Direct deposit is a convenient and efficient way for employees to receive their salary directly into their bank account without the need for physical checks. To set up direct deposit, employers typically require employees to fill out a direct deposit authorization form.

This form provides the necessary information for the employer to initiate direct deposits into the employee’s bank account.

In this comprehensive guide, we will delve into the details of direct deposit authorization forms, why they are important, what to include in the form, how to fill it out, and tips for successful submission.

What is a Direct Deposit Authorization Form?

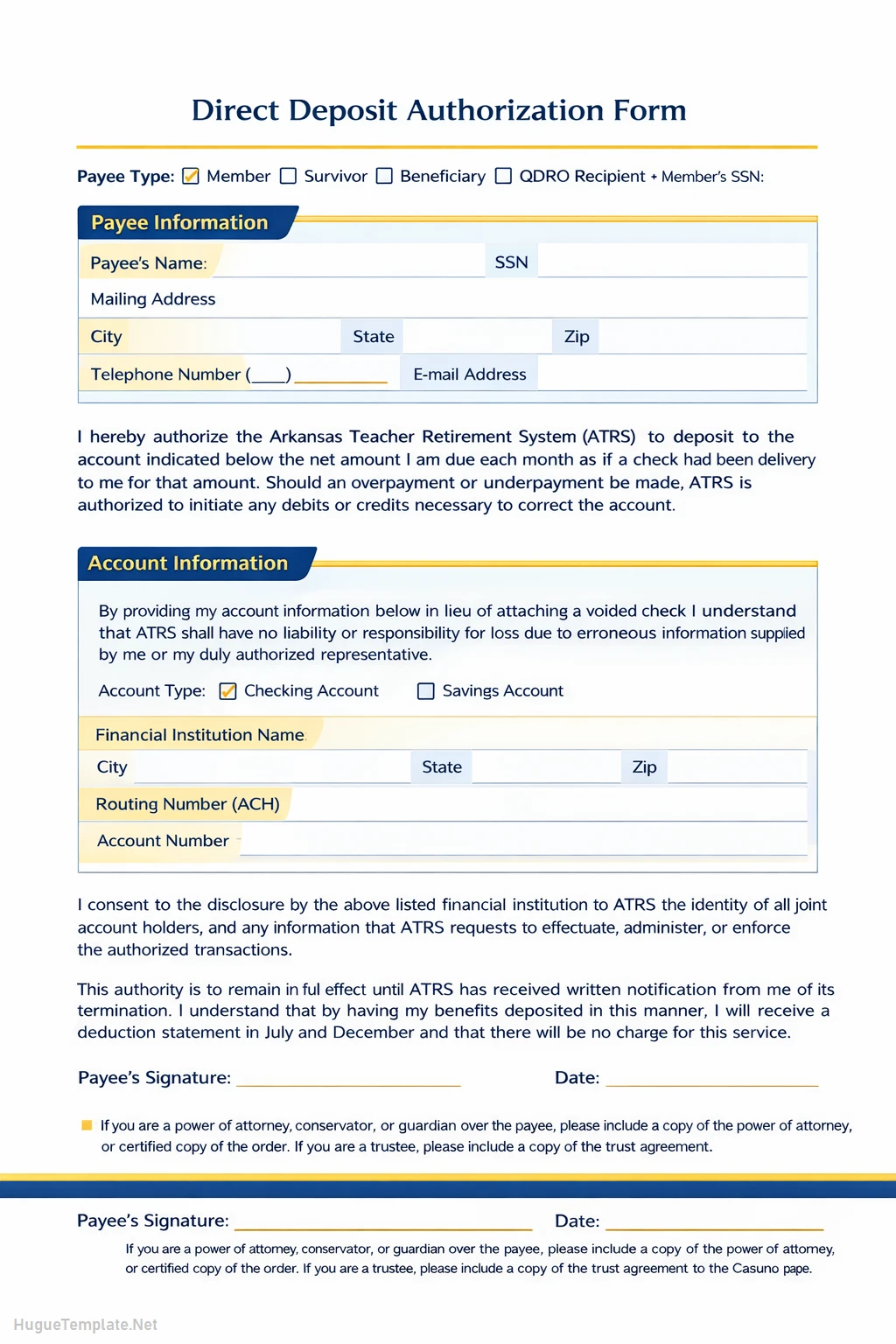

A direct deposit authorization form is a document that allows an employer to process salary payments directly into an employee’s bank account. The form includes essential information such as the employee’s name, bank account number, routing number, and authorization signature.

By completing this form, employees authorize their employer to deposit their salary into the designated bank account on payday.

Why is a Direct Deposit Authorization Form Important?

Direct deposit authorization forms play a crucial role in streamlining the payroll process for both employers and employees. By opting for direct deposit, employees eliminate the hassle of manually depositing physical checks and waiting for funds to clear.

Employers benefit from reduced administrative costs and increased efficiency in managing payroll. Additionally, direct deposit offers a secure and reliable method of receiving salary payments, reducing the risk of lost or stolen checks.

What to Include in a Direct Deposit Authorization Form

When filling out a direct deposit authorization form, it is essential to provide accurate and detailed information to ensure seamless processing of salary payments. Here are the key elements to include in the form:

- Employee Information: Full name, employee ID, and contact details.

- Bank Account Details: Account number, routing number, and type of account (checking or savings).

- Authorization Signature: Employee’s signature to authorize direct deposit.

- Voided Check: Some employers may require a voided check to verify the bank account information.

How to Fill Out a Direct Deposit Authorization Form

Completing a direct deposit authorization form is a straightforward process that typically requires the following steps:

- Obtain the Form: Request the direct deposit authorization form from your employer or human resources department.

- Provide Information: Fill in your personal details, bank account information, and authorization signature.

- Attach Voided Check: If required, attach a voided check to verify your bank account details.

- Submit the Form: Return the completed form to your employer as per their instructions.

Tips for Successful Direct Deposit Authorization

To ensure a seamless transition to direct deposit, consider the following tips for successful submission of the authorization form:

- Double-Check Information: Verify that all details provided are accurate and up-to-date.

- Follow Instructions: Adhere to any specific guidelines or requirements outlined by your employer.

- Keep a Copy: Retain a copy of the completed form for your records.

- Monitor Deposits: Confirm that direct deposits are being made correctly and promptly into your bank account.

Conclusion

Direct deposit authorization forms are essential documents that facilitate the seamless transfer of salary payments from employers to employees. By understanding the purpose of these forms, what to include, how to fill them out, and tips for successful submission, individuals can effectively manage their finances and streamline the payroll process. Embracing the convenience and security of direct deposit can lead to enhanced financial management and peace of mind for both employers and employees.

Direct Deposit Authorization Form Template – DOWNLOAD