When embarking on a construction project, one of the most crucial elements to consider is the budget. A well-planned budget acts as a financial roadmap, guiding resource allocation, controlling costs, and ensuring profitability throughout the project. By tracking estimated versus actual spending, a budget enables informed decision-making, helps manage risks such as unexpected price surges, and ensures that all stakeholders, including clients and contractors, are aligned on financial expectations.

In this article, we will delve into the importance of building a budget for construction projects and provide valuable insights on how to create and maintain an effective budget from start to finish.

What is a Building Budget?

A building budget is a detailed financial plan that outlines the estimated costs of a construction project and allocates resources accordingly. It serves as a roadmap for controlling expenses, monitoring spending, and ensuring that the project remains financially viable.

A well-prepared budget takes into account all potential costs, including labor, materials, equipment, permits, and any other expenses associated with the project. By creating a comprehensive budget, project managers can effectively track spending, make informed decisions, and keep the project on track financially.

Why is a Building Budget Essential for Construction Projects?

A building budget is essential for construction projects for several reasons.

Role of the Budget in Project Planning

During the initial planning stages of a construction project, the budget plays a pivotal role in determining the feasibility and scope of the project. By accurately estimating costs and allocating resources based on the budget, project managers can set realistic goals and timelines for completion. The budget serves as a financial guideline that informs all aspects of project planning, from selecting materials and suppliers to hiring subcontractors and managing labor costs.

Impact of Budget on Resource Allocation

Effective resource allocation is key to the success of any construction project, and the budget plays a critical role in this process. By outlining the expected costs for labor, materials, and equipment, the budget helps project managers allocate resources efficiently and avoid overspending. Additionally, the budget enables project teams to prioritize resources based on project requirements and timelines, ensuring that essential tasks are completed within budget constraints.

Significance of the Budget in Cost Control

Cost control is a major concern for construction projects, and the budget serves as a tool for managing and monitoring expenses throughout the project lifecycle. By comparing estimated costs to actual expenditures, project managers can identify areas where costs are exceeding projections and take corrective action. Budgets also help control costs by setting spending limits and establishing protocols for approving additional expenses, ensuring that the project remains financially viable.

What to Include in a Building Budget?

When creating a building budget for a construction project, it is important to include the following elements:

Estimating Costs

Accurately estimating costs is a crucial step in creating a building budget. This involves gathering detailed quotes from suppliers, subcontractors, and other vendors to determine the expected expenses for labor, materials, equipment, permits, and other project-related costs. By conducting thorough research and obtaining multiple quotes, project managers can create a more accurate budget that reflects the true costs of the project.

Determining Profit Margin

Setting a profit margin is an essential part of building a budget for a construction project. The profit margin represents the amount of money that the project is expected to generate above and beyond the total costs. By including a profit margin in the budget, project managers can ensure that the project remains financially viable and profitable, even in the face of unexpected expenses or cost overruns.

Allocating Contingency Funds

Allocating contingency funds is another important aspect of building a budget for construction projects. Contingency funds are set aside to cover unexpected expenses, emergencies, or changes in project scope that may arise during the construction process. By including a contingency fund in the budget, project managers can mitigate risks and ensure that the project has the financial flexibility to address unforeseen challenges.

Establishing a Timeline

Establishing a timeline for expenditure is crucial when creating a building budget. By mapping out when expenses are expected to occur throughout the project lifecycle, project managers can better manage cash flow, allocate resources effectively, and ensure that funds are available when needed. A well-planned timeline helps prevent delays, ensures that expenses are incurred on time, and keeps the project on track financially.

Regular Monitoring of the Budget

Once the building budget is in place, it is essential to regularly monitor and track spending against the budget estimates. By comparing actual expenditures to budgeted amounts, project managers can identify variances, analyze the reasons behind them, and take corrective action as needed. Regular monitoring helps ensure that the project stays on budget, prevents cost overruns, and allows for timely adjustments to be made to keep the project financially viable.

How to Create and Maintain a Building Budget

Creating and maintaining a building budget for a construction project requires careful planning and monitoring. Here are some key steps to follow:

Step 1: Estimate Costs Accurately

Start by gathering detailed estimates for labor, materials, equipment, permits, and other project expenses. Be thorough in your cost projections to ensure that your budget is comprehensive and realistic. Consider factors such as market conditions, inflation rates, and potential price fluctuations when estimating costs to create a more accurate financial plan.

Step 2: Allocate Resources Wisely

Distribute resources effectively based on your budget allocations. Prioritize critical areas of spending to ensure that essential project needs are met within the allocated budget. Consider factors such as project scope, timeline, and quality requirements when allocating resources to optimize budget utilization and achieve project objectives efficiently.

Step 3: Track Spending Closely

Regularly monitor actual spending against your budget estimates to identify any discrepancies or variances. Implement a system for tracking expenses, documenting transactions, and analyzing financial data to ensure that the project stays on budget. Use software tools, spreadsheets, or budgeting apps to streamline the monitoring process and facilitate accurate financial reporting.

Step 4: Communicate with Stakeholders

Keep all project stakeholders, including clients, contractors, and team members, informed about the budget and any changes or updates. Establish clear channels of communication for sharing financial information, discussing budgetary concerns, and addressing potential risks. Encourage open dialogue, transparency, and collaboration among stakeholders to ensure alignment on financial expectations and successful budget management.

Step 5: Adjust as Needed

Be prepared to adjust your budget as the project progresses. Unexpected expenses may arise, or project requirements may change, necessitating revisions to your financial plan. Stay vigilant in monitoring financial performance, identifying potential risks, and adapting the budget as needed to address emerging challenges and opportunities. Flexibility, agility, and proactive decision-making are key to maintaining a successful building budget throughout the construction project.

Tips for Successful Budget Management

To ensure the success of your building budget for a construction project, consider the following tips:

1. Plan Ahead

Start budgeting early in the project planning phase to allow for thorough cost estimation. Consider all potential expenses, risks, and variables that may impact the budget and create a realistic financial plan that aligns with project goals and objectives.

2. Stay Organized

Keep detailed records of all expenses and transactions to track spending accurately. Maintain a systematic approach to budget management, including documenting financial data

3. Monitor Regularly

Review your budget on a regular basis to identify any deviations and address them promptly. Set up a schedule for financial reviews, conduct regular budget meetings with key stakeholders, and analyze budget reports to ensure that spending aligns with projections and goals. Monitoring your budget consistently allows you to proactively manage financial risks and make informed decisions to keep the project on track.

4. Communicate Effectively

Keep all stakeholders informed about budget updates, changes, and any financial risks or challenges. Establish clear lines of communication for sharing budget information, discussing variances, and addressing concerns. Ensure that all team members understand their role in budget management and encourage collaborative decision-making to maintain transparency and accountability throughout the project.

5. Be Flexible

Adapt to changing circumstances by adjusting your budget as needed to accommodate unforeseen expenses or changes in project scope. Stay agile in responding to evolving project requirements, market conditions, and external factors that may impact your budget. Embrace flexibility in budget management to navigate unexpected challenges effectively and keep the project financially sustainable.

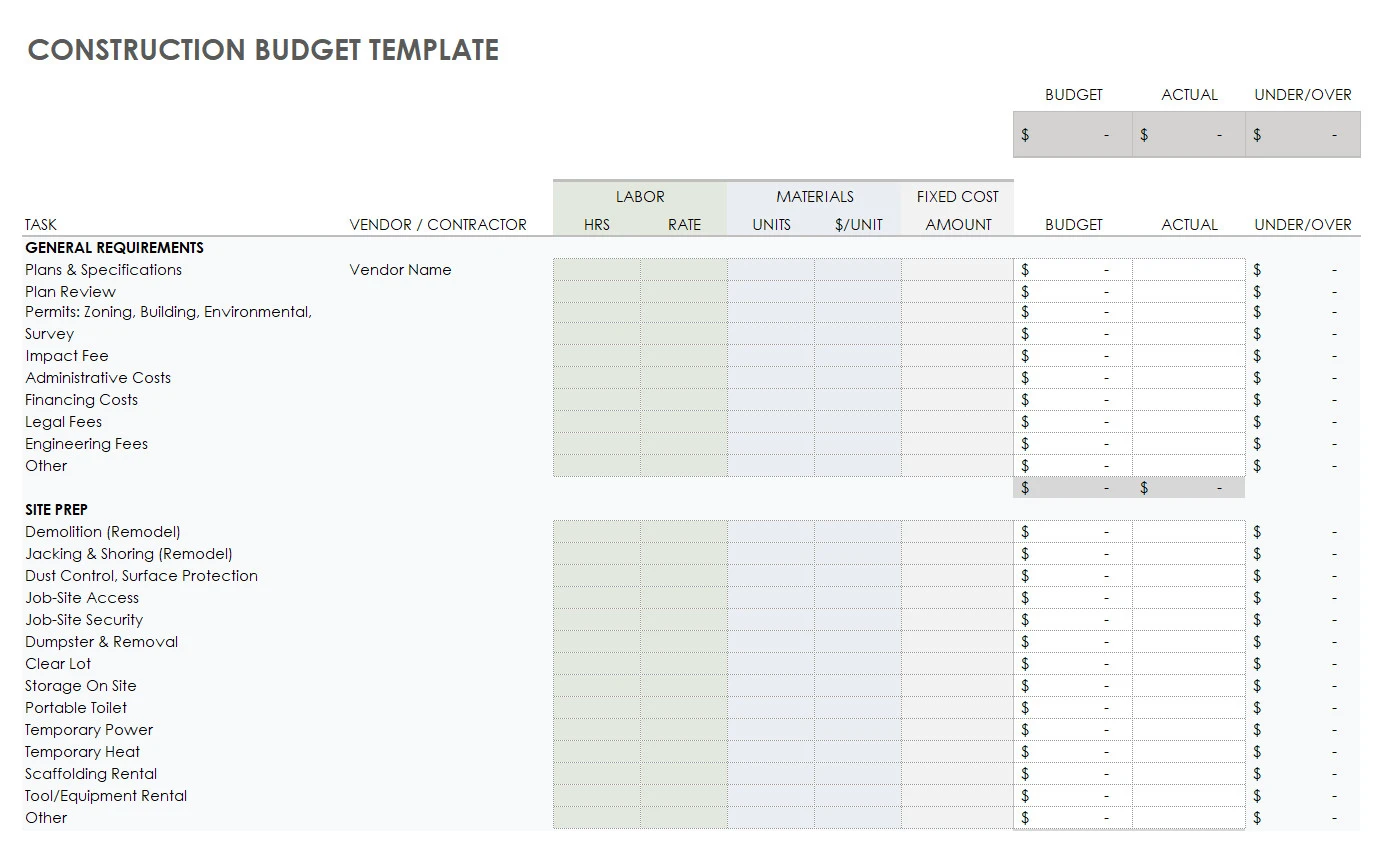

Building Budget Template – DOWNLOAD