In the world of business and commerce, the exchange of goods and services for money is a fundamental aspect of any transaction. The completion of this exchange is often documented through a bill receipt, which serves as proof of payment and provides a record for both the buyer and the seller.

A bill receipt is a crucial document that ensures transparency, protects against disputes, and facilitates various financial processes, including expense tracking, returns, warranty claims, accounting, and tax purposes.

What is a Bill Receipt?

A bill receipt is a written acknowledgment provided by the seller to the buyer upon receiving payment for goods or services. It contains detailed information about the transaction, including the items purchased, costs, payment method, date of purchase, and any additional terms and conditions.

The bill receipt serves as a legal document that confirms the completion of a financial transaction and provides evidence of the exchange between the buyer and the seller.

Why Are Bill Receipts Important?

Bill receipts play a crucial role in documenting financial transactions and providing a record of the exchange between parties. Here are some key reasons why bill receipts are important:

Proof of Payment

One of the primary reasons why bill receipts are important is that they serve as proof of payment. A bill receipt provides concrete evidence that the buyer has paid for the goods or services, which can be crucial in case of disputes or warranty claims. Without a bill receipt, it can be challenging to verify that a transaction has taken place.

Record Keeping

Another vital aspect of bill receipts is their role in maintaining accurate records. By maintaining a record of all transactions through bill receipts, both buyers and sellers can track their financial activities, monitor expenses, and ensure accuracy in their financial records. Proper record-keeping is essential for budgeting, financial planning, and tax compliance.

Transparency

Bill receipts promote transparency in financial transactions by providing detailed information about the exchange. Transparency is crucial in establishing trust between buyers and sellers and ensuring that both parties are aware of the terms and conditions of the transaction. With a clear and detailed bill receipt, all parties involved can have a complete understanding of the transaction.

Dispute Resolution

In the event of disputes or discrepancies, bill receipts play a crucial role in resolving issues. By referring to the information documented in the bill receipt, both parties can clarify any misunderstandings or discrepancies that may arise. The detailed nature of bill receipts helps in identifying the source of the problem and finding a resolution that is fair to all parties involved.

Accounting and Tax Purposes

Bill receipts are essential for accounting purposes and serve as documentation for tax filing and reporting. By maintaining accurate and detailed bill receipts, businesses can track their expenses, calculate profits, and ensure compliance with tax regulations. Bill receipts provide a clear trail of financial transactions that can be easily referenced during audits or financial reviews.

Key Elements of a Bill Receipt

A typical bill receipt includes several key elements that are essential for documenting a financial transaction. These key elements may vary depending on the nature of the transaction, but common components of a bill receipt include:

Vendor Information

The vendor information section of a bill receipt includes the name, address, and contact details of the seller. This information is crucial for identifying the party responsible for providing the goods or services and can be used for communication or dispute resolution purposes. The vendor information helps establish the legitimacy of the transaction and provides a point of contact for further inquiries.

Customer Information

The customer information section of a bill receipt includes the name, address, and contact details of the buyer. This information is essential for identifying the party who purchased the goods or services and can be used for tracking sales, marketing purposes, or customer service. Including accurate customer information on a bill receipt ensures that all parties involved are properly identified and accounted for in the transaction.

Transaction Details

The transaction details section of a bill receipt provides a detailed description of the items purchased, including quantities, unit prices, total costs, and any applicable taxes or fees. This information is crucial for understanding the specifics of the transaction and ensuring accuracy in the pricing and billing process. Clear and detailed transaction details help prevent misunderstandings and disputes related to the cost of goods or services.

Payment Information

The payment information section of a bill receipt includes the mode of payment, payment date, and any payment terms or conditions. This information is vital for tracking the payment process, verifying the receipt of funds, and ensuring that the transaction has been completed successfully. Including accurate payment information on a bill receipt helps both parties confirm the payment details and avoid any confusion or discrepancies related to the payment process.

Terms and Conditions

The terms and conditions section of a bill receipt includes any additional terms or conditions related to the transaction, such as return policies, warranties, or guarantees. These terms and conditions provide clarity on the rights and responsibilities of both the buyer and the seller and help prevent misunderstandings or disagreements in the future. Including clear and concise terms and conditions on a bill receipt ensures that both parties are aware of their obligations and rights under the transaction.

How to Create a Bill Receipt

Creating a bill receipt is a simple process that involves documenting the details of a financial transaction. Here are some steps to follow when creating a bill receipt:

Step 1: Include Transaction Details

The first step in creating a bill receipt is to include all relevant transaction details, such as the date of the transaction, a unique receipt number for reference, and a description of the items purchased. Providing a clear and detailed account of the transaction ensures that both parties have a complete understanding of the exchange that took place.

Step 2: Calculate Total Cost

Next, calculate the total cost of the transaction, including any taxes or fees that may apply. Accurately calculating the total cost ensures that the buyer is aware of the final amount due and helps prevent misunderstandings related to pricing or billing. Including a breakdown of costs on the bill receipt provides transparency and clarity on the financial aspects of the transaction.

Step 3: Provide Payment Information

Include information about the mode of payment used by the buyer, the payment date, and any payment terms or conditions that apply to the transaction. Clearly stating the payment details on the bill receipt helps verify the receipt of funds, track the payment process, and ensure that the transaction has been completed successfully. Providing accurate payment information is essential for financial accountability and transparency in the transaction.

Step 4: Include Terms and Conditions

Lastly, include any additional terms and conditions related to the transaction on the bill receipt, such as return policies, warranties, or guarantees. Clearly outlining the terms and conditions helps establish the rights and obligations of both parties and prevents misunderstandings or disputes in the future. Including a section for terms and conditions on the bill receipt ensures that all parties are aware of the expectations and requirements of the transaction.

Tips for Managing Bill Receipts

Managing bill receipts effectively is essential for maintaining accurate financial records and ensuring compliance with tax regulations. Here are some tips for managing bill receipts:

Organize Bill Receipts

Organize bill receipts by date or category to easily track expenses and transactions. By sorting bill receipts systematically, you can quickly locate specific receipts when needed and maintain a clear record of your financial activities.

Store Bill Receipts Securely

Store bill receipts in a secure and accessible location to prevent loss or damage. Consider using digital storage options or physical filing systems to safeguard your bill receipts and ensure they are protected from theft or misplacement.

Digitize Bill Receipts

Digitize bill receipts using accounting software or scanning apps for easy retrieval and storage. By digitizing your bill receipts, you can reduce paper clutter, access receipts from anywhere, and streamline your record-keeping process.

Review and Reconcile

Regularly review and reconcile bill receipts with bank statements to identify any discrepancies. Compare your bill receipts with your financial records to ensure accuracy and address any errors or inconsistencies promptly.

Keep Copies

Keep copies of bill receipts for a specified period to comply with tax regulations and audit requirements. Retaining copies of your bill receipts provides a backup in case of loss or disputes and helps you stay organized for financial reporting purposes.

Use Cloud-Based Solutions

Consider using cloud-based storage solutions for secure and convenient access to bill receipts from anywhere. Cloud storage platforms provide a reliable and accessible way to manage your bill receipts and ensure they are easily retrievable when needed.

Seek Professional Advice

Seek professional advice from a tax consultant or accountant on proper bill receipt management practices. Consulting with experts can help you understand the best practices for organizing, storing, and maintaining your bill receipts to meet regulatory requirements and ensure financial compliance.

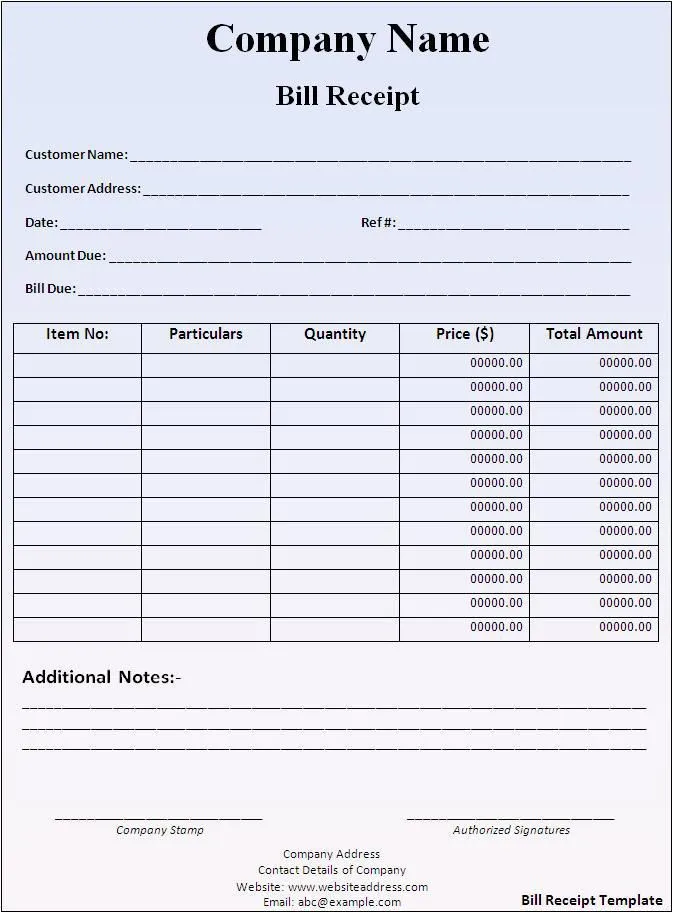

Free Bill Receipt Template

A Bill Receipt helps you document payments clearly and professionally for both personal and business transactions. It provides a structured format for recording payment details, dates, amounts, and methods, ensuring accuracy and transparency. With a well-designed template, you can keep organized records, simplify bookkeeping, and provide proof of payment when needed.

Download our Bill Receipt Template today to create clear, reliable receipts with ease and confidence.

Bill Receipt Template – DOWNLOAD