Keeping track of your bills can be a daunting task, especially when you have multiple expenses to monitor each month. This is where a bill tracker comes in handy.

A bill tracker is a tool that helps you organize and manage your bills efficiently, ensuring that you never miss a payment deadline.

In this article, we will delve into the world of bill trackers, exploring what they are, why they are important, what to include in a good bill tracker, how to use one effectively, and tips for successful bill tracking.

What is a Bill Tracker?

A bill tracker is a system or tool that allows you to keep track of your bills, due dates, payment amounts, and payment status. It helps you stay organized and ensures that you never miss a payment deadline.

With a bill tracker, you can easily see which bills are due, how much you owe, and when the payment is due. This can help you avoid late fees, improve your credit score, and maintain financial stability.

Why is a Bill Tracker Important?

A bill tracker is important for several reasons. Firstly, it helps you stay organized and on top of your finances. By tracking your bills, you can avoid missing payments, which can lead to late fees and a negative impact on your credit score.

Additionally, a bill tracker can help you budget effectively by giving you a clear overview of your monthly expenses. This can help you identify areas where you can cut costs and save money.

What to Include in a Good Bill Tracker

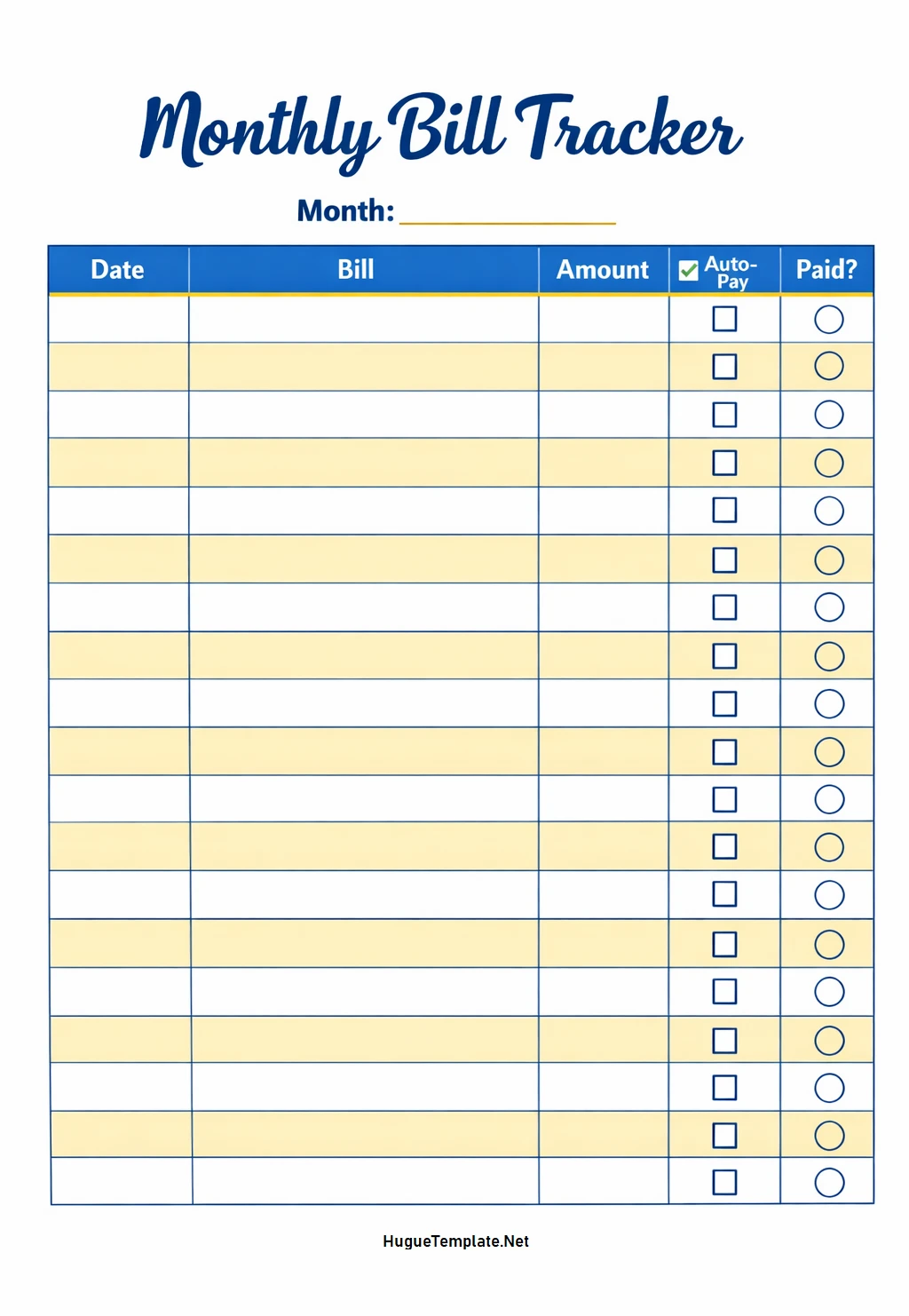

When creating a bill tracker, there are several key elements to include to ensure its effectiveness. These include:

- Bill Name: Clearly label each bill to easily identify it.

- Due Date: Include the date by which the bill needs to be paid.

- Amount Due: Specify the amount that needs to be paid for each bill.

- Payment Status: Track whether the bill has been paid or is still outstanding.

- Notes: Include any additional information or reminders related to the bill.

How to Use a Bill Tracker Effectively

Using a bill tracker effectively involves regular maintenance and updating. Here are some tips on how to make the most of your bill tracker:

- Set Reminders: Use the reminder feature on your bill tracker to alert you of upcoming due dates.

- Update Regularly: Make it a habit to update your bill tracker regularly with new bills and payment information.

- Review Regularly: Take time to review your bill tracker each week to ensure all bills are accounted for and paid on time.

- Utilize Categories: Organize your bills by categories (e.g., utilities, rent, subscriptions) for easier tracking.

- Monitor Payment History: Keep track of your payment history to identify any patterns or issues with certain bills.

Tips for Successful Bill Tracking

Here are some additional tips to help you succeed in managing your bills effectively:

- Automate Payments: Set up automatic payments for recurring bills to avoid missing deadlines.

- Establish a Routine: Make bill tracking a part of your regular financial routine to ensure consistency.

- Stay Organized: Keep all your bills and payment information in one central location for easy access.

- Seek Help if Needed: If you find bill tracking overwhelming, consider using budgeting apps or seeking assistance from a financial advisor.

- Celebrate Milestones: Reward yourself for staying on top of your bills and meeting your financial goals.

By incorporating these tips and strategies into your bill tracking routine, you can take control of your finances and achieve greater peace of mind. Remember, staying organized and proactive is key to financial success. Start using a bill tracker today and watch your financial health improve!

Bill Tracker Template – DOWNLOAD