before printing a check using a blank check template, it is essential to double-check all the information entered, including the payee name, amount, and date. Verifying the accuracy of the details helps prevent errors and ensures that the payment is processed correctly.

Secure Storage

It is crucial to store blank check stock in a secure and confidential location to prevent unauthorized access and potential misuse. Safeguarding blank checks reduces the risk of fraud and unauthorized check printing. Users should store blank check templates in a locked cabinet or safe place.

Use Secure Printing

When printing checks from a blank check template, it is advisable to use a secure printer that meets industry standards for check printing. Secure printers help prevent tampering, alteration, or duplication of checks. Users should ensure that their printers are equipped with security features such as MICR toner and encryption.

Record Transactions

Maintaining a detailed record of all check transactions is essential for tracking and reconciling payments. Users should keep a comprehensive log of issued checks, including the check number, payee name, amount, and date. Recording transactions helps in balancing accounts and detecting any discrepancies or irregularities.

Steps for Writing a Check

Writing a check using a blank check template involves a series of simple steps that ensure accuracy and compliance with banking standards. By following these steps, users can create a check that is valid, secure, and ready for payment.

Step 1: Fill in the Date

The first step in writing a check is to fill in the date on the designated line provided on the check template. The date indicates when the check is issued and helps the payee determine the validity of the payment. It is important to write the date clearly and accurately to avoid any confusion.

Step 2: Enter the Payee Name

Next, enter the name of the payee on the “Pay to the Order of” line on the check template. Make sure to write the payee’s name exactly as it appears on their identification or as specified by the recipient. Accuracy in the payee name is crucial to ensure that the payment reaches the intended recipient.

Step 3: Write the Amount

Enter the amount of the payment both numerically and in words on the designated lines provided on the check template. Start by writing the numerical amount in the box on the right-hand side, followed by the written amount in words on the line below. Double-check the amount to ensure consistency between the numerical and written values.

Step 4: Include a Memo

If necessary, include a memo on the designated line provided on the check template. The memo is optional and can be used to provide additional information about the payment, such as an invoice number, account number, or the purpose of the transaction. Including a memo can help both the payer and payee identify the context of the payment.

Step 5: Sign the Check

Finally, sign the check on the signature line at the bottom right corner of the check template. The signature is a critical security feature that authorizes the payment and verifies the authenticity of the check. Make sure to sign the check using your legal signature to ensure that it is valid and legally binding.

Review and Finalize

Before finalizing the check, take a moment to review all the information entered on the check template. Verify the accuracy of the date, payee name, amount, and memo, and ensure that the signature is properly placed. Once you have confirmed that all details are correct, you can proceed to print the check and issue it to the intended recipient.

Blank Check Template – DOWNLOAD