When borrowing money, a loan contract agreement plays a crucial role in outlining the terms and conditions of the loan. This legal document serves as a binding agreement between the lender and borrower, detailing the amount of money borrowed, the interest rate, the repayment schedule, and any other relevant terms.

Understanding the ins and outs of a loan contract agreement can help both parties navigate the borrowing process smoothly.

What Is A Loan Contract Agreement?

A loan contract agreement, also known as a loan contract, is a formal written document that establishes the terms and conditions of a loan between a lender and a borrower. This agreement outlines the rights and responsibilities of each party, including the amount of money borrowed, the interest rate, the repayment schedule, and any collateral or guarantees required.

By signing a loan agreement contract, both the lender and borrower are legally bound to adhere to the terms outlined in the agreement.

Why Is It Important?

A loan agreement contract is important for several reasons.

Protecting the Lender

For lenders, a loan agreement is essential for protecting their financial interests. By clearly outlining the terms of the loan, including the repayment schedule and interest rate, the lender can ensure that they will be repaid in a timely manner. Additionally, a loan agreement contract can provide recourse for the lender if the borrower defaults on the loan, allowing them to take legal action to recover the funds owed.

Protecting the Borrower

For borrowers, a loan agreement can provide peace of mind by clearly outlining their obligations under the loan. By understanding the terms of the loan upfront, borrowers can avoid any surprises or misunderstandings later on. Additionally, a loan agreement contract can protect borrowers from unscrupulous lenders who may try to change the terms of the loan after it has been agreed upon.

Legal Recourse

One of the key benefits of a loan agreement contract is that it provides legal recourse for both parties in the event of a dispute. If either the lender or borrower fails to uphold their end of the agreement, the other party can take legal action to enforce the terms of the contract. This can provide a sense of security for both parties, knowing that they have legal options available to them if needed.

Preventing Disputes

By clearly outlining the terms of the loan in a written agreement, a loan agreement contract can help prevent disputes between the lender and borrower. Both parties can refer back to the contract to resolve any disagreements or misunderstandings that may arise during the course of the loan. This can help maintain a positive relationship between the lender and borrower and ensure that the loan process goes smoothly.

Difference Between A Loan Agreement And A Mortgage

While both a loan agreement and a mortgage involve borrowing money, there are some key differences between the two. A loan agreement is a broader term that refers to any agreement between a lender and borrower for the borrowing of money.

On the other hand, a mortgage specifically refers to a loan agreement in which the borrower uses a specific property as collateral for the loan. In a mortgage agreement, the lender has the right to seize the property if the borrower fails to repay the loan.

The Role Of The Lender And Borrower

In a loan contract agreement, the lender is the individual or institution that is providing the funds to the borrower. The lender’s primary role is to assess the borrower’s creditworthiness, determine the terms of the loan, and disburse the funds.

The borrower, on the other hand, is the individual or entity that is receiving the loan. The borrower’s main responsibility is to repay the loan according to the terms outlined in the agreement.

When Is A Loan Agreement Legally Effective?

A loan agreement becomes legally effective once both parties have signed the document. In order for a loan agreement to be legally binding, it must meet certain legal requirements, such as being in writing, signed by both parties, and containing all the essential terms of the loan.

Once these requirements are met, the loan agreement is considered legally effective and enforceable in a court of law.

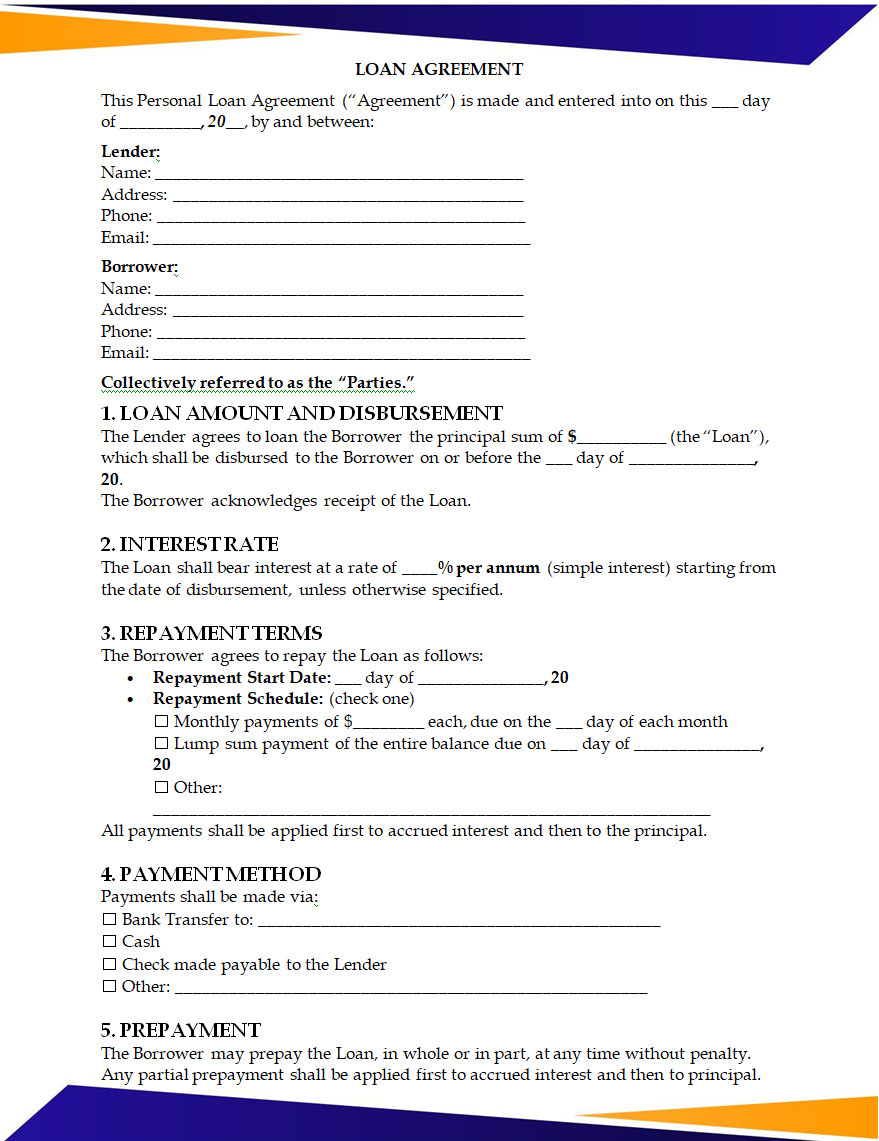

How To Write A Personal Loan Agreement

Writing a personal loan agreement may seem like a daunting task, but it doesn’t have to be complicated. Here are some key steps to follow when drafting a personal loan agreement:

Identify the Parties

When writing a personal loan agreement, it is important to clearly identify the parties involved in the agreement. This includes the lender and borrower, as well as any other relevant parties, such as cosigners or guarantors. By clearly identifying the parties, you can avoid any confusion or misunderstandings about who is responsible for the loan.

Outline the Terms

The next step in writing a personal loan agreement is to outline the terms of the loan. This includes detailing the loan amount, interest rate, repayment schedule, and any other relevant terms. Be sure to include any specific conditions or requirements that must be met by the borrower in order to fulfill the terms of the agreement.

Include Any Collateral

If the personal loan is secured by collateral, such as a vehicle or property, be sure to include details about the collateral in the agreement. This may include a description of the collateral, its estimated value, and any conditions for using it as security for the loan. By including collateral information, you can protect the lender’s interests in case the borrower defaults on the loan.

Include Provisions for Default

It is important to include provisions in the personal loan agreement that outline what will happen if the borrower defaults on the loan. This may include details about late payment penalties, repossession of collateral, or legal action that may be taken to recover the funds owed. By including default provisions, both parties can understand the consequences of failing to repay the loan.

Sign and Date the Agreement

Once the personal loan agreement has been drafted, both parties should sign and date the document to indicate their acceptance of the terms. Both the lender and borrower need to have a signed copy of the agreement for their records. By signing and dating the agreement, both parties acknowledge their agreement to be bound by the terms of the loan.

Loan Contract Agreement Template

Loan Contract Agreement Template – WORD