Managing your finances can be a challenging task, especially when it comes to aligning your spending and saving with your paychecks. One effective strategy to consider is implementing a bi-weekly budget.

Unlike a traditional monthly budget, a bi-weekly budget allows you to have a more accurate financial picture by matching your expenses and income more closely. This approach can help prevent cash flow gaps, manage irregular expenses, and utilize those extra paychecks throughout the year to achieve debt or savings goals.

What is a Bi-Weekly Budget?

A bi-weekly budget is a financial planning method that aligns your spending and saving with your every two weeks’ paychecks. Instead of budgeting monthly, where expenses may not align perfectly with your income, a bi-weekly budget links specific expenses to specific paydays.

This can help you gain better control over your finances, reduce financial stress, and make it easier to consistently meet your financial obligations.

Why You Should Consider a Bi-Weekly Budget?

There are several reasons why a bi-weekly budget can be beneficial for your financial management:

More Accurate Financial Picture

When you budget monthly, it can be challenging to accurately track your income and expenses. Certain bills may fall due at different times of the month, making it difficult to determine how much you have available to spend at any given time. With a bi-weekly budget, you can align your expenses with your paychecks more effectively, giving you a clearer understanding of your financial situation.

Preventing Cash Flow Gaps

Cash flow gaps can occur when your expenses exceed your available funds, leading to financial stress and potential late payments. By budgeting on a bi-weekly basis, you can ensure that you have enough money to cover your bills as they come due. This can help you avoid overdraft fees, late payment penalties, and other financial consequences of cash flow gaps.

Managing Irregular Expenses

Irregular expenses, such as annual subscriptions, car maintenance, or medical bills, can throw off your budgeting plans if not accounted for properly. A bi-weekly budget allows you to spread the costs of these irregular expenses over multiple paychecks, making them more manageable. By setting aside a portion of each paycheck for these expenses, you can avoid scrambling to come up with the funds when the bills arrive.

Leveraging Extra Paychecks

One of the advantages of a bi-weekly budget is that you receive two extra paychecks each year. These additional funds can be used to accelerate your debt repayment or savings goals. By planning and allocating these extra paychecks towards your financial objectives, you can make significant progress towards achieving financial stability and independence.

Key Elements of a Bi-Weekly Budget

When creating a bi-weekly budget, there are several key elements to consider:

Determine Your Income

Calculating your total income for each pay period is the first step in creating a bi-weekly budget. This includes not only your regular salary but also any additional sources of income, such as bonuses or commissions. By having a clear understanding of how much you earn, you can allocate your funds more effectively.

List Your Expenses

Making a comprehensive list of all your expenses is essential for creating a successful bi-weekly budget. Start by categorizing your expenses into fixed costs, such as rent and utilities, and variable expenses, such as groceries and entertainment. This will help you prioritize your spending and ensure that you have enough funds for essential bills.

Allocate Funds

Once you have identified your income and expenses, the next step is to allocate funds to each expense category. This involves determining how much money you need to set aside for bills, savings, debt repayment, and other financial goals. By assigning a specific amount to each category, you can avoid overspending and stay within your budget.

Set Savings Goals

Saving money is an essential part of financial planning, and a bi-weekly budget can help you achieve your savings goals more effectively. Determine how much you want to save each pay period and allocate funds towards your savings account or investment accounts. By making saving a priority in your budget, you can build a financial cushion for emergencies and future expenses.

Track Your Spending

Monitoring your expenses regularly is crucial for staying on track with your bi-weekly budget. Keep a detailed record of your spending, either through a budgeting app, spreadsheet, or pen and paper. Review your expenses periodically to identify any areas where you may be overspending and make adjustments to ensure that you are meeting your financial goals.

How to Implement a Bi-Weekly Budget

Here are some steps to help you implement a bi-weekly budget effectively:

Calculate Your Bi-Weekly Income

Start by calculating your total income for each pay period, including any bonuses or commissions you may receive. If you have a variable income, use an average of your earnings over the past few months to estimate your bi-weekly income. Having an accurate understanding of how much you earn will help you allocate your funds appropriately.

List Your Fixed Expenses

Identify your fixed expenses, such as rent, utilities, and loan payments, that occur regularly each pay period. These are essential costs that you must prioritize in your budget to ensure that you have a roof over your head, utilities to use, and debts to repay. By listing your fixed expenses, you can allocate funds towards these bills first before addressing variable expenses.

Identify Variable Expenses

List your variable expenses, like groceries, gas, and entertainment, and estimate how much you typically spend on these categories. Variable expenses can fluctuate from pay period to pay period, so it’s essential to have a rough idea of how much you usually spend on these costs. By tracking your variable expenses over time, you can create a more accurate budget that reflects your spending habits.

Allocate Funds to Each Expense Category

Distribute your income to cover all your expenses, making sure to prioritize essential costs and savings goals. Start by allocating funds towards your fixed expenses to ensure that you have enough to cover these bills each pay period. Then, allocate funds towards your variable expenses, savings goals, debt repayment, and any other financial priorities. By assigning a specific amount to each expense category, you can create a balanced budget that meets all your financial needs.

Set Aside Funds for Irregular Expenses

Create a separate category in your budget for irregular expenses and allocate a portion of your income to cover these costs when they arise. Irregular expenses, such as car repairs or medical bills, can disrupt your budget if not planned for in advance. By setting aside funds for these unexpected costs, you can avoid dipping into your savings or using credit cards to cover the bills.

Monitor Your Spending

Track your expenses regularly and adjust your budget as needed to ensure you are staying within your financial plan. Keep a detailed record of your spending, either through a budgeting app, spreadsheet, or pen and paper. Review your expenses at least once a week to identify any areas where you may be overspending and make adjustments to stay on track with your budget.

Plan for Extra Paychecks

When you receive your two extra paychecks each year, decide how you will allocate these funds towards debt repayment or savings to accelerate your financial progress. Extra paychecks can provide a financial boost that can help you reach your financial goals faster. Consider using these additional funds to pay off high-interest debts, build your emergency fund, or invest in your future.

Review and Adjust Regularly

Review your budget periodically to evaluate your progress towards your financial goals and make any necessary adjustments to optimize your budgeting strategy. Financial circumstances can change over time, so it’s essential to review your budget regularly to ensure that it still aligns with your financial objectives. Make adjustments as needed to accommodate any changes in your income, expenses, or financial goals.

Tips for Successful Bi-Weekly Budgeting

Here are some tips to help you succeed with your bi-weekly budget:

Automate Your Savings

Set up automatic transfers to your savings account to ensure you are consistently saving each pay period. Automating your savings can help you build a financial cushion for emergencies and future expenses without having to think about it. Treat your savings like a bill that must be paid each pay period to prioritize your financial goals.

Use Budgeting Tools

Consider using budgeting apps or spreadsheets to help you track your expenses and stay organized. Budgeting tools can streamline the budgeting process and provide insights into your spending habits. Look for apps that offer features like expense tracking, goal setting, and budget alerts to help you stay on top of your finances.

Build an Emergency Fund

Prioritize building an emergency fund to cover unexpected expenses and financial emergencies. Aim to save at least three to six months’ worth of living expenses in an easily accessible savings account. Having an emergency fund can provide peace of mind and financial security in case of job loss, medical emergencies, or other unforeseen events.

Stay Flexible

Be willing to adjust your budget as needed to accommodate changes in your income or expenses. Life is unpredictable, and your financial situation may change over time. Stay flexible with your budgeting approach and be willing to make adjustments to ensure that you are still meeting your financial goals. Remember that it’s okay to tweak your budget as needed to reflect your current circumstances.

Celebrate Your Wins

Acknowledge your progress and celebrate reaching financial milestones to stay motivated on your budgeting journey. Whether you’ve paid off a credit card, reached a savings goal, or stayed within your budget for several months, take the time to celebrate your achievements. Recognizing your successes can boost your confidence and keep you motivated to continue making positive financial choices.

Seek Professional Help

If you are struggling with budgeting or managing your finances, consider seeking guidance from a financial advisor or counselor. A financial professional can provide personalized advice and strategies to help you achieve your financial goals. Whether you need help creating a budget, managing debt, or planning for the future, a financial advisor can offer valuable insights and support.

By implementing a bi-weekly budget, you can gain better control over your finances, reduce stress, and make significant progress towards your financial goals. With a clear understanding of your income and expenses, along with strategic planning and diligent tracking, you can achieve financial stability and peace of mind.

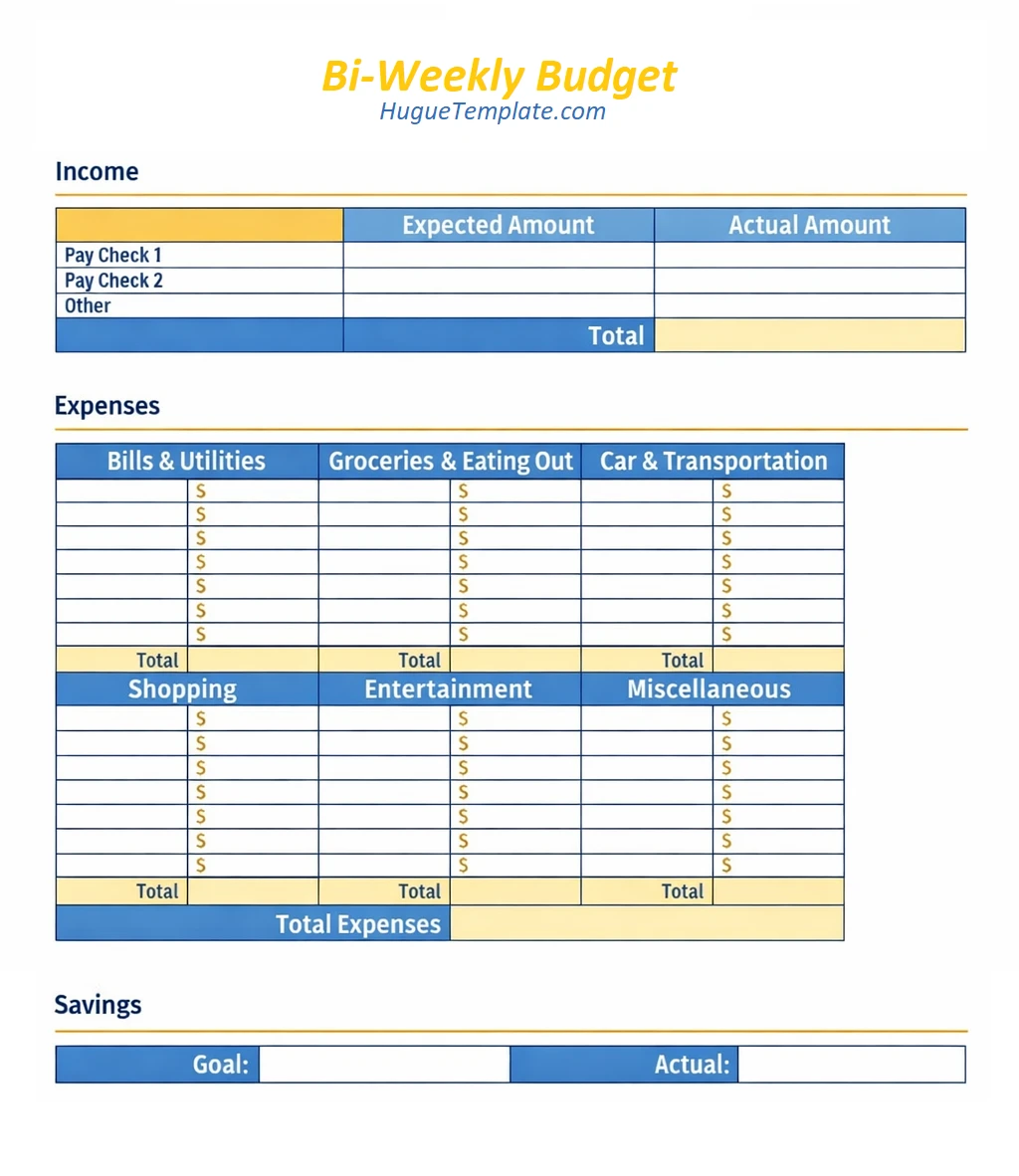

Free Bi-weekly Budget Template

A Bi-Weekly Budget helps you manage income and expenses based on a two-week pay schedule. It provides a clear structure for tracking bills, savings, and spending, making it easier to stay organized and maintain financial control. With a well-designed template, you can plan, avoid overspending, and make smarter budgeting decisions.

Download our Bi-Weekly Budget Template today to manage your finances efficiently and stay on track with confidence.

Bi-weekly Budget Template – DOWNLOAD