A bill payment schedule is a tool that helps individuals and businesses stay organized and track their financial obligations. It provides a clear payment timeline, ensuring timely payments and improving financial planning.

With a bill payment schedule, you can prevent missed deadlines and avoid associated late fees. For businesses, this schedule aids in managing cash flow and forecasting future financial requirements.

Why is a Bill Payment Schedule Important?

Keeping track of bills and payments can be a daunting task, especially when you have multiple financial obligations. A bill payment schedule simplifies this process by providing a visual representation of your payment timeline. It allows you to see at a glance which bills are due and when, helping you prioritize payments and avoid late fees.

For businesses, a bill payment schedule is crucial for managing cash flow. It helps you anticipate upcoming expenses and plan accordingly. By having a clear overview of your payment obligations, you can make informed financial decisions and ensure that you have enough funds to cover your expenses.

How to Create a Bill Payment Schedule

Creating a bill payment schedule is a straightforward process. Follow these steps to get started:

Step 1: Gather Your Bills and Payment Information

Collect all your bills and payment information, including due dates, amounts, and payment methods. Make sure you have accurate and up-to-date information to avoid any errors.

Step 2: Choose a Template

There are many templates available online that you can use to create your bill payment schedule. Look for a template that suits your needs and preferences. You can find templates in various formats, such as Excel, Word, or PDF. Alternatively, you can create a custom template using a spreadsheet software.

Step 3: Input Your Bills and Due Dates

Start filling in the template with your bill information. Input the bill name, due date, amount, and any other relevant details. Make sure to include all your recurring bills, such as rent, utilities, and loans.

Step 4: Customize and Format the Schedule

Personalize your bill payment schedule by adding categories, colors, or additional columns if needed. You can also format the schedule to make it more visually appealing and easier to read.

Step 5: Print and Display

Once you are satisfied with your bill payment schedule, print it out and display it in a visible place, such as your desk or bulletin board. This will serve as a constant reminder of your payment obligations and help you stay on track.

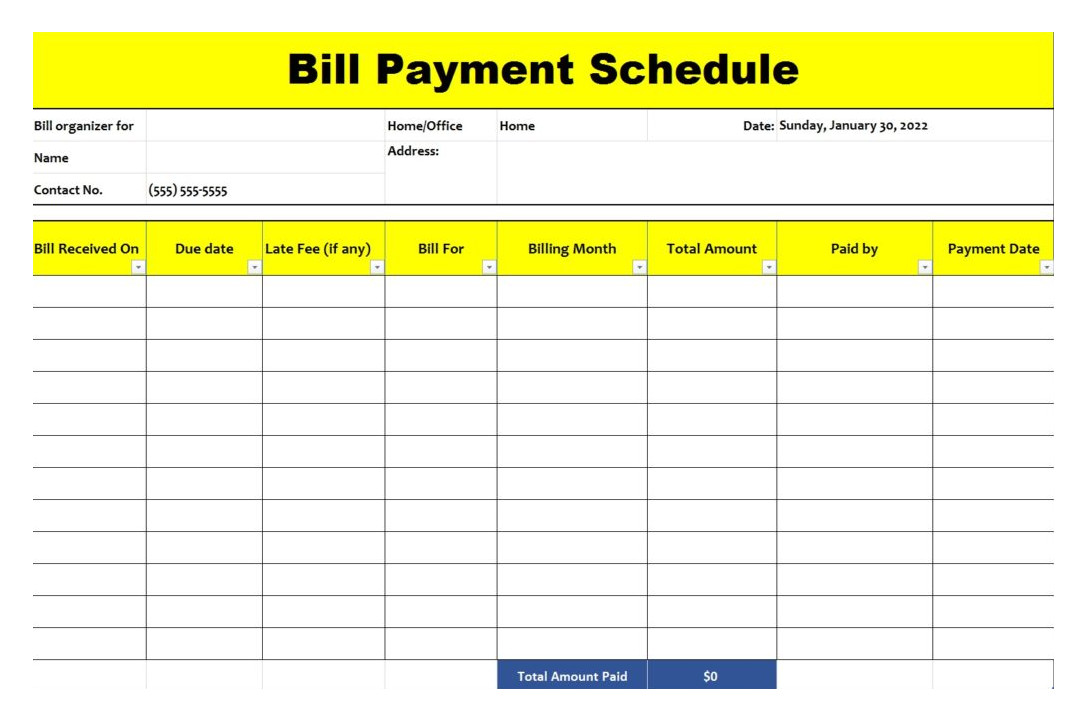

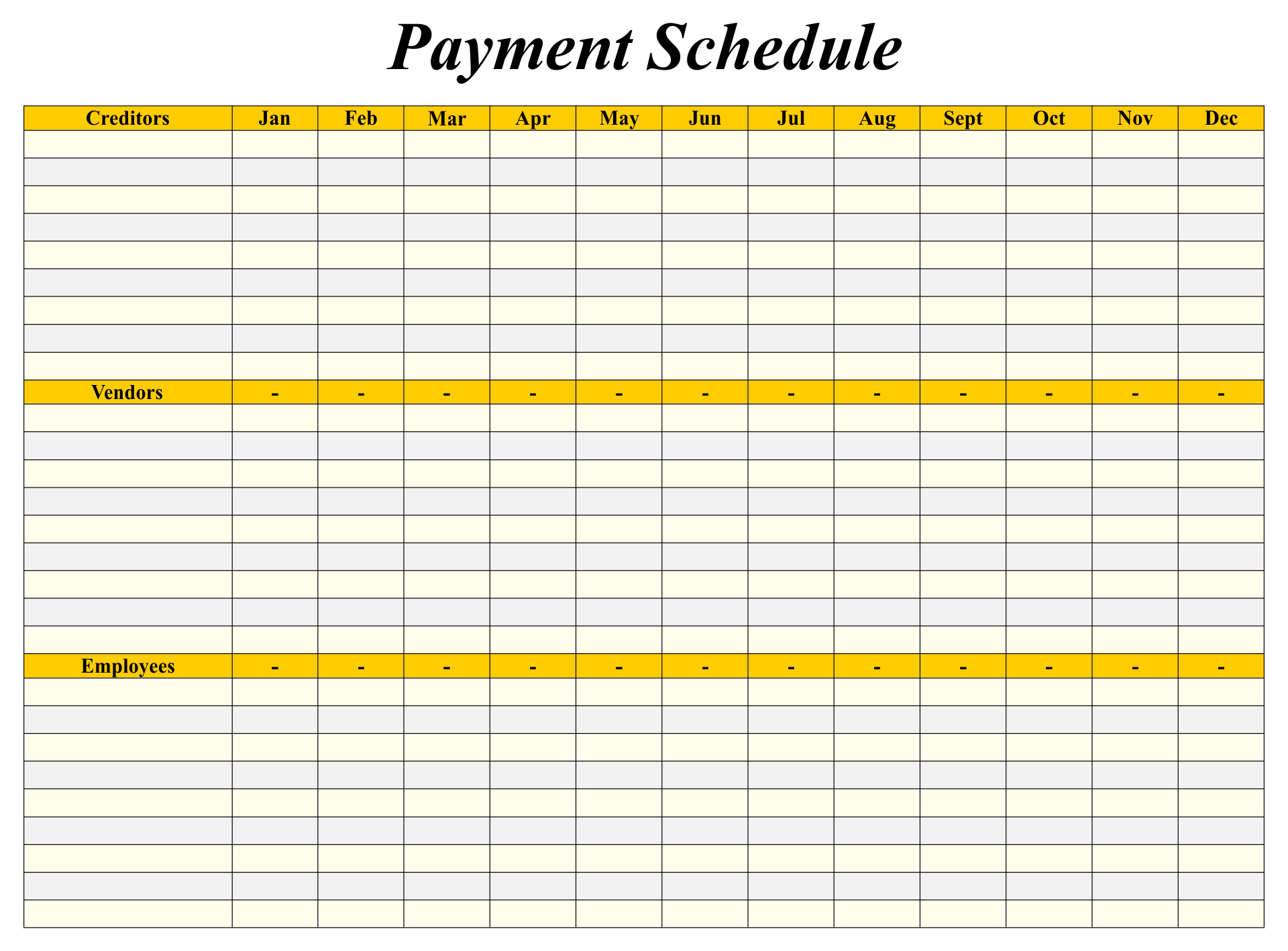

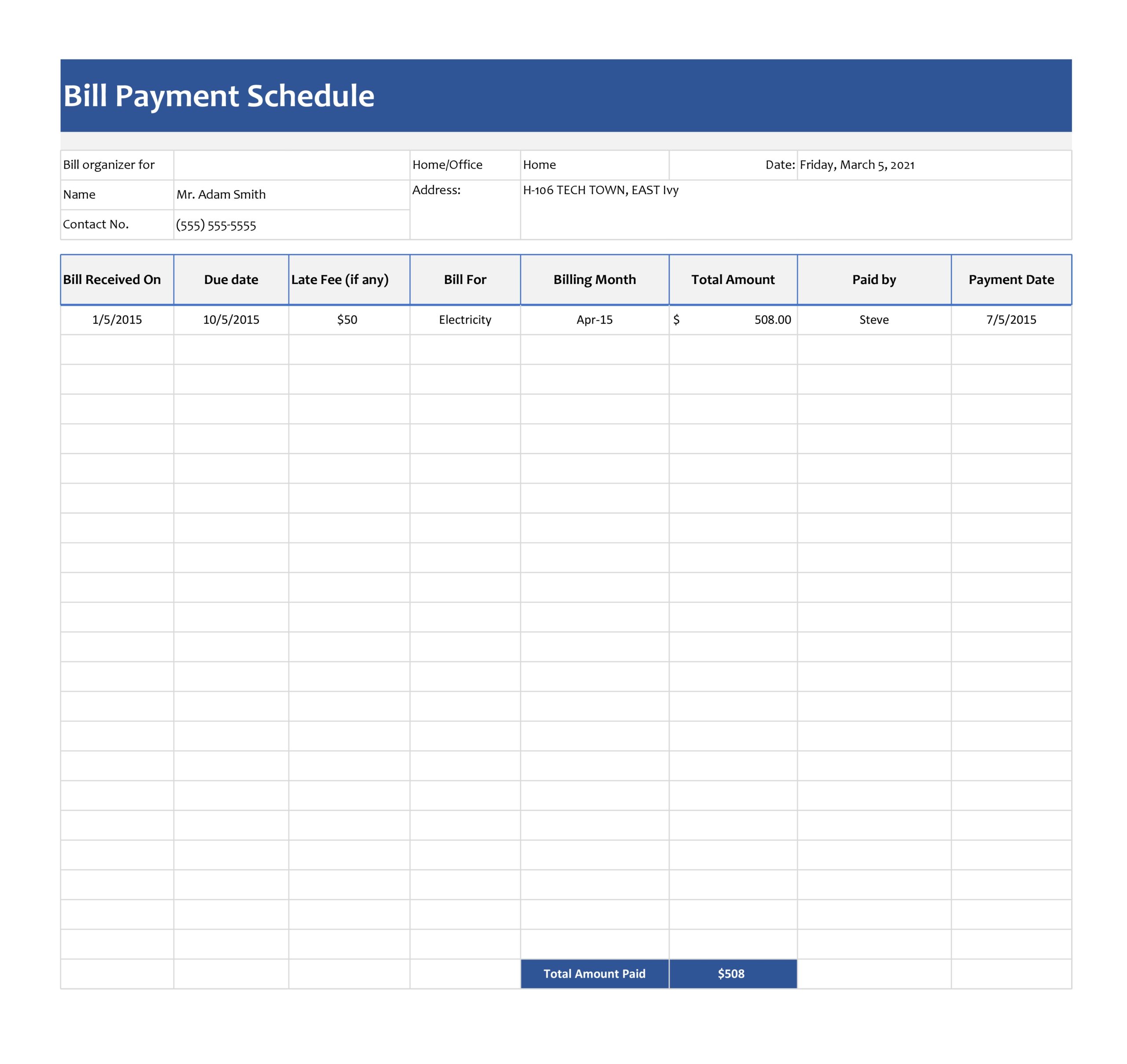

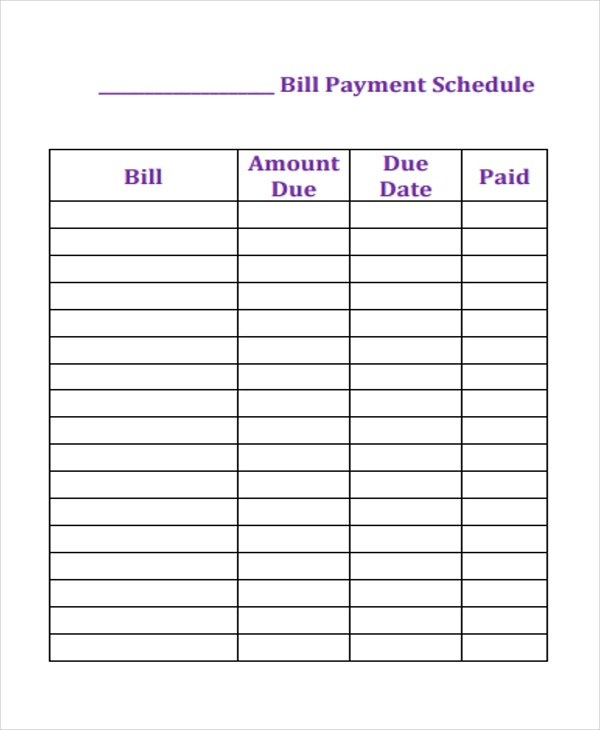

Examples of Bill Payment Schedules

Here are a few examples of how a bill payment schedule can look:

Tips for Successful Bill Payment Management

Here are some tips to help you effectively manage your bill payments:

- Set Reminders: Use reminders on your phone or computer to alert you about upcoming bill due dates.

- Automate Payments: Whenever possible, set up automatic payments for your bills. This ensures that payments are made on time, even if you forget.

- Create a Budget: Develop a budget that includes your monthly income and expenses. This will help you allocate funds for bill payments and avoid overspending.

- Track Your Expenses: Keep a record of all your expenses to identify areas where you can cut back and save money.

- Communicate with Creditors: If you are unable to make a payment on time, contact your creditors and explain the situation. They may be willing to work out a payment plan or offer temporary relief.

- Review Your Bills: Regularly review your bills to check for any errors or discrepancies. If you notice any issues, contact the billing company immediately.

- Monitor Your Credit Score: Timely bill payments are crucial for maintaining a good credit score. Monitor your credit report regularly to ensure that all your payments are reported accurately.

- Stay Organized: Keep all your bills and payment receipts in one place to easily track your expenses and reference them when needed.

Conclusion

A bill payment schedule is a valuable tool for individuals and businesses alike. It helps you stay organized, track your financial obligations, and ensure timely payments. By using a bill payment schedule, you can avoid missed deadlines, late fees, and improve your overall financial planning.

Take the time to create a customized schedule that works for you and follow the tips mentioned to successfully manage your bill payments.

Bill Payment Schedule Template – Download