As technology continues to advance, the way we receive our wages has also evolved. Gone are the days of paper checks being handed out to employees on payday. In today’s digital age, many employers now offer direct deposit as a convenient and secure way for employees to receive their wages.

However, in order to set up direct deposit, employees must first fill out an employee direct deposit form. This form is a crucial step in the process, as it formally gives the employer permission and banking details to electronically transfer the employee’s wages directly into their bank account.

What is an Employee Direct Deposit Form?

An employee direct deposit form is a document that allows an employee to provide their employer with the necessary information to set up electronic payroll. This form includes the employee’s banking information, such as their account number and routing number, which is needed to transfer wages directly into their bank account.

By completing this form, employees are giving their employer permission to deposit their wages electronically, eliminating the need for paper checks.

Why is an Employee Direct Deposit Form Important?

Employee direct deposit forms are important for several reasons.

Ensuring Timely Payments

By filling out an employee direct deposit form, employees help ensure that they receive their wages on time. With direct deposit, funds are typically deposited into the employee’s bank account on payday, eliminating the need to wait for a paper check to clear. This timely payment is essential for employees to meet their financial obligations.

Eliminating the Risk of Lost or Stolen Checks

One of the major advantages of direct deposit is the elimination of the risk of lost or stolen paper checks. When wages are deposited directly into an employee’s bank account, there is no physical check that can be misplaced or stolen. This provides added security and peace of mind for employees.

Improving Payment Accuracy

Direct deposit also improves payment accuracy for employees. By providing their bank account and routing numbers on the direct deposit form, employees ensure that their wages are deposited directly into the correct account. This reduces the likelihood of errors that can occur with paper checks, such as incorrect amounts or missing payments.

Enhancing Employee Satisfaction

Offering direct deposit as a payment option and making it easy for employees to fill out direct deposit forms can enhance employee satisfaction. Employees appreciate the convenience and security of direct deposit, which can lead to higher levels of job satisfaction and loyalty to the employer.

Supporting Remote Workforce

With many employees now working remotely or in different locations, direct deposit offers a practical solution for paying employees regardless of their physical location. By having employees fill out direct deposit forms, employers can ensure that wages are deposited electronically, regardless of where the employee is working from.

Promoting Financial Inclusion

Direct deposit forms can also promote financial inclusion by providing all employees with access to electronic wage payments. For employees who may not have easy access to a bank or who prefer not to use paper checks, direct deposit offers a more inclusive payment option that meets the needs of a diverse workforce.

Encouraging Paperless Processes

Employee direct deposit forms are part of a larger trend towards paperless processes in the workplace. By moving away from paper checks and opting for electronic wage payments, businesses can reduce their paper usage and streamline their payroll processes. This environmentally friendly approach aligns with many companies’ sustainability goals.

Ensuring Compliance with Payroll Laws

Direct deposit forms also play a role in ensuring compliance with payroll laws and regulations. By having employees fill out the necessary forms, employers can document that proper authorization was given for electronic wage payments. This documentation is important in case of any disputes or audits related to wage payments.

Enhancing Employee Trust

By offering direct deposit as a payment option and ensuring that employees fill out direct deposit forms, employers can enhance trust with their workforce. Direct deposit is seen as a secure and efficient way to receive wages, demonstrating to employees that their employer values their financial well-being and is committed to their satisfaction.

Fostering Financial Responsibility

Direct deposit forms can also help foster financial responsibility among employees. By requiring employees to provide their banking information and understand how direct deposit works, employers can encourage good financial habits, such as regularly checking bank statements and monitoring wage payments.

Promoting Transparency in Wage Payments

Employee direct deposit forms promote transparency in wage payments by clearly documenting the process of electronic wage transfers. By having employees fill out direct deposit forms, employers can ensure that all parties are aware of how wages will be paid and can address any questions or concerns related to the payment process.

Adapting to Digital Trends

As more businesses embrace digital solutions, including electronic wage payments, direct deposit forms help employers adapt to digital trends in the workplace. By having employees fill out direct deposit forms, employers demonstrate their commitment to modern payment methods and technology-driven processes.

Supporting Employee Well-Being

Offering direct deposit as a payment option and having employees fill out direct deposit forms supports employee well-being by providing a secure and convenient way to receive wages. Employees can have peace of mind knowing that their wages will be deposited directly into their bank account, eliminating the need to physically handle paper checks.

Improving Payroll Efficiency

Direct deposit forms contribute to improved payroll efficiency by streamlining the process of paying employees. By receiving electronic payroll information through direct deposit forms, employers can process payroll more efficiently and accurately, reducing the administrative burden on payroll departments and ensuring that employees are paid on time.

Key Elements of an Employee Direct Deposit Form

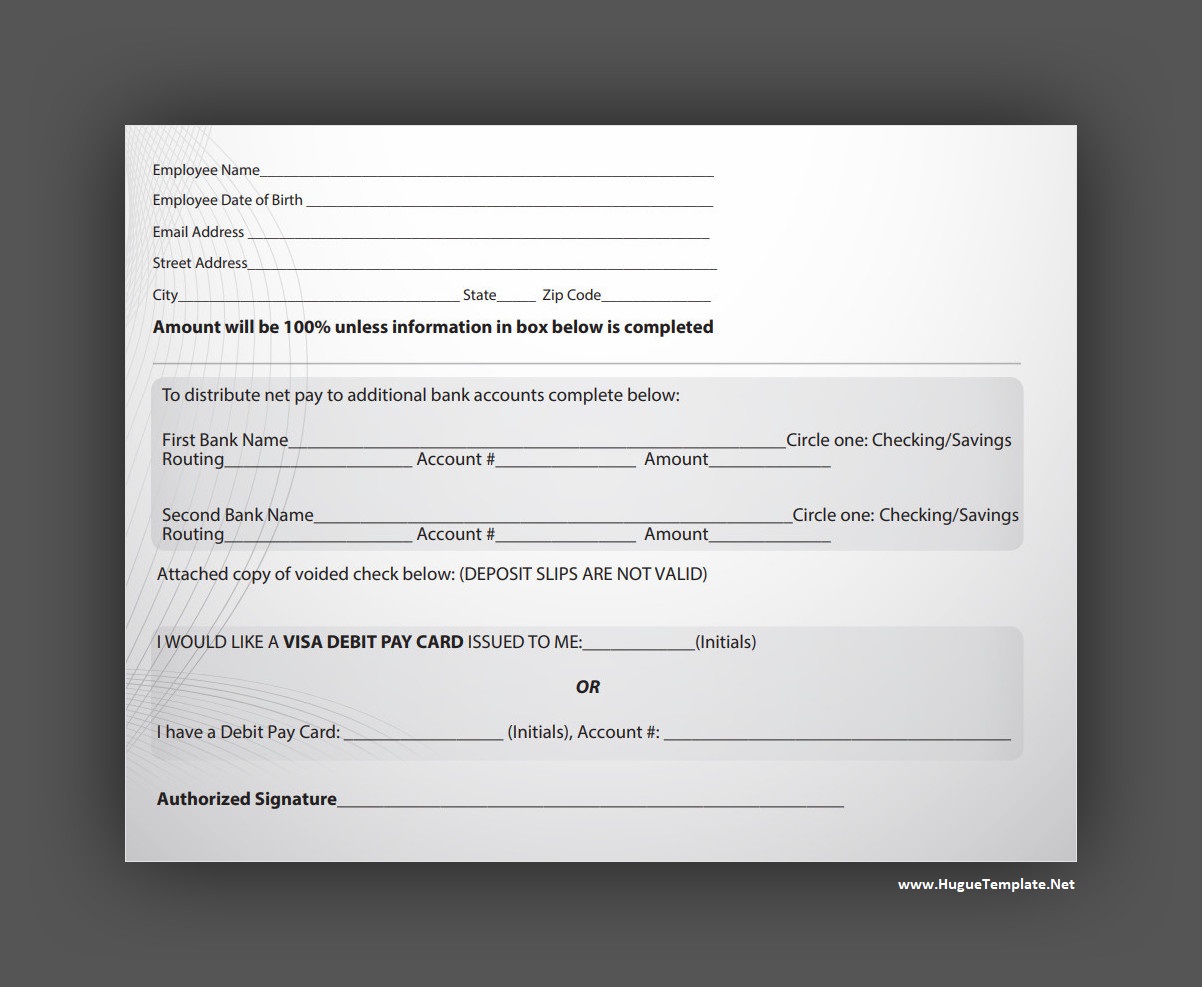

When filling out an employee direct deposit form, there are several key elements that employees should be aware of

- Bank Information: Employees will need to provide their bank’s name, account number, and routing number on the form. This information is crucial for ensuring that wages are deposited into the correct account.

- Authorization: By signing the form, employees are authorizing their employer to deposit their wages directly into their bank account. This authorization is a legal requirement to initiate electronic wage payments.

- Employee Information: The form will typically require employees to provide their name, address, and contact information. This information helps employers verify the identity of the employee and ensure that the wages are being deposited to the correct individual.

- Employer Information: Employees may need to include their employer’s name, address, and contact information on the form. This information is necessary for payroll processing and ensures that the funds are being transferred from the correct employer.

How to Fill Out an Employee Direct Deposit Form

Filling out an employee direct deposit form is a straightforward process, but it is important to do so accurately to avoid any issues with receiving wages. Here is a step-by-step guide on how to fill out the form:

Obtain the Form

Employees can typically obtain the employee direct deposit form from their employer’s HR department or payroll office. The form may be provided in paper or electronic format, depending on the employer’s preferences. It is important to use the official form provided by the employer to ensure that all necessary information is captured.

Provide Bank Information

Fill in your bank’s name, account number, and routing number on the form. This information is essential for ensuring that your wages are deposited directly into your bank account. Double-check the numbers you provide to avoid any errors that could delay or disrupt the payment process.

Complete Employee Information

Include your name, address, and contact information on the form. This information helps verify your identity and ensures that the wages are being deposited to the correct individual. Providing accurate employee information is crucial for seamless wage payments.

Sign and Date

Sign and date the form to authorize your employer to deposit your wages electronically. Your signature confirms that you consent to electronic wage payments and understand the terms of direct deposit. Dating the form ensures that the authorization is current and valid for processing.

Review and Confirm

Before submitting the employee direct deposit form, review all the information you have provided to ensure its accuracy. Double-check your bank information, employee details, and signature to avoid any mistakes that could impact your wage payments. Confirm that all required fields are filled out correctly before submitting the form to your employer.

Tips for Setting Up Direct Deposit

When setting up direct deposit, there are a few tips that employees should keep in mind to ensure a smooth process:

Double-Check Information

Make sure all the information provided on the form is accurate to avoid any delays in receiving your wages. Verify your bank’s name, account number, and routing number before submitting the form to ensure that funds are deposited into the correct account.

Inform Your Bank

Let your bank know that you will be receiving direct deposits to ensure they are processed correctly. Provide your bank with any specific instructions or information related to electronic wage payments to prevent any issues with receiving your funds.

Keep a Copy

Make a copy of the completed form for your records in case there are any discrepancies in the future. Retaining a copy of the employee direct deposit form can help you reference the information provided and address any questions or concerns related to your wage payments.

Update Information Promptly

If there are any changes to your bank account or personal information, notify your employer promptly to update the direct deposit form. Keeping your information up to date ensures that your wages are deposited correctly and prevents any disruptions in payment processing.

Monitor Your Deposits

Regularly monitor your bank account to confirm that your wages are being deposited correctly through direct deposit. Check your account statements and transaction history to verify the amount and timing of your wage payments and address any discrepancies promptly with your employer or bank.

Seek Assistance if Needed

If you encounter any issues or have questions about setting up direct deposit, don’t hesitate to seek assistance from your employer’s HR department or payroll office. They can provide guidance on completing the employee direct deposit form and address any concerns you may have about electronic wage payments.

Stay Informed About Direct Deposit

Stay informed about the benefits and processes of direct deposit to make the most of this convenient payment method. Educate yourself on how direct deposit works, its security features, and any updates or changes to the process to ensure a smooth and efficient payment experience.

Review Security Measures

Take the time to review the security measures in place for direct deposit to protect your personal and financial information. Verify that your employer has secure processes for handling direct deposit forms and transmitting electronic wage payments to safeguard your sensitive data.

Keep Records Secure

Store your copies of the employee direct deposit form and any related documentation securely to protect your personal and banking information. Keep physical copies in a safe place and store electronic copies on a secure device or cloud storage with restricted access.

Report Any Issues Promptly

If you notice any discrepancies or unauthorized transactions related to your direct deposit, report them to your employer and bank immediately. Promptly addressing any issues or concerns helps protect your financial interests and ensures the security of your electronic wage payments.

Employee Direct Deposit Form – Download