Are you a business owner looking to securely collect payment information from your customers? Or perhaps you are a customer who wants to ensure that your credit card details are safe when making a purchase.

In either case, understanding the importance of a credit card authorization form is crucial. This comprehensive guide will walk you through everything you need to know about credit card authorization forms.

What is a Credit Card Authorization Form?

A credit card authorization form is a document that allows a merchant to charge a customer’s credit card for a specified amount. It serves as a written agreement between the merchant and the customer, authorizing the merchant to process the payment using the credit card information provided. This form is essential for businesses that need to collect payments in a secure and efficient manner.

When a customer fills out a credit card authorization form, they are providing the merchant with the necessary information to process a payment. This typically includes the customer’s name, credit card number, expiration date, billing address, and the amount to be charged. By signing the form, the customer gives consent for the merchant to charge their credit card for the specified amount.

Why is a Credit Card Authorization Form Important?

A credit card authorization form is essential for both businesses and customers for several reasons:

- Security: By using a credit card authorization form, businesses can securely collect payment information without the need for customers to provide their credit card details over the phone or via email.

- Legal Protection: The form serves as a legally binding agreement between the merchant and the customer, protecting both parties in case of any disputes or chargebacks.

- Convenience: For customers, filling out a credit card authorization form is a straightforward process that streamlines the payment process.

Overall, a credit card authorization form helps to establish trust between businesses and customers while ensuring that payments are processed securely and efficiently.

What to Include in a Credit Card Authorization Form

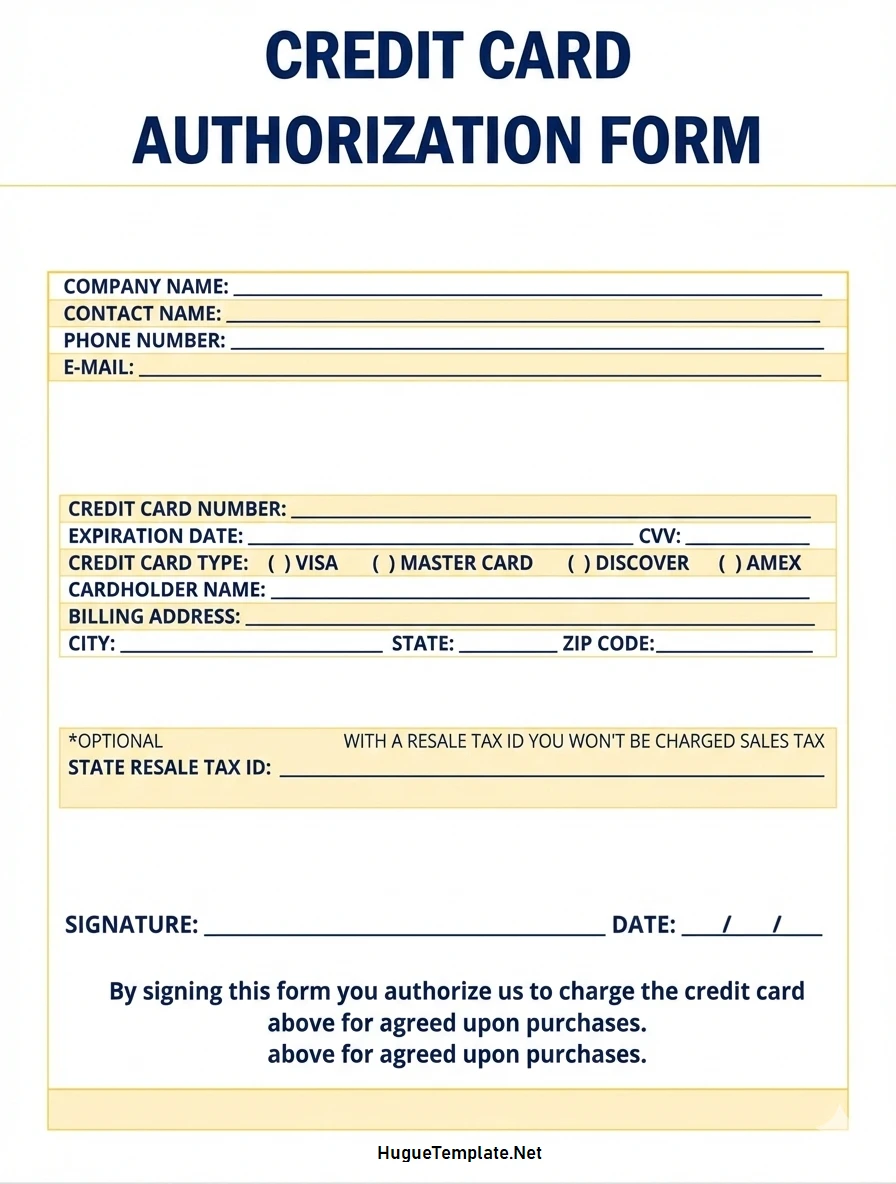

When creating a credit card authorization form, it is important to include the following key elements:

- Customer Information: Name, billing address, contact information.

- Credit Card Details: Card number, expiration date, CVV code.

- Authorization Section: Signature of the cardholder, authorization for the specified amount.

- Terms and Conditions: Details about the payment terms, refund policy, and authorization validity.

By including these components in the credit card authorization form, both the merchant and the customer can ensure that all necessary information is provided for a successful payment transaction.

How to Fill Out a Credit Card Authorization Form

Filling out a credit card authorization form is a simple process that involves the following steps:

- Customer Information: Fill out your name, billing address, and contact details.

- Credit Card Details: Enter your credit card number, expiration date, and CVV code.

- Authorization: Sign the form to authorize the merchant to charge your credit card for the specified amount.

It is important to carefully review the information entered on the form to ensure accuracy and prevent any processing errors.

Tips for Successful Credit Card Authorization

To ensure a smooth credit card authorization process, consider the following tips:

- Verify Information: Double-check all information provided on the form to avoid any mistakes.

- Keep Records: Maintain a copy of the completed form for your records and reference.

- Update Regularly: Periodically review and update your credit card authorization forms to ensure they are current and compliant with regulations.

- Secure Storage: Store credit card authorization forms in a secure location to protect customer data.

By following these tips, you can ensure that the credit card authorization process is efficient, secure, and compliant with industry standards.

Conclusion

In conclusion, a credit card authorization form is a crucial tool for businesses to securely collect payment information from customers. By understanding the importance of this form, both businesses and customers can ensure that payments are processed efficiently and securely.

Whether you are a business owner or a customer, knowing how to use and fill out a credit card authorization form is essential for a seamless payment experience. Remember to include all necessary information, carefully review the form, and follow best practices for successful credit card authorization.

Credit Card Authorization Form Template – DOWNLOAD