Bank reconciliation is a critical process for businesses to maintain the accuracy of their financial records. By comparing the internal cash records with the bank’s records, discrepancies can be identified and rectified promptly. This verification process is crucial for preventing errors, detecting fraud, ensuring compliance, and enhancing cash control.

Bank reconciliation serves as a vital internal control mechanism, helping businesses confirm their true cash position and maintain accurate financial statements.

What is Bank Reconciliation?

Bank reconciliation is the process of comparing the transactions in a company’s internal cash records with the transactions shown on the bank statement. It involves matching the balances in the internal records with the bank’s records to ensure they align.

This process helps in identifying any discrepancies or errors that may exist between the two sets of records.

The Process of Bank Reconciliation

The process of bank reconciliation typically involves several steps:

- Gather Documents: Collect the company’s internal cash records and the bank statements for the period that needs to be reconciled.

- Compare Transactions: Match the transactions in the internal records with those on the bank statement to identify any differences.

- Adjust for Discrepancies: Make adjustments to the internal records to align them with the bank statement, taking into account any outstanding transactions or errors.

- Reconcile Balances: Ensure that the closing balances in the internal records match the closing balances on the bank statement after adjustments.

- Document the Reconciliation: Keep a record of the reconciliation process, including any adjustments made and the final reconciled balances.

Benefits of Bank Reconciliation

Bank reconciliation offers several benefits to businesses:

- Accuracy: By reconciling bank accounts, businesses can ensure the accuracy of their financial records and statements.

- Prevention of Fraud: Bank reconciliation helps in detecting any unauthorized transactions or fraudulent activities early on.

- Compliance: By reconciling bank accounts, businesses can comply with regulatory requirements and ensure accurate tax reporting.

- Cash Control: Bank reconciliation provides better control over cash flow, reducing the risk of overdrafts or cash shortages.

Why is Bank Reconciliation Important?

Bank reconciliation is crucial for several reasons:

Verification of Financial Statements

One of the primary reasons for conducting bank reconciliation is to verify the accuracy of the financial statements. By reconciling bank accounts, businesses can ensure that all transactions are recorded correctly and that the financial statements reflect the true financial position of the company.

Prevention of Errors and Fraud

Bank reconciliation helps in detecting errors in recording transactions and identifying any unauthorized or fraudulent activities. By reconciling bank accounts regularly, businesses can prevent financial discrepancies and protect themselves from potential fraud.

Better Cash Control

Bank reconciliation provides businesses with better control over their cash flow. By reconciling bank accounts, businesses can track their cash balances accurately and identify any discrepancies or issues that may impact their cash position.

Compliance and Tax Reporting

Bank reconciliation is essential for compliance with regulatory requirements and accurate tax reporting. By reconciling bank accounts, businesses can ensure that their financial records are up to date and in line with legal and tax obligations.

Key Elements of Bank Reconciliation

The key elements of bank reconciliation include:

Starting Balance

The starting balance is the balance in the company’s internal cash records at the beginning of the reconciliation period. It serves as the starting point for the reconciliation process and is crucial for ensuring accuracy.

Bank Statement Balance

The bank statement balance is the balance shown on the bank statement for the same period. It represents the actual transactions processed by the bank and serves as a reference point for reconciling the internal records.

Outstanding Transactions

Outstanding transactions are those transactions that have been initiated by the company but have not yet been processed by the bank. These transactions need to be accounted for in the reconciliation process to ensure the accuracy of the final balances.

Reconciling Items

Reconciling items are the adjustments made to the company’s internal cash records to match the bank statement balance. These adjustments may include adding or deducting amounts to align the two sets of records accurately.

How to Reconcile Bank Accounts

Reconciling bank accounts involves a series of steps to ensure accuracy and consistency in financial records:

Compare Internal Records with Bank Statement

Begin by comparing the transactions in the company’s internal records with those on the bank statement. Look for any discrepancies or missing transactions that need to be addressed during the reconciliation process.

Adjust for Outstanding Transactions

If there are outstanding transactions that have not been processed by the bank, make the necessary adjustments to the internal records to reflect these transactions accurately. This step ensures that all transactions are accounted for in the reconciliation process.

Reconcile the Balances

After making adjustments for outstanding transactions, reconcile the balances in the internal records with the bank statement balance. Ensure that the closing balances match after all adjustments have been applied, indicating a successful reconciliation process.

Review and Confirm

Review the reconciled balances and confirm that all transactions have been accounted for and reconciled accurately. Check for any discrepancies or errors that may still exist and make corrections as needed to ensure the accuracy of the financial records.

Document the Reconciliation

Document the reconciliation process, including the adjustments made, any outstanding transactions, and the final reconciled balances. Keeping a record of the reconciliation process helps in maintaining a clear audit trail and provides a reference for future reconciliations.

Follow Up on Discrepancies

If there are any unresolved discrepancies or issues identified during the reconciliation process, follow up with the bank to investigate and resolve these issues. Take the necessary steps to correct any errors or discrepancies found to ensure the accuracy of the financial records.

Repeat Regularly

It is essential to repeat the bank reconciliation process regularly, preferably monthly, to maintain the accuracy of financial records. Regular reconciliation helps in staying up to date with the company’s financial position and identifying any discrepancies or issues promptly.

Tips for Successful Bank Reconciliation

Here are some tips to ensure successful bank reconciliation:

Keep Accurate Records

Maintaining detailed and accurate records of all financial transactions is crucial for successful bank reconciliation. Keep track of all transactions, including deposits, withdrawals, and payments, to facilitate the reconciliation process.

Use Accounting Software

Consider using accounting software to automate the bank reconciliation process. Accounting software can help streamline the reconciliation process, reduce manual errors, and provide real-time updates on cash balances and transactions.

Reconcile Regularly

Reconciling bank accounts regularly is key to maintaining the accuracy of financial records. Aim to reconcile bank accounts at least once a month to stay on top of your financial status and identify any discrepancies early on.

Seek Professional Help

If you’re unsure about the bank reconciliation process or encounter complex issues during reconciliation, seek help from a financial advisor or accountant. Professional assistance can help ensure that the reconciliation process is accurate and compliant with accounting standards.

Monitor for Fraud

Keep an eye out for any unusual transactions or discrepancies that may indicate fraudulent activities. Monitor bank accounts regularly for unauthorized transactions or suspicious activities and take immediate action to address any issues that may arise.

Stay Organized

Organize all documentation related to bank reconciliation in a secure and accessible manner. Keep records of all transactions, adjustments, and reconciliations for easy reference and audit trail. Staying organized can help streamline the reconciliation process and ensure accuracy in financial records.

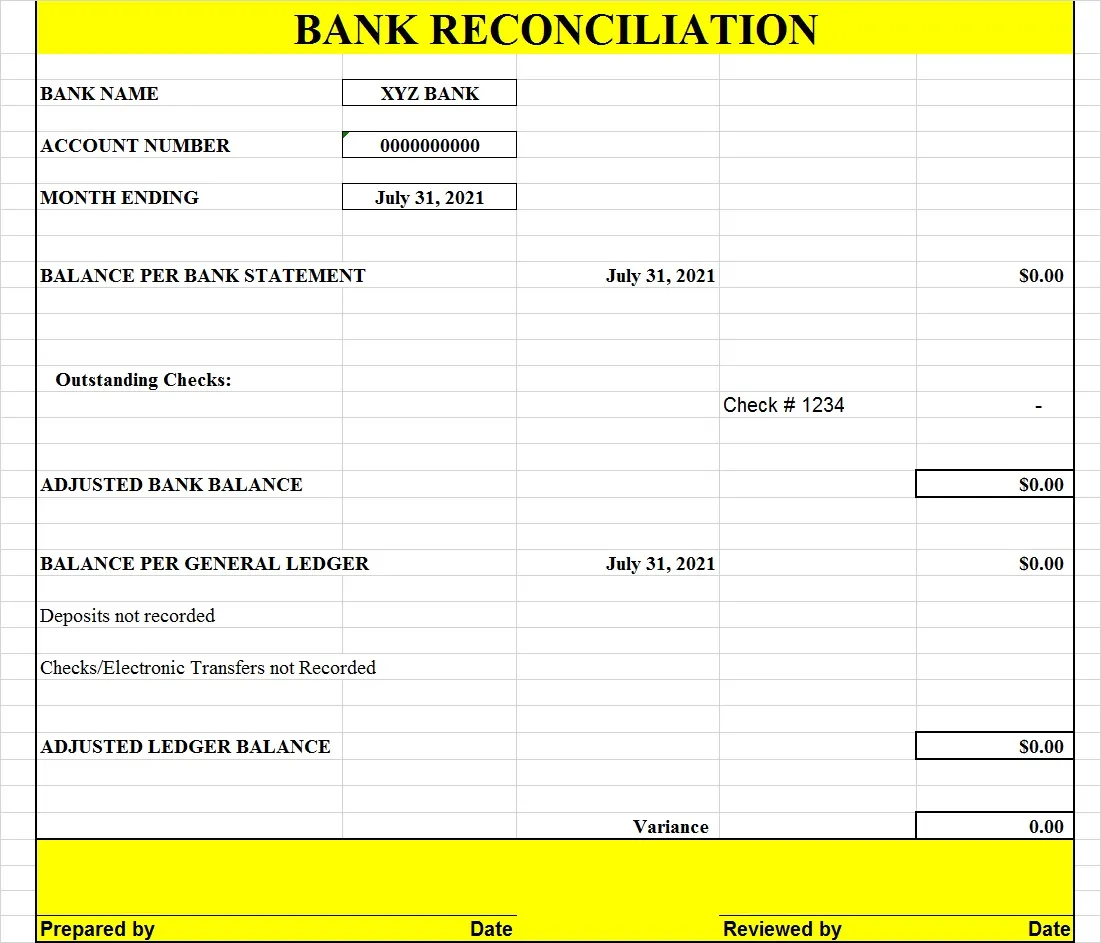

Bank Reconciliation Template – EXCEL