Annual reports are comprehensive documents that are designed to provide readers with detailed information about a company’s performance in the preceding year. These reports contain a wealth of information, including performance highlights, a letter from the CEO, financial information, and objectives and goals for future years.

While annual reports may seem like dry and technical documents, they are actually crucial tools for investors, stakeholders, and anyone else who is interested in understanding how a company is performing. In this article, we will explore what annual reports are, why they are important, what they contain, who uses them, and when they should be filed.

What is an Annual Report?

An annual report is a comprehensive document that provides detailed information about a company’s performance over the past year. It serves as a communication tool between the company and its stakeholders, offering insights into the financial health, strategic direction, and overall performance of the organization.

Annual reports are typically prepared by the company’s management team and are a requirement for publicly traded companies to provide transparency and accountability to their shareholders and the public.

Why are Annual Reports Important?

Transparency and Accountability

Annual reports play a vital role in promoting transparency and accountability within an organization. By providing a detailed account of the company’s financial performance, operations, and governance practices, annual reports help build trust and confidence among shareholders, investors, regulators, and other stakeholders. Transparency in reporting ensures that the company’s activities are conducted ethically and in compliance with legal and regulatory requirements.

Investor Relations

Annual reports are essential tools for maintaining strong investor relations and attracting potential investors to the company. Investors rely on annual reports to assess the company’s financial health, growth prospects, risks, and overall performance. By presenting a clear and comprehensive analysis of the company’s operations and financial results, annual reports help investors make informed decisions about buying, holding, or selling the company’s stock.

Strategic Planning

Annual reports provide valuable insights into the company’s strategic direction, goals, and objectives for the future. By outlining the company’s key initiatives, market trends, competitive landscape, and growth opportunities, annual reports help stakeholders understand the company’s long-term vision and planning. This information is crucial for executives, board members, employees, and other stakeholders to align their efforts towards achieving the company’s strategic objectives.

Performance Evaluation

Annual reports serve as a benchmark for evaluating the company’s performance over time and comparing it with industry peers and competitors. By analyzing key performance indicators, financial ratios, and operational metrics presented in the annual report, stakeholders can assess the company’s efficiency, profitability, liquidity, and overall competitiveness in the market. This performance evaluation helps identify areas for improvement, strategic priorities, and potential risks that need to be addressed.

Risk Management

Annual reports disclose information about the company’s risk management practices, including identifying potential risks, assessing their impact, and implementing mitigation strategies. By providing a comprehensive overview of the company’s risk exposure, annual reports help stakeholders understand the key risks that could affect the company’s financial performance, reputation, and prospects. This risk disclosure enables investors and other stakeholders to make informed decisions about the company’s risk profile and resilience.

Regulatory Compliance

Annual reports are a crucial part of regulatory compliance for publicly traded companies, as they are required to disclose accurate and timely information to regulatory authorities and shareholders. By adhering to accounting standards, reporting guidelines, and disclosure requirements set by regulatory bodies, companies demonstrate their commitment to upholding ethical standards, corporate governance best practices, and legal obligations. Failure to comply with regulatory requirements can result in fines, penalties, and reputational damage for the company.

Brand Reputation

Annual reports play a significant role in shaping the company’s brand reputation and image among stakeholders, including customers, employees, suppliers, and the general public. A well-crafted annual report that showcases the company’s achievements, values, and commitment to sustainability can enhance its brand perception and differentiate it from competitors. By highlighting the company’s corporate social responsibility initiatives, environmental stewardship, and ethical business practices, annual reports help build trust and loyalty among stakeholders.

Continuous Improvement

Annual reports provide a platform for companies to reflect on their performance, achievements, and areas for improvement over the past year. By conducting a thorough analysis of their operations, financial results, and strategic initiatives, companies can identify strengths, weaknesses, opportunities, and threats that impact their long-term success. This self-assessment process enables companies to set new goals, implement corrective actions, and drive continuous improvement in their business practices and performance metrics.

What Does an Annual Report Contain?

Financial Statements

One of the key components of an annual report is the financial statements, which provide a detailed overview of the company’s financial performance during the reporting period. The financial statements typically include the income statement, balance sheet, cash flow statement, and statement of changes in equity. These statements present the company’s revenues, expenses, assets, liabilities, cash flows, and shareholders’ equity in a structured format that enables stakeholders to assess the company’s profitability, liquidity, solvency, and financial position.

Management Discussion and Analysis (MD&A)

The management discussion and analysis (MD&A) section of an annual report offers insights into the company’s financial results, operational highlights, strategic initiatives, and challenges faced during the reporting period. This narrative section is written by the company’s management team and provides context and explanations for the financial information presented in the report. The MD&A helps stakeholders understand the company’s performance drivers, key risks, market trends, and future outlook, enabling them to make informed decisions about the company’s prospects.

Corporate Governance Information

Annual reports often include information about the company’s corporate governance structure, practices, and policies. This section outlines the composition of the board of directors, executive compensation practices, shareholder rights, audit committee oversight, and ethical standards. By disclosing information about corporate governance, companies demonstrate their commitment to transparency, accountability, and ethical conduct in their decision-making processes. Strong corporate governance practices help build trust and confidence among stakeholders and enhance the company’s reputation.

Sustainability Reports

Many companies include sustainability reports in their annual reports to disclose information about their environmental, social, and governance (ESG) initiatives and performance. Sustainability reports detail the company’s efforts to reduce its environmental impact, promote social responsibility, and enhance stakeholder engagement. By reporting on ESG metrics, such as carbon emissions, diversity and inclusion practices, community outreach programs, and ethical sourcing policies, companies demonstrate their commitment to sustainable business practices and responsible corporate citizenship.

Auditor’s Report

Annual reports typically include an auditor’s report, which is prepared by an independent accounting firm that has audited the company’s financial statements. The auditor’s report provides an opinion on the fairness and accuracy of the financial statements, as well as the company’s compliance with accounting standards and regulatory requirements. The auditor’s report adds credibility to the financial information presented in the annual report and assures stakeholders that the company’s financial statements have been prepared in accordance with generally accepted accounting principles (GAAP).

Letter from the CEO

Many annual reports feature a letter from the company’s CEO or top executive, in which they provide a personal reflection on the company’s performance, achievements, challenges, and goals for the future. The CEO’s letter offers a narrative perspective on the company’s strategic vision, leadership priorities, and commitment to stakeholders. This personal touch humanizes the annual report and helps stakeholders connect with the company’s leadership. The CEO’s letter often sets the tone for the annual report, highlighting key themes, accomplishments, and areas of focus for the coming year.

Risk Factors

Annual reports typically include a section on risk factors, which outlines the potential risks and uncertainties that could impact the company’s financial performance and operations. This risk disclosure is important for investors and other stakeholders to understand the key challenges and vulnerabilities that the company faces in its business environment. By identifying risks related to market conditions, competition, regulatory changes, cybersecurity threats, and other factors, companies can proactively manage and mitigate these risks to protect their long-term sustainability.

Corporate Social Responsibility (CSR)

Many companies integrate corporate social responsibility (CSR) initiatives into their annual reports to showcase their commitment to social and environmental causes. CSR reports highlight the company’s efforts to give back to the community, support charitable organizations, promote diversity and inclusion, and reduce its environmental footprint. By reporting on CSR activities, companies demonstrate their values, engage stakeholders, and build trust with customers, employees, and the broader community.

Key Performance Indicators (KPIs)

Annual reports often include key performance indicators (KPIs) that measure the company’s progress towards achieving its strategic objectives and financial goals. These metrics provide stakeholders with a quantifiable assessment of the company’s performance in areas such as revenue growth, profitability, operational efficiency, customer satisfaction, and employee engagement. By tracking KPIs over time and comparing them to industry benchmarks, companies can evaluate their performance, identify trends, and drive continuous improvement in their business operations.

Who Uses Annual Reports?

Investors

Investors are one of the key users of annual reports, as they rely on the information contained in these documents to make informed investment decisions. By analyzing the company’s financial performance, strategic initiatives, and future outlook presented in the annual report, investors can assess the company’s profitability, growth potential, risk profile, and overall investment attractiveness. Annual reports help investors understand the company’s financial health, operational efficiency, and competitive positioning in the market, enabling them to make sound investment decisions that align with their investment objectives and risk tolerance.

Stakeholders

Stakeholders, including employees, customers, suppliers, and the local community, use annual reports to gain insight into the company’s performance, governance practices, and social and environmental impact. By reviewing the company’s financial statements, corporate governance disclosures, sustainability reports, and community engagement initiatives presented in the annual report, stakeholders can assess the company’s commitment to ethical business practices, environmental sustainability, and social responsibility. Annual reports help stakeholders understand how the company is creating value for its stakeholders, supporting the community, and fostering a culture of integrity, transparency, and accountability.

Regulators

Regulators, such as the Securities and Exchange Commission (SEC) and other regulatory authorities, use annual reports to monitor compliance with financial reporting requirements, accounting standards, and disclosure regulations. By reviewing the company’s financial statements, auditors’ reports, and compliance certifications presented in the annual report, regulators can ensure that the company is adhering to regulatory requirements, disclosing accurate and timely information, and maintaining transparency and accountability in its financial reporting. Annual reports help regulators assess the company’s compliance with laws and regulations and take appropriate action to address any deficiencies or non-compliance issues.

Analysts

Financial analysts and industry experts use annual reports to conduct in-depth analysis of the company’s financial performance, competitive positioning, and growth prospects. By reviewing the company’s financial statements, management discussion and analysis (MD&A) section, and key performance indicators presented in the annual report, analysts can evaluate the company’s revenue trends, profit margins, market share, and strategic initiatives. Annual reports provide analysts with valuable insights into the company’s operations, industry dynamics, and future outlook, enabling them to make informed recommendations to investors, clients, and stakeholders.

Creditors

Creditors, such as banks, lenders, and bondholders, use annual reports to assess the company’s creditworthiness, financial health, and ability to meet its debt obligations. By analyzing the company’s financial statements, cash flow projections, debt levels, and liquidity ratios presented in the annual report, creditors can evaluate the company’s ability to generate sufficient cash flow, repay debt on time, and manage financial risks. Annual reports help creditors assess the company’s credit risk, financial stability, and capacity to honor its financial commitments, enabling them to make informed lending decisions and manage their credit exposure effectively.

Governance Organizations

Governance organizations, such as institutional investors, proxy advisory firms, and corporate governance rating agencies, use annual reports to evaluate the company’s governance practices, board composition, executive compensation policies, and shareholder rights. By reviewing the company’s corporate governance disclosures, board diversity initiatives, executive pay ratios, and shareholder engagement efforts presented in the annual report, governance organizations can assess the company’s commitment to transparency, accountability, and ethical leadership. Annual reports help governance organizations evaluate the company’s governance structure, risk management practices, and alignment with industry best practices, enabling them to make recommendations for improving governance standards and shareholder value.

Non-Governmental Organizations (NGOs)

Non-Governmental Organizations (NGOs), advocacy groups, and social responsibility organizations use annual reports to assess the company’s social and environmental impact, sustainability practices, and community engagement initiatives. By reviewing the company’s sustainability reports, environmental performance data, human rights commitments, and philanthropic activities presented in the annual report, NGOs can evaluate the company’s efforts to address social and environmental challenges, promote ethical business practices, and contribute to sustainable development. Annual reports help NGOs monitor the company’s progress towards achieving its ESG goals, address stakeholder concerns, and collaborate on initiatives that benefit society and the environment.

Media and Public

The media, general public, and other external stakeholders use annual reports to gain insight into the company’s financial performance, strategic direction, and corporate responsibility practices. By reviewing the company’s financial results, sustainability initiatives, community engagement programs, and ethical business practices presented in the annual report, the media and the public can assess the company’s impact on society, environment, and economy. Annual reports help the media and the public understand the company’s values, priorities, and contributions to society, enabling them to report on the company’s activities, achievements, and challenges to a wider audience.

When Should Annual Reports Be Filed?

Regulatory Deadlines

Publicly traded companies are required to file their annual reports with regulatory authorities, such as the Securities and Exchange Commission (SEC), within a specific timeframe mandated by regulatory guidelines. The deadline for filing annual reports, also known as Form 10-K in the United States, is typically 60 to 90 days after the end of the company’s fiscal year. Failure to file annual reports on time can result in penalties, fines, and legal repercussions for the company, its executives, and audit firms. Companies must adhere to regulatory deadlines to ensure compliance with financial reporting requirements and provide stakeholders with accurate and timely information about the company’s performance.

Shareholder Expectations

Companies often aim to publish their annual reports within a reasonable timeframe after the end of the fiscal year to meet shareholder expectations for transparency, accountability, and timely disclosure of financial information. Shareholders, investors, analysts, and other stakeholders rely on annual reports to assess the company’s financial performance, strategic initiatives, and future prospects. By filing annual reports promptly and making them accessible to stakeholders, companies demonstrate their commitment to good governance practices, open communication, and stakeholder engagement. Timely filing of annual reports helps companies build trust, credibility, and confidence among shareholders and investors.

Internal Reporting Deadlines

Internally, companies may set deadlines for preparing and finalizing their annual reports to ensure the accuracy, completeness, and quality of the information presented in the report. Internal reporting deadlines help companies allocate sufficient time for gathering financial data, conducting audits, reviewing disclosure requirements, and obtaining approvals from senior management and the board of directors. By establishing clear timelines and milestones for annual report preparation, companies can streamline the reporting process, mitigate risks of errors or omissions, and ensure that the report is filed on time with regulatory authorities. Internal reporting deadlines help companies meet external reporting requirements and provide stakeholders with reliable information about the company’s performance.

Board Approval Process

Before filing their annual reports, companies typically undergo a board approval process to review and finalize the content of the report, including financial statements, management discussion and analysis (MD&A), auditors’ reports, and other key disclosures. The board of directors plays a critical role in overseeing the preparation and approval of the annual report, ensuring that the report accurately reflects the company’s financial performance, strategic priorities, and governance practices. By obtaining board approval for the annual report, companies demonstrate their commitment to transparency, accountability, and good governance. The board approval process helps companies validate the accuracy and integrity of the information presented in the report before it is shared with stakeholders and filed with regulatory authorities.

External Audit Review

Companies often engage external audit firms to conduct an independent review of their financial statements and internal controls before finalizing their annual reports. External audit firms perform audit procedures to verify the accuracy, reliability, and compliance of the financial information presented in the annual report with accounting standards and regulatory requirements. By undergoing an external audit review, companies enhance the credibility, accuracy, and transparency of their financial reporting process. External audit reviews help companies identify any errors or discrepancies in their financial statements, strengthen internal controls, and ensure compliance with auditing standards. The audit review process helps companies enhance the quality and reliability of their financial reporting, mitigate risks of financial misstatements, and provide stakeholders with assurance about the accuracy of the information presented in the annual report.

Shareholder Communication

Companies may consider shareholder communication and engagement strategies when determining the timing of filing their annual reports. Shareholders and investors often anticipate receiving annual reports to assess the company’s performance, governance practices, and future outlook. By communicating proactively with shareholders about the timeline for filing the annual report, companies can manage shareholder expectations, address any concerns or questions, and foster a culture of transparency and trust. Effective shareholder communication helps companies maintain positive relationships with their investors, enhance investor confidence, and demonstrate a commitment to open and honest communication.

Market Conditions

Market conditions and external factors may influence the timing of filing annual reports for some companies. Economic volatility, industry trends, regulatory changes, and competitive pressures can impact the company’s financial performance, strategic priorities, and disclosure requirements. Companies may choose to delay or expedite the filing of their annual reports based on market conditions, investor sentiment, and business considerations. By assessing market conditions and external factors, companies can make informed decisions about when to file their annual reports to provide stakeholders with relevant and timely information about the company’s performance and outlook.

Strategic Objectives

Companies may align the timing of filing their annual reports with their strategic objectives, business priorities, and long-term goals. The annual report serves as a reflection of the company’s achievements, challenges, and future direction, providing stakeholders with insights into the company’s strategy, performance, and value creation. By considering strategic objectives when determining the timing of filing the annual report, companies can ensure that the report effectively communicates the company’s vision, accomplishments, and priorities to stakeholders. Aligning the timing of filing annual reports with strategic objectives helps companies reinforce their strategic messaging, engage stakeholders, and demonstrate progress towards achieving their strategic goals.

Continuous Improvement

Companies may use the process of preparing and filing annual reports as an opportunity for continuous improvement in their financial reporting, governance practices, and stakeholder engagement. By reviewing feedback from stakeholders, conducting internal evaluations, and identifying areas for enhancement, companies can improve the quality, relevance, and transparency of their annual reports. Companies that prioritize continuous improvement in their reporting process can enhance stakeholder trust, credibility, and confidence in the company’s management and governance practices. Embracing a culture of continuous improvement in annual reporting helps companies evolve with changing stakeholder expectations, industry trends, and regulatory requirements.

Timely Disclosure

Timely disclosure of annual reports is essential for maintaining transparency, accountability, and trust with stakeholders. By filing annual reports within the regulatory deadlines and communicating proactively with shareholders about the timing of the report, companies demonstrate their commitment to the timely disclosure of material information. Timely disclosure helps investors, regulators, analysts, and other stakeholders access accurate and up-to-date information about the company’s performance, governance practices, and strategic direction. Companies that prioritize the timely disclosure of annual reports can enhance stakeholder confidence, investor trust, and market credibility.

Reputation Management

Companies may consider reputation management strategies when determining the timing of filing their annual reports to protect and enhance their corporate image. Annual reports are an important communication tool for shaping the company’s reputation, demonstrating transparency, and building trust with stakeholders. By filing annual reports on time, companies signal their commitment to integrity, reliability, and good governance practices. Positive reputation management practices help companies maintain a strong brand image, attract investors, and retain the trust of customers, employees, and other stakeholders. Timely filing of annual reports is a key aspect of reputation management and stakeholder communication.

Legal Compliance

Ensuring legal compliance with regulatory requirements is a key consideration for companies when determining the timing of filing their annual reports. Publicly traded companies are obligated to adhere to strict guidelines and deadlines for filing annual reports with regulatory authorities, such as the SEC. Failure to comply with legal requirements, including timely filing of annual reports, can result in fines, penalties, and legal repercussions for the company and its executives. Companies that prioritize legal compliance in their reporting process demonstrate their commitment to upholding ethical standards, transparency, and accountability in their financial reporting. Adhering to legal requirements for filing annual reports helps companies mitigate regulatory risks, protect shareholder interests, and uphold corporate governance standards.

Investor Relations Strategy

Companies may align the timing of filing their annual reports with their investor relations strategy to engage with shareholders, analysts, and other stakeholders effectively. Annual reports are a critical tool for investor relations, providing stakeholders with insights into the company’s financial performance, strategic direction, and governance practices. By filing annual reports on time and leveraging the report as a communication tool to engage with investors, companies can strengthen investor relations, attract new investors, and enhance shareholder value. Aligning the timing of filing annual reports with the company’s investor relations strategy helps companies build trust, credibility, and long-term relationships with their investor base.

Strategic Communication

Strategic communication considerations may influence the timing of filing annual reports for companies seeking to deliver key messages, achievements, and priorities to stakeholders effectively. Annual reports serve as a platform for companies to communicate their financial performance, strategic initiatives, corporate governance practices, and sustainability efforts to stakeholders. By aligning the timing of filing annual reports with strategic communication objectives, companies can ensure that the report effectively conveys the company’s key messages, accomplishments, and future outlook. Strategic communication in annual reports helps companies articulate their vision, engage stakeholders, and strengthen their reputation in the market.

Market Expectations

Considering market expectations and stakeholder needs is important when determining the timing of filing annual reports to meet the information needs of investors, analysts, regulators, and other stakeholders. Annual reports are a key source of information for stakeholders to assess the company’s financial performance, strategic priorities, and governance practices. By filing annual reports within a reasonable timeframe after the end of the fiscal year, companies can meet market expectations, address stakeholder needs, and provide stakeholders with relevant and timely information about the company’s performance. Meeting market expectations in annual reporting helps companies maintain transparency, credibility, and confidence among stakeholders and investors.

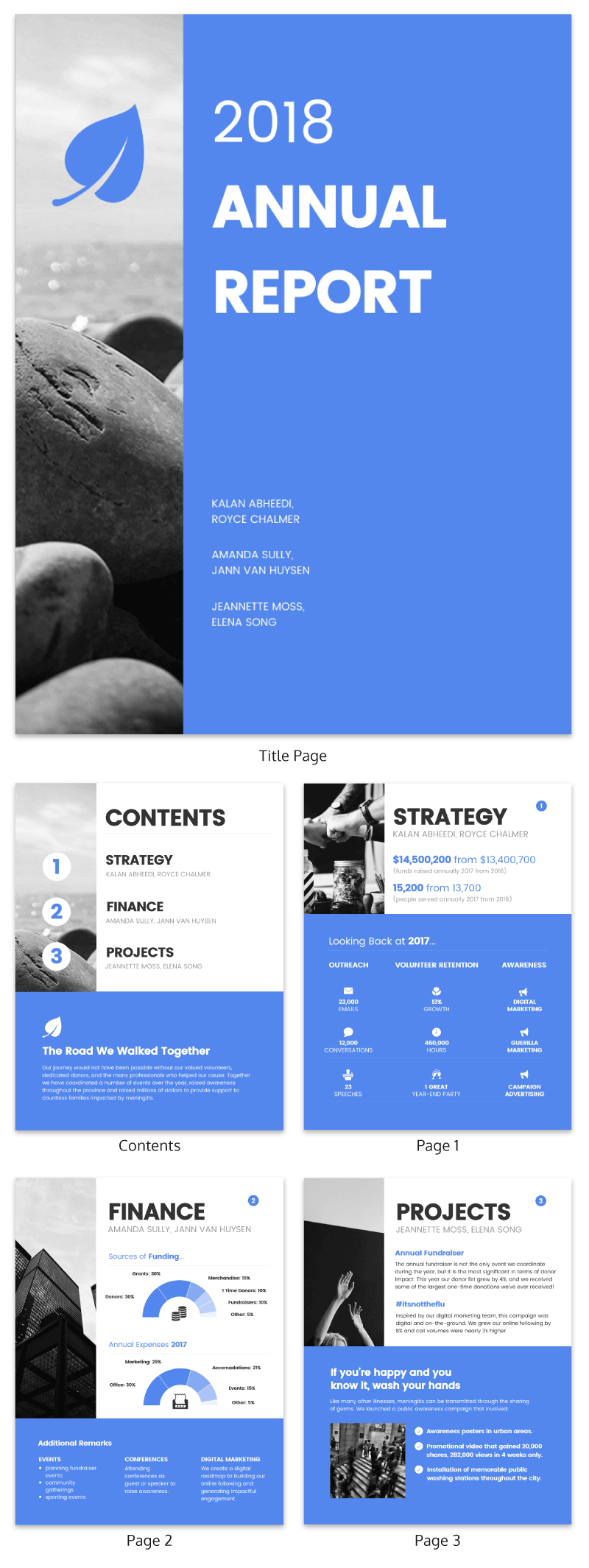

Annual Report Template – DOWNLOAD