Managing finances can be daunting, especially when planning for the future. An annual budget serves as a financial plan that projects income and expenses for a year, enabling effective resource management, financial control, and goal achievement.

It provides a framework for making informed financial decisions, monitoring progress, attracting investment, managing debt, and ensuring financial sustainability by aligning expenditures with strategic goals and allowing for adjustments for unexpected events.

What Is an Annual Budget?

An annual budget is a comprehensive financial plan that outlines projected income and expenses for a specific period, typically one year. It serves as a roadmap for allocating resources, setting financial goals, and monitoring progress towards achieving those goals.

By creating an annual budget, individuals and organizations can gain a clear understanding of their financial health, identify areas for improvement, and make informed decisions to ensure long-term financial stability.

The Importance of Creating an Annual Financial Budget

Creating an annual budget is crucial for both individuals and businesses to effectively manage their finances and achieve financial success. Some key benefits of having an annual budget include:

- Financial Control: An annual budget helps individuals and organizations track their income and expenses, enabling them to identify areas where they can cut costs and save money.

- Goal Achievement: By setting financial goals in the budget, individuals and businesses can stay focused on their objectives and work towards achieving them throughout the year.

- Resource Management: An annual budget allows for the efficient allocation of resources, ensuring that funds are allocated to priority areas and projects that align with strategic objectives.

- Monitoring Progress: Regularly reviewing the budget enables individuals and organizations to track their financial performance, identify variances, and make necessary adjustments to stay on track.

- Attracting Investment: A well-planned annual budget can attract investors and lenders by demonstrating financial stability, responsible management, and potential for growth.

- Managing Debt: By including debt repayment in the budget, individuals and organizations can create a plan to reduce debt over time and improve their financial position.

- Financial Sustainability: An annual budget ensures that expenditures are aligned with strategic goals and allows for adjustments to be made for unexpected events, ensuring long-term financial sustainability.

Common Budgeting Mistakes to Avoid

While budgeting is a valuable tool for financial planning, there are common mistakes that individuals and businesses should avoid to ensure the effectiveness of their annual budget. Some common budgeting mistakes include:

- Not Tracking Expenses: Failing to track expenses regularly can lead to overspending and budget deviations.

- Underestimating Costs: Underestimating expenses can result in financial strain and difficulties in meeting financial obligations.

- Ignoring Emergency Fund: Not setting aside funds for emergencies can leave individuals vulnerable to unexpected expenses.

- Overestimating Income: Relying on inflated income projections can lead to financial insecurity and budget shortfalls.

- Not Reviewing Budget: Failing to review the budget regularly can result in missed opportunities for adjustment and improvement.

Tips for Successful Budgeting

To ensure successful budgeting and financial management, consider the following tips:

- Be Realistic: Set achievable financial goals and allocate resources accordingly in the budget.

- Track Spending: Monitor your expenses regularly to stay on top of your budget and identify areas where you can cut costs.

- Automate Savings: Set up automatic transfers to your savings account to ensure consistent savings contributions.

- Review Regularly: Review your budget on a monthly or quarterly basis to assess progress, make adjustments, and stay on track.

- Use Budgeting Tools: Utilize budgeting apps or software to streamline the budgeting process and track your financial progress.

- Seek Professional Help: If you’re struggling with budgeting, consider seeking assistance from a financial advisor or consultant to help you create a personalized budget plan.

When is the Best Time to Build Your Annual Budget?

The best time to build an annual budget is typically before the start of the new fiscal year. For individuals, this could mean creating a budget at the beginning of the calendar year or aligning it with the start of a new job or financial milestone. For businesses, the budgeting process often starts well in advance of the new fiscal year to allow for thorough planning and alignment with strategic goals.

How to Set a Budget

1. Assess Your Financial Situation

Begin by assessing your current financial situation, including income, expenses, assets, liabilities, and financial goals. Understanding where you stand financially will help you set realistic budgeting goals.

2. Define Your Financial Goals

Identify your short-term and long-term financial goals, such as saving for a vacation, buying a home, paying off debt, or investing for retirement. Setting clear goals will give your budget a sense of purpose and direction.

3. Track Your Income and Expenses

Track all sources of income and categorize your expenses to understand where your money is going. This will help you identify areas where you can cut costs and save money.

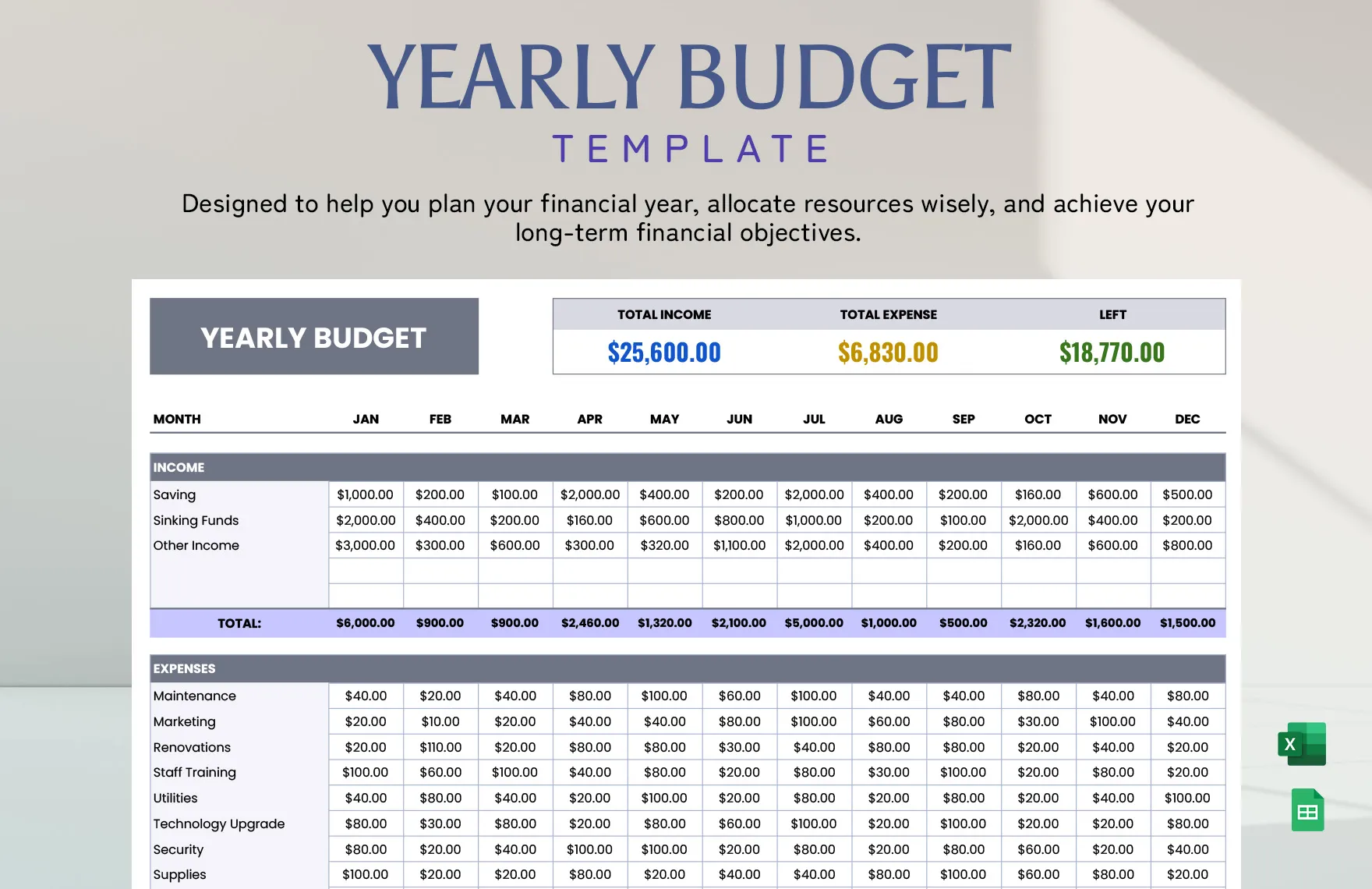

4. Create a Budget Template

Use a budget template or spreadsheet to organize your income, expenses, savings, and investments. This will help you visualize your financial plan and track your progress over time.

5. Allocate Funds to Expense Categories

Distribute your income among different expense categories such as housing, transportation, groceries, utilities, entertainment, savings, and debt repayment. Ensure that you prioritize essential expenses and allocate funds accordingly.

6. Set Aside Funds for Savings and Investments

Allocate a portion of your budget to savings and investments to build wealth, secure your financial future, and achieve your long-term financial goals. Consider automating transfers to make saving easier.

7. Include a Contingency Fund

Set aside funds for emergencies or unexpected expenses in a contingency fund to avoid dipping into savings or accumulating debt. Having a financial safety net will provide peace of mind and financial security.

8. Monitor Your Budget Regularly

Review your budget regularly, such as monthly or quarterly, to track your spending, assess progress towards your goals, and make adjustments as needed. Monitoring your budget will help you stay on track and make informed financial decisions.

9. Seek Professional Advice if Needed

If you’re struggling with budgeting or need help creating a comprehensive financial plan, consider seeking advice from a financial advisor or consultant. A professional can provide guidance, expertise, and personalized recommendations to help you achieve your financial goals.

10. Adjust Your Budget as Needed

Be flexible with your budget and be willing to make adjustments as needed. Life circumstances, financial goals, and priorities may change, so it’s important to adapt your budget accordingly to stay on track and achieve financial success.

Annual Budget Template – DOWNLOAD