What is an Accounting Ledger?

An accounting ledger is the backbone of a company’s financial record-keeping system. It is a centralized repository where all financial transactions are recorded in an organized and systematic manner.

Each transaction is classified into specific accounts such as assets, liabilities, equity, revenues, and expenses to provide a clear snapshot of the company’s financial health.

The Function of an Accounting Ledger

The primary function of an accounting ledger is to maintain a detailed record of all financial transactions that occur within a business. By organizing transactions into specific accounts, the ledger ensures that financial data is accurate, consistent, and easily accessible for reporting and analysis purposes.

Moreover, the ledger acts as a historical record of the company’s financial activities, allowing stakeholders to track the flow of money in and out of the business over time. This historical perspective is essential for identifying trends, monitoring performance, and making informed financial decisions.

Overall, an accounting ledger serves as a reliable source of financial information that forms the basis for preparing key financial statements like the income statement, balance sheet, and cash flow statement. Without an accurate and well-maintained ledger, businesses would struggle to track their financial position, analyze their performance, and comply with regulatory requirements.

The Structure of an Accounting Ledger

An accounting ledger typically consists of multiple accounts, each representing a different aspect of the company’s finances. These accounts are organized into categories based on the type of transaction they represent, such as assets, liabilities, equity, revenues, and expenses.

Within each account, individual transactions are recorded in a systematic manner, following the principles of double-entry accounting. This means that each transaction is recorded twice – once as a debit and once as a credit – to ensure that the accounting equation (Assets = Liabilities + Equity) remains in balance.

By maintaining this structured approach to recording transactions, the accounting ledger provides a clear and comprehensive overview of the company’s financial position at any given time. This level of detail is essential for generating accurate financial reports and conducting in-depth financial analysis.

The Benefits of Using an Accounting Ledger

There are several key benefits to using an accounting ledger in a business:

- Accuracy: By recording all financial transactions in a structured and organized manner, the ledger ensures that the company’s financial data is accurate and reliable.

- Transparency: A well-maintained ledger provides transparency into the company’s financial activities, allowing stakeholders to track the flow of money and make informed decisions.

- Compliance: Keeping detailed financial records in the ledger helps businesses comply with regulatory requirements and demonstrate adherence to accounting standards.

- Financial Analysis: The ledger serves as a valuable tool for generating financial reports, analyzing performance, and identifying areas for improvement.

- Budgeting and Planning: By tracking financial data in the ledger, businesses can create budgets, forecast future expenses, and set financial goals more effectively.

Common Mistakes to Avoid in Accounting Ledger Management

While an accounting ledger is a powerful tool for financial management, there are several common mistakes that businesses should avoid:

- Not Reconciling Accounts: Failing to reconcile accounts regularly can lead to errors and discrepancies in financial reports.

- Ignoring Documentation: Not keeping proper documentation of transactions can make it challenging to trace the source of errors or discrepancies.

- Overlooking Data Entry Errors: Mistakes in data entry can have a significant impact on the accuracy of financial records, so it’s essential to double-check entries for accuracy.

- Not Updating the Ledger Regularly: Delaying the entry of transactions into the ledger can result in incomplete or outdated financial data, affecting decision-making.

- Not Using Accounting Software: Manual ledger management can be time-consuming and prone to errors, so businesses should consider using accounting software for greater efficiency and accuracy.

Best Practices for Maintaining an Accounting Ledger

To ensure the effectiveness and accuracy of an accounting ledger, businesses should follow these best practices:

- Record Transactions Promptly: Enter transactions into the ledger as soon as they occur to avoid errors or omissions.

- Reconcile Accounts Regularly: Compare ledger balances to bank statements and other financial records to identify discrepancies.

- Keep Detailed Documentation: Maintain supporting documents for all transactions to provide evidence and context for financial records.

- Review Entries for Accuracy: Double-check entries for accuracy and completeness to ensure the integrity of financial data.

- Implement Internal Controls: Establish internal controls to prevent fraud, errors, and misuse of financial information in the ledger.

Future Trends in Accounting Ledger Management

As technology continues to advance, the future of accounting ledger management is likely to see significant changes. Some emerging trends in this area include:

- Automation: Increasing automation of accounting processes, including transaction recording, reconciliation, and reporting, to improve efficiency and accuracy.

- Integration with AI: Incorporating artificial intelligence (AI) and machine learning capabilities into accounting software to enhance data analysis and decision-making.

- Cloud-Based Solutions: Adoption of cloud-based accounting software for greater accessibility, collaboration, and data security in ledger management.

- Blockchain Technology: Exploring the use of blockchain technology for secure and transparent recording of financial transactions in the ledger.

- Data Analytics: Leveraging data analytics tools to gain deeper insights into financial data, trends, and patterns for strategic decision-making.

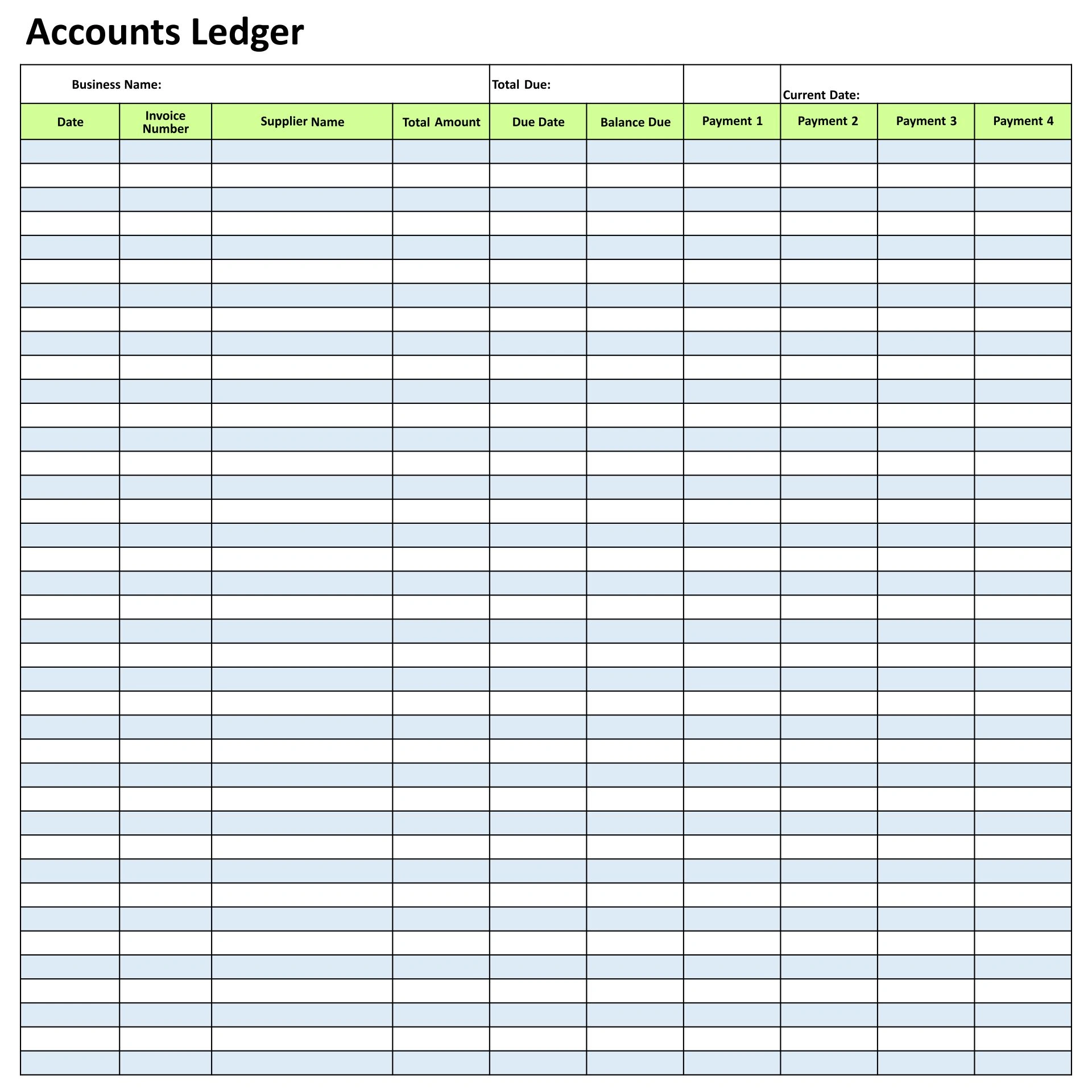

Accounting Ledger Template – DOWNLOAD