In the world of personal finance, keeping track of your money is key to financial success. One tool that helps individuals manage their finances effectively is the bank statement.

A bank statement provides a formal record of all transactions in a bank account over a specific period, allowing account holders to track their finances, detect errors or fraud, monitor spending habits, reconcile their accounts, and serve as proof of financial activity for tasks like applying for loans or filing taxes.

What is a Bank Statement?

A bank statement is a document issued by a bank to an account holder, typically monthly, that details all the transactions that have occurred in the account over a specified period. This document provides a comprehensive overview of the account’s activity, including deposits, withdrawals, transfers, fees, and interest earned.

Bank statements are essential for individuals to monitor their financial health and ensure the accuracy of their accounts.

Importance of Bank Statements

Bank statements serve as a fundamental tool for individuals to understand their financial standing. With the detailed information provided in a bank statement, account holders can gain insights into their spending habits, income sources, and overall financial health.

Without regular access to this information, individuals may struggle to effectively manage their finances and make informed decisions about their money.

Understanding Bank Statement Terminology

When reviewing a bank statement, it’s important to understand the various terms and abbreviations used in the document. Some common terms found on a bank statement include:

- Deposit: The addition of funds to the account.

- Withdrawal: The removal of funds from the account.

- Transfer: The movement of funds between accounts.

- Service Charge: A fee charged by the bank for account maintenance.

- Interest Earned: The amount of interest accrued on the account balance.

Types of Bank Statements

Several types of bank statements account holders may receive, depending on their banking preferences and needs. Some common types of bank statements include:

Paper Statements

Traditional paper bank statements are physical documents that are mailed to account holders monthly. These statements provide a detailed overview of account activity, including deposits, withdrawals, and fees. Account holders can use paper statements to reconcile their accounts and track their spending habits.

Online Statements

Many banks offer online statements that can be accessed through their websites or mobile apps. Online statements provide account holders with the convenience of viewing their transactions in real-time and accessing historical statements for reference. By going paperless, account holders can reduce clutter and contribute to environmental sustainability.

E-Statements

Electronic statements, or e-statements, are digital versions of bank statements that are sent to account holders via email or stored on the bank’s online portal. E-statements offer a secure and convenient way to access account information without relying on paper documents. Account holders can easily download and print e-statements for record-keeping purposes.

Benefits of Bank Statements

Bank statements offer various benefits to account holders, including:

Financial Awareness

By reviewing their bank statements regularly, individuals can stay informed about their financial activity and make informed decisions about their money. Bank statements provide a snapshot of account balances, transactions, and trends, allowing account holders to identify areas for improvement and plan for the future.

Budgeting Assistance

Tracking expenses through bank statements enables individuals to create and stick to a budget that aligns with their financial goals. By categorizing spending and identifying areas of overspending, account holders can make adjustments to their budget and improve their financial health.

Fraud Prevention

Regularly monitoring bank statements can help detect and prevent fraudulent activity in an account. By reviewing transactions for any unauthorized charges or suspicious activity, account holders can take immediate action to protect their funds and report any fraudulent transactions to their bank.

Financial Planning

Bank statements provide valuable information that can be used for long-term financial planning and goal setting. By analyzing spending patterns, saving habits, and investment opportunities, individuals can make informed decisions about their financial future and work towards achieving their financial goals.

Components of a Bank Statement

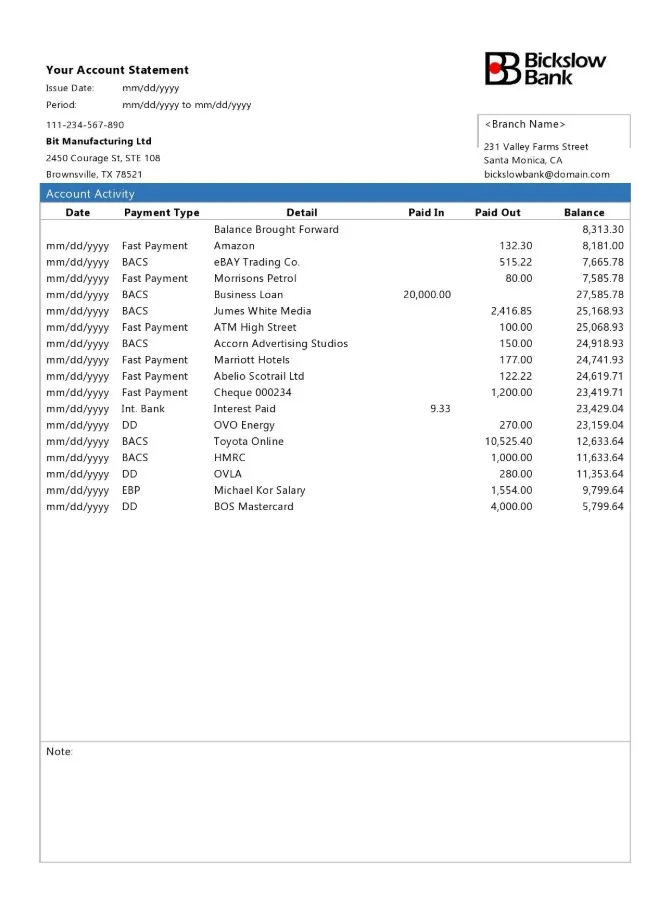

A typical bank statement includes the following components:

Account Information

The account holder’s name, account number, and contact information are typically displayed at the top of the bank statement. This information helps identify the account to which the statement pertains and ensures that the document is delivered to the correct recipient.

Transaction History

A detailed list of all transactions made in the account during the statement period is included in the bank statement. This section typically includes the date of each transaction, a description of the transaction, the amount of the transaction, and the running balance of the account after each transaction.

Beginning and Ending Balances

The starting and closing balances of the account for the statement period are indicated on the bank statement. The beginning balance is the amount of money in the account at the start of the statement period, while the ending balance is the amount of money in the account at the end of the period after all transactions have been accounted for.

Fees and Charges

Any fees or charges incurred by the account holder during the statement period are listed on the bank statement. These fees may include monthly maintenance fees, overdraft fees, ATM fees, or other charges assessed by the bank. By reviewing these fees, account holders can identify areas where they may be able to reduce costs and save money.

Interest Earned

The amount of interest earned on the account during the statement period is typically displayed on the bank statement. Interest is earned on the account balance based on the bank’s interest rate and is added to the account periodically. By tracking interest earned, account holders can monitor the growth of their savings and investments over time.

In conclusion, bank statements play a crucial role in helping individuals manage their finances effectively. By providing a detailed record of account activity, bank statements enable account holders to track their spending, detect errors or fraud, reconcile their accounts, and provide proof of financial activity when needed. Whether in paper form or accessed online, bank statements are valuable tools for staying informed about your finances and making informed decisions about your money. Next time you receive your bank statement, take the time to review it carefully and ensure that your financial records are accurate and up to date.

Bank Statement Template – DOWNLOAD