In today’s digital age, direct deposit has become the preferred method for receiving payments. It offers convenience, security, and efficiency for both employers and employees. However, to set up direct deposit, you may need to provide your employer with a bank letter.

This article will guide you through everything you need to know about bank letters for direct deposit.

What is a Bank Letter for Direct Deposit?

A bank letter for direct deposit is a document provided by your bank that confirms your account details. This letter is necessary for setting up direct deposit with your employer or any other organization that requires your banking information. It typically includes your account number, routing number, and the name of the bank.

Setting up direct deposit requires accurate account information to ensure that funds are deposited correctly into your account. In some cases, employers may request a bank letter to verify your account details before initiating direct deposit payments.

Why You Need a Bank Letter for Direct Deposit

Having a bank letter for direct deposit is essential for a smooth and hassle-free process of setting up direct deposit. Without this document, you may encounter delays in receiving payments or risk having funds deposited into the wrong account.

Providing a bank letter ensures that your employer has the correct account information to transfer funds securely and efficiently. It also serves as a verification of your banking details, giving both parties peace of mind that payments will be processed accurately.

How to Obtain a Bank Letter for Direct Deposit

Obtaining a bank letter for direct deposit is a straightforward process. You can contact your bank either in person, over the phone, or through online banking to request the letter. Most banks have a designated department or customer service team that handles these requests.

When requesting a bank letter, be prepared to provide your account information and any specific details required by your employer. The bank will then generate the letter with the necessary information and may offer it to you in person, through email, or by mail.

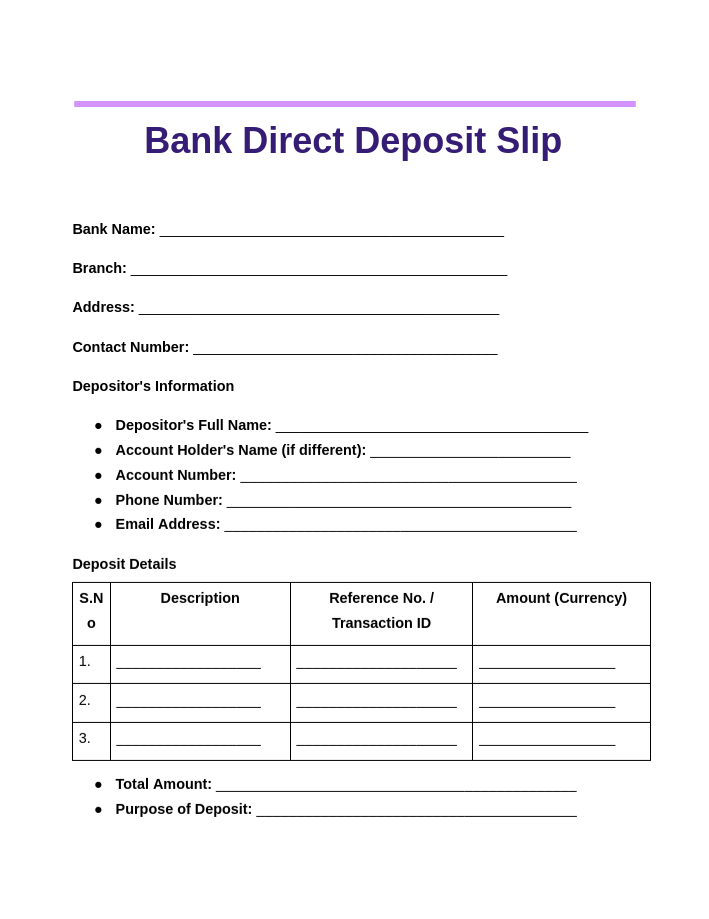

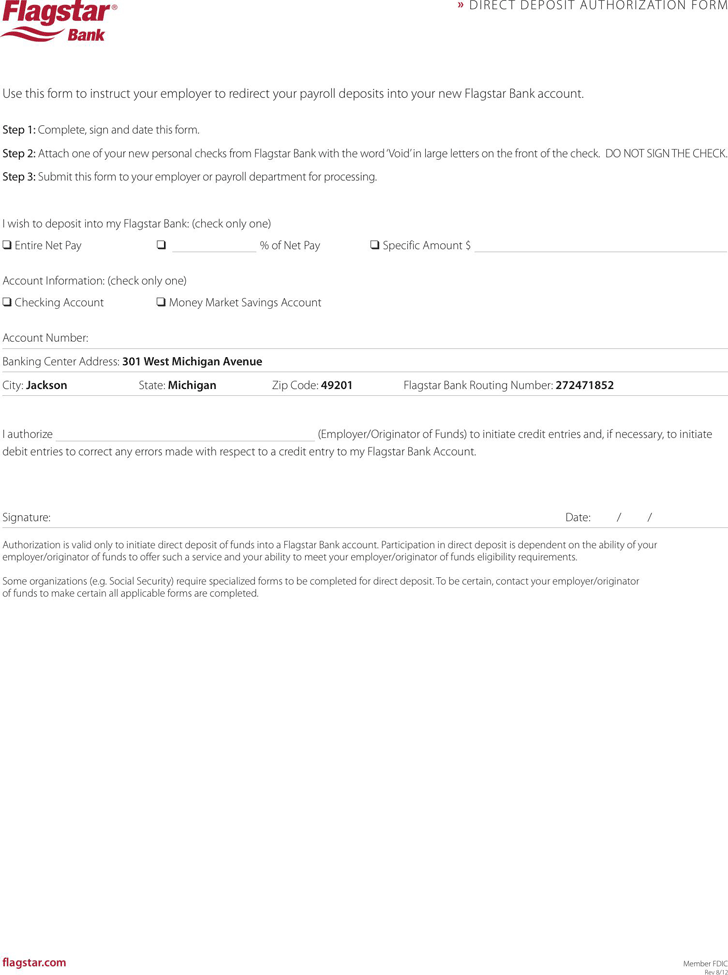

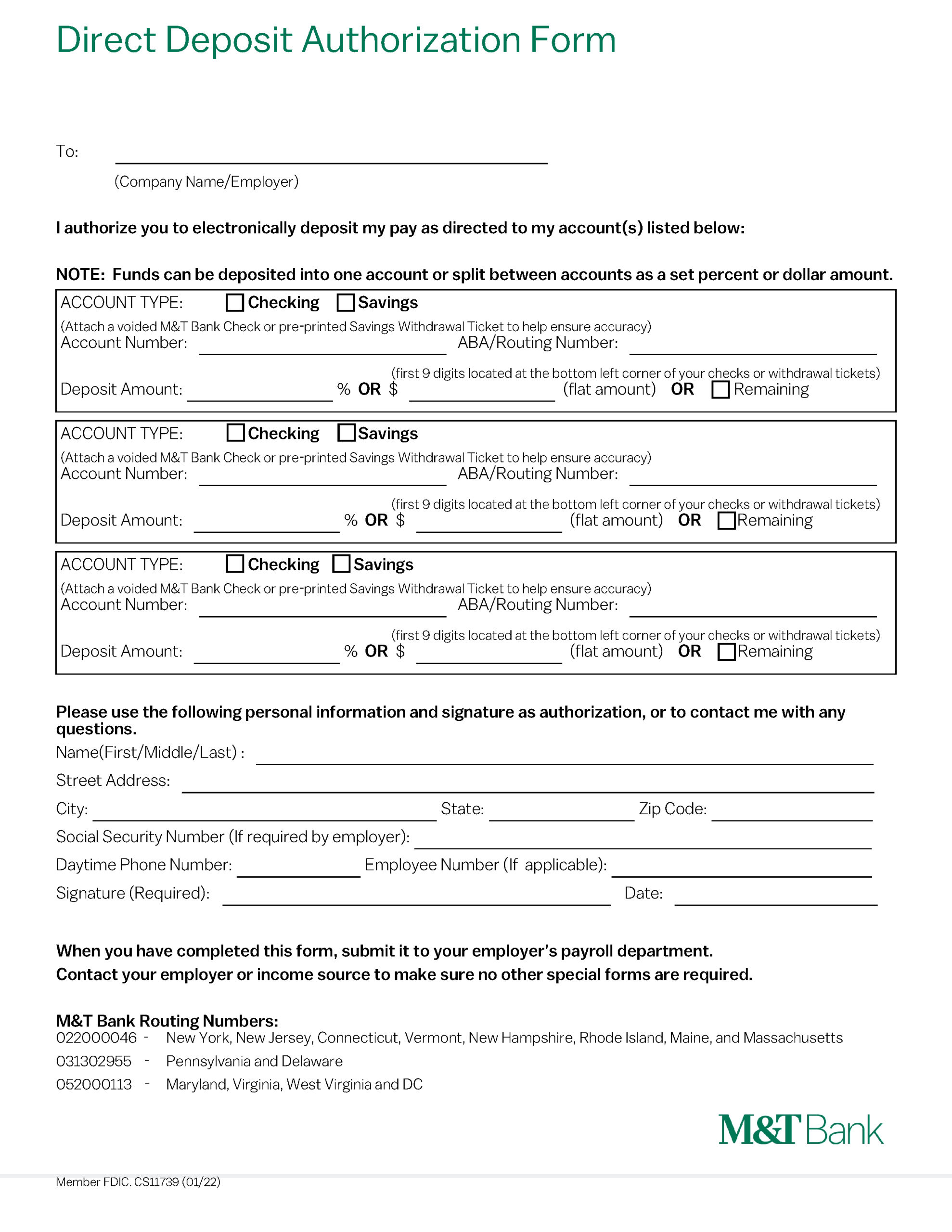

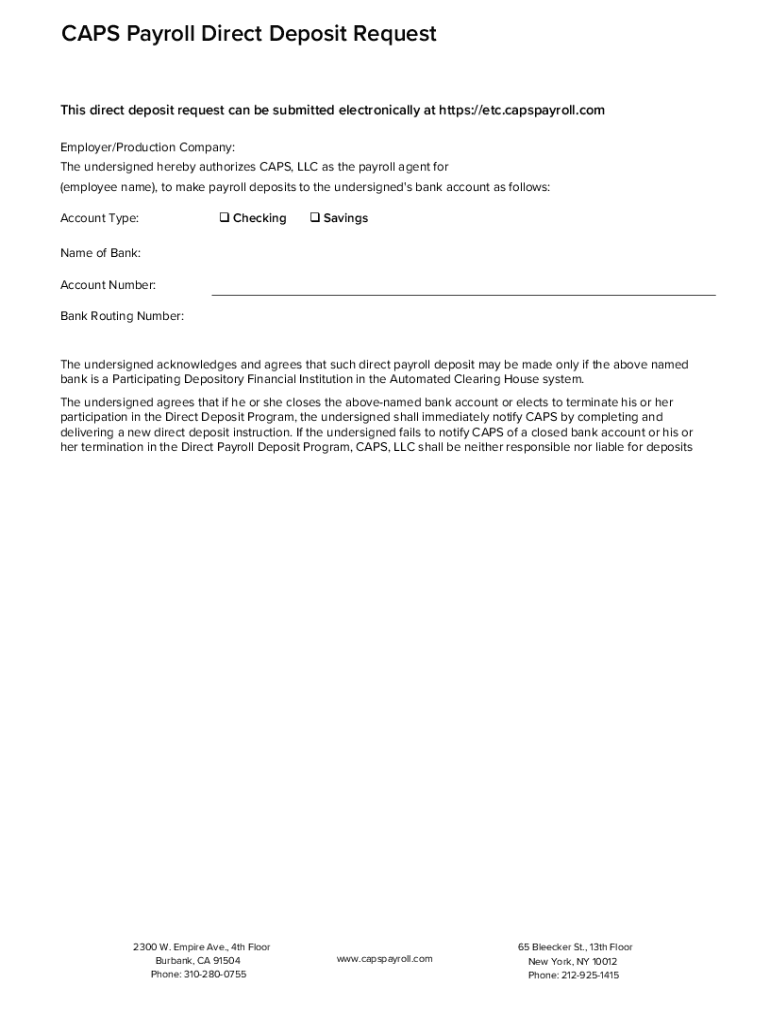

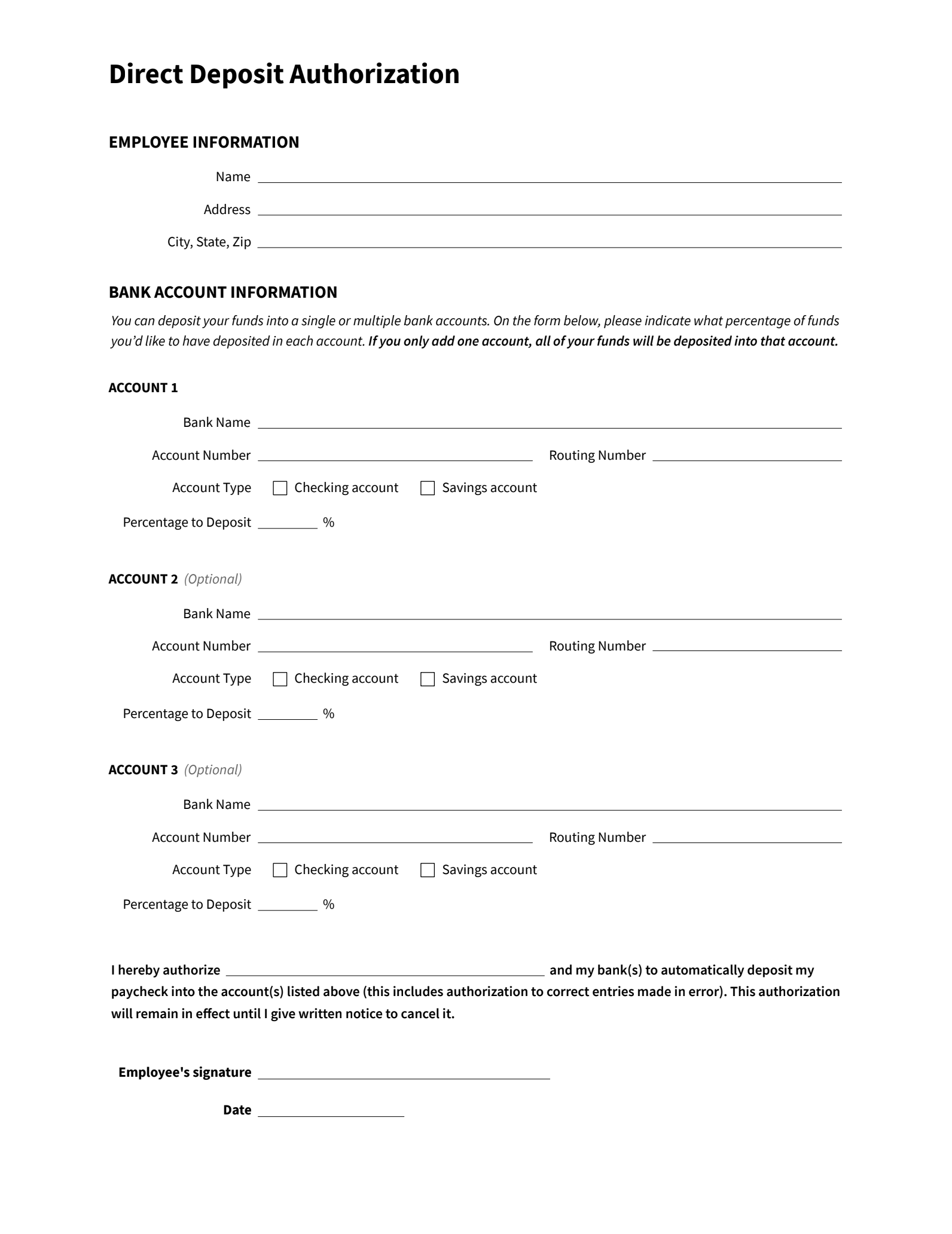

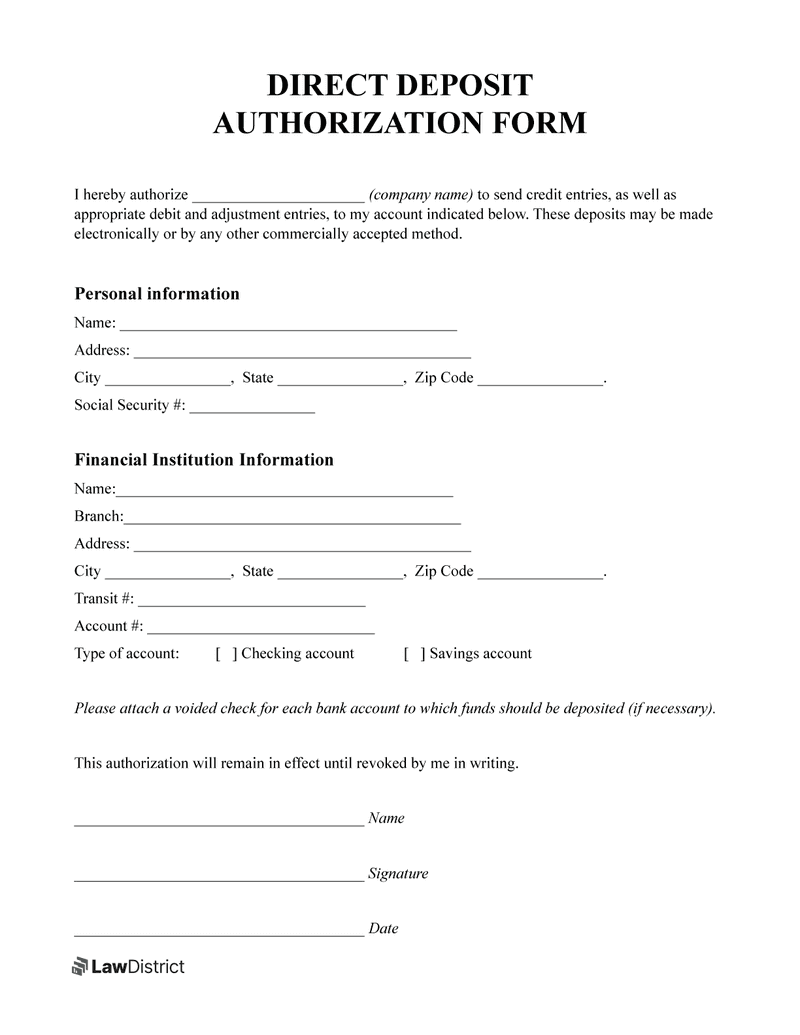

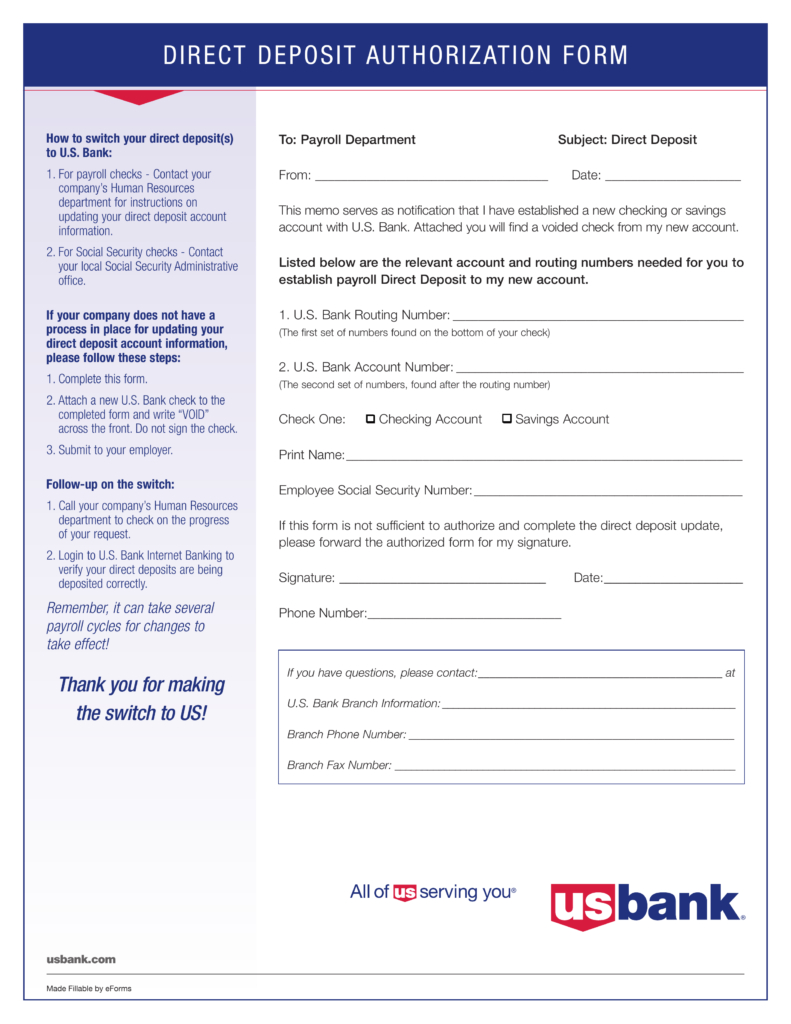

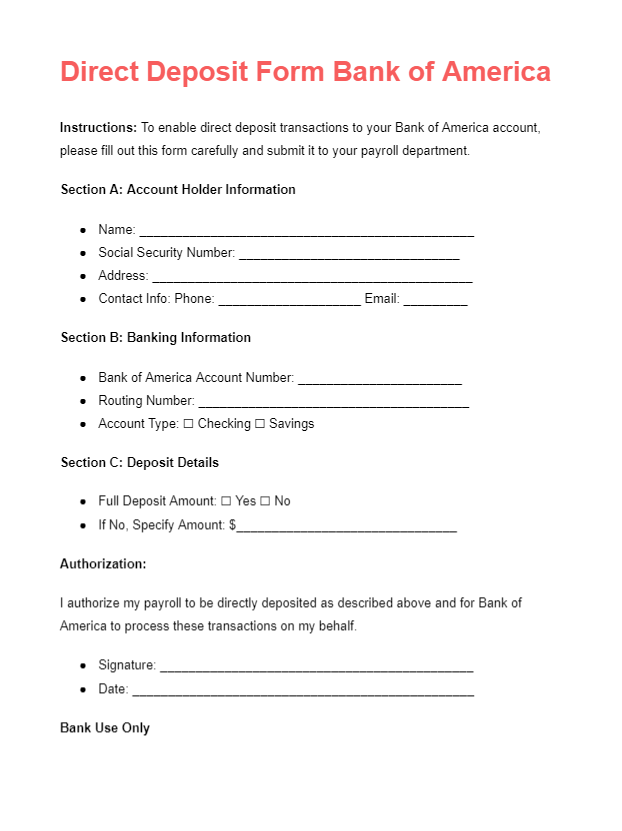

Examples of Bank Letters for Direct Deposit

Bank letters for direct deposit may vary in format and content depending on the bank and its policies. However, most letters include essential information such as:

- Account Holder’s Name: This is the name of the individual who owns the bank account.

- Account Number: This unique number identifies the specific bank account where funds will be deposited.

- Routing Number: This number is used to identify the bank where the account is held and is essential for processing direct deposits.

- Bank Name and Address: This information identifies the financial institution where the account is held.

Tips for Successful Direct Deposit Setup

Setting up direct deposit with your employer can streamline the payment process and ensure that you receive funds promptly. Here are some tips for a successful direct deposit setup:

- Double-Check Your Account Information: Ensure that the account number and routing number provided to your employer are accurate to prevent any payment issues.

- Keep Your Bank Informed: Notify your bank of any changes to your account information to avoid disruptions in direct deposit payments.

- Monitor Your Account: Regularly check your bank statements to verify that direct deposits are being made correctly and on time.

- Secure Your Bank Letter: Keep your bank letter in a safe place and only provide it to trusted parties when necessary.

Conclusion

In conclusion, a bank letter for direct deposit is a crucial document for setting up direct deposit with your employer. It ensures that payments are processed accurately and securely, benefiting both parties involved.

By following the steps outlined in this guide and keeping the tips in mind, you can successfully set up direct deposit and enjoy the convenience of automated payments.

Bank Letter For Direct Deposit – Download