As a business owner, keeping track of expenses is crucial for the success of your company. Business expenses serve as a tool to meticulously track, categorize, and analyze a company’s expenditures. By centralizing expense data, businesses can gain a clearer understanding of their financial health, identify areas of overspending, and improve overall cash flow management.

In this article, we will delve into the benefits of tracking business expenses and provide tips on how to create and maintain an efficient business expenses spreadsheet.

What is a Business Expense?

A business expense encompasses any cost incurred by a business in the course of operating and generating revenue. These expenses can vary widely, including rent, utilities, employee salaries, marketing costs, office supplies, and more.

By tracking and categorizing these expenses, businesses can gain insight into their financial health and make informed decisions to improve profitability and sustainability.

How to Create a Business Expenses Spreadsheet

Creating a business expenses spreadsheet is a straightforward process that involves setting up a template, categorizing expenses, and updating the spreadsheet regularly. With the right tools and organization, businesses can streamline expense tracking and improve financial management.

Setting Up the Spreadsheet Template

To create a business expenses spreadsheet, start by setting up a template in a software program like Microsoft Excel or Google Sheets. Include columns for date, expense category, description, amount, and payment method. Customize the template to suit your business needs and ensure that it is easy to navigate and update.

Categorizing Expenses

Organize expenses into different categories to facilitate tracking and analysis. Common expense categories include office supplies, utilities, rent, travel, marketing, salaries, and professional services. Assign each expense to the appropriate category to maintain consistency and accuracy in your spreadsheet.

Updating Expenses Regularly

Consistent updates are essential to keeping the business expenses spreadsheet current and accurate. Make it a habit to enter expenses as they occur, preferably on a daily or weekly basis. This practice ensures that you have real-time visibility into your financial transactions and can proactively manage your cash flow.

Analyzing Expense Trends

Regularly analyze expense trends in your spreadsheet to identify patterns, anomalies, and areas for improvement. Look for recurring expenses that may be reduced or eliminated, as well as opportunities to optimize spending. By monitoring expense trends, businesses can make data-driven decisions that support financial growth and sustainability.

Integrating Expense Tracking Software

Consider using expense tracking software or apps to automate and streamline the process of recording expenses. These tools can sync with your bank accounts, credit cards, and receipts to capture expenses automatically. By integrating software, businesses can save time, reduce manual errors, and enhance the accuracy of their expense tracking.

The Best Way To Keep Track of Business Expenses

The best way to keep track of business expenses is to establish a systematic approach that prioritizes accuracy, consistency, and organization. By implementing best practices and utilizing the right tools, businesses can effectively monitor expenses and optimize financial performance.

Maintain Detailed Records

Keep detailed records of all business expenses, including receipts, invoices, and bank statements. This documentation serves as evidence for tax purposes, audits, and financial reporting. By maintaining accurate records, businesses can validate expenses, track deductions, and ensure compliance with regulatory requirements.

Implement Expense Policies

Establish clear expense policies and guidelines for employees to follow when incurring business-related expenses. This helps standardize expense reporting, prevent fraud or abuse, and maintain transparency in financial transactions. By setting expectations upfront, businesses can minimize errors, discrepancies, and misunderstandings related to expenses.

Monitor Spending Patterns

Regularly monitor spending patterns and analyze expense data to identify trends and outliers. Look for areas where costs are escalating or where efficiencies can be gained. By understanding spending patterns, businesses can proactively manage expenses, control costs, and improve overall financial performance.

Conduct Regular Expense Audits

Perform regular audits of your business expenses to ensure accuracy, compliance, and efficiency. Review expense reports, receipts, and invoices to verify the legitimacy of expenditures and identify any discrepancies. By conducting audits, businesses can detect errors, prevent fraud, and optimize expense management processes.

Utilize Technology Solutions

Leverage technology solutions such as accounting software, expense tracking apps, and cloud-based platforms to simplify expense management. These tools automate repetitive tasks, provide real-time insights into expenses, and support collaboration among team members. By embracing technology, businesses can streamline expense tracking, reduce administrative burden, and enhance financial visibility.

Seek Professional Advice

When in doubt about how to track or categorize certain expenses, seek advice from financial professionals or accountants. They can provide guidance on best practices, compliance requirements, and financial strategies that align with your business goals. By consulting experts, businesses can ensure that their expense tracking methods are accurate, reliable, and in line with industry standards.

Encourage Employee Accountability

Encourage employee accountability when it comes to business expenses by promoting transparency, communication, and responsibility. Educate employees on expense policies, provide training on proper expense reporting procedures, and incentivize adherence to guidelines. By fostering a culture of accountability, businesses can reduce errors, boost compliance, and build trust within the organization.

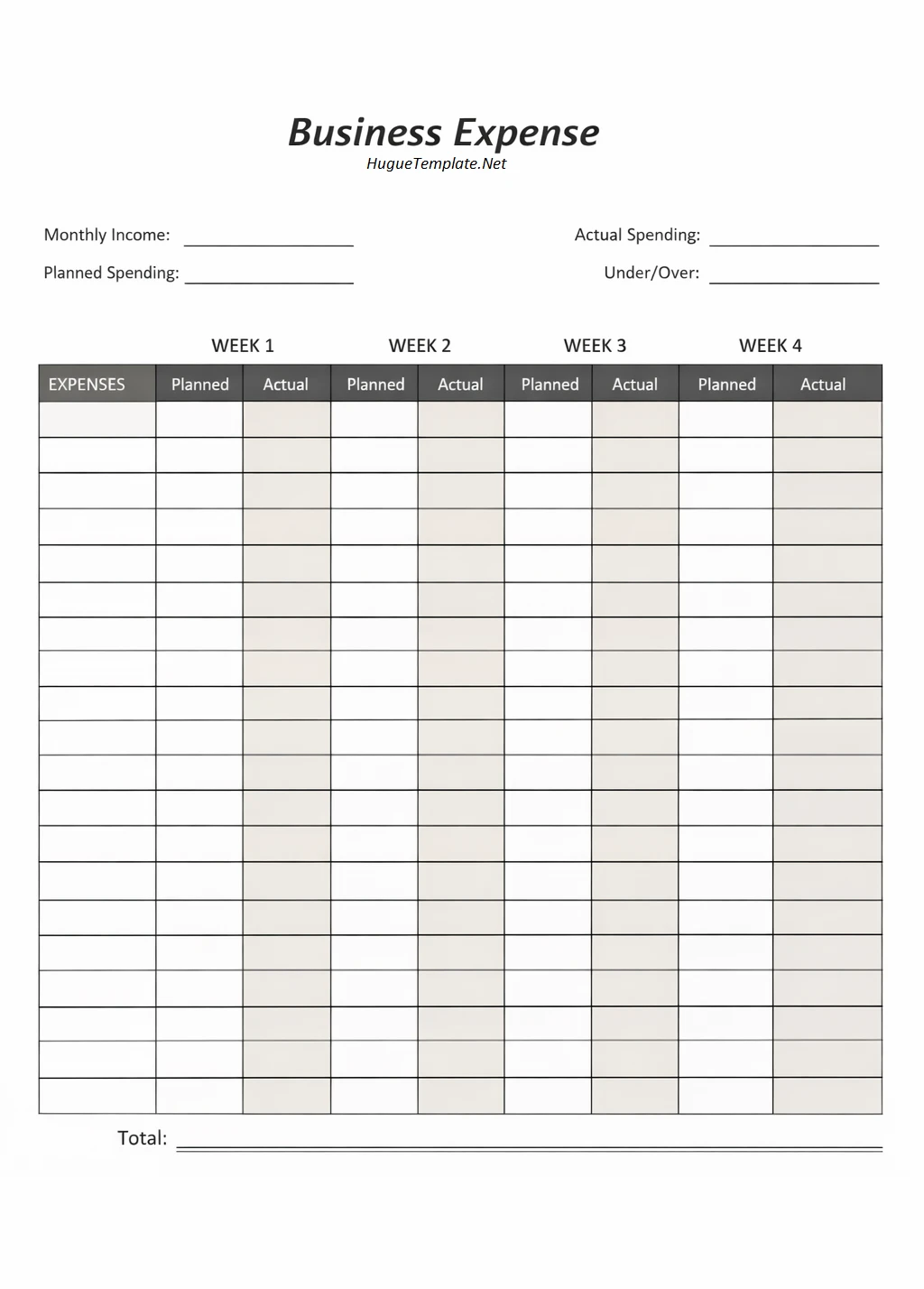

Free Business Expense Template

A Business Expense helps you track and organize company spending in a clear and professional format. It provides a structured way to record expense dates, categories, amounts, and purposes, supporting accurate accounting and financial control. With a well-designed template, you can simplify expense reporting, improve budgeting, and maintain reliable financial records.

Download our Business Expense Template today to manage business costs efficiently and stay organized with confidence.

Business Expense Template – DOWNLOAD