What Is Direct Deposit?

Direct deposit is a financial transaction in which a paying entity electronically transfers funds directly into a recipient’s bank account. This method eliminates the need for paper checks and provides a secure and convenient way for individuals to access their funds.

What is a Bank Direct Deposit Form?

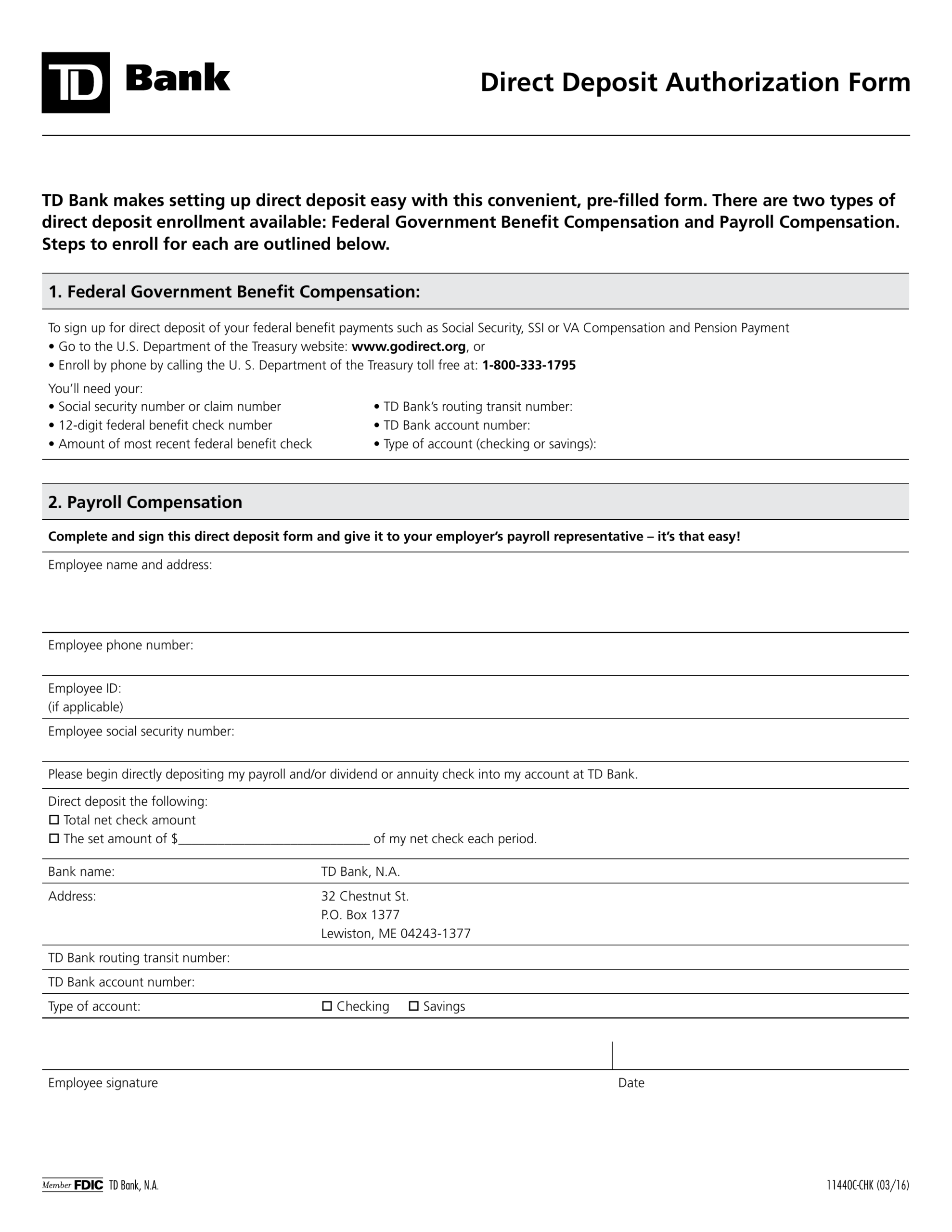

A bank direct deposit form serves as a written authorization from a recipient to a paying entity, allowing the entity to electronically deposit funds directly into the recipient’s bank account. This form is essential for setting up and managing direct deposit arrangements.

How Direct Deposit Works

Submission of Bank Direct Deposit Form

To initiate direct deposit, recipients must complete a bank direct deposit form and submit it to the paying entity, such as an employer or government agency. The form contains the recipient’s personal and banking details, along with an authorization statement to process the deposit.

Processing of Direct Deposit Request

Once the paying entity receives the bank direct deposit form, they will process the direct deposit request and set up the electronic transfer of funds. The entity verifies the recipient’s information and ensures that the authorization statement is signed before initiating the deposit.

Transfer of Funds through Direct Deposit

On the designated payment date, the paying entity electronically transfers the funds directly into the recipient’s bank account. Recipients can access their funds immediately through various banking channels, making direct deposit a quick and efficient payment method.

Confirmation of Direct Deposit Transaction

After the funds have been deposited into the recipient’s account, the paying entity may confirm the direct deposit transaction. Recipients can verify the deposit by checking their account balance or reviewing their transaction history online or through their banking app.

Frequency of Direct Deposit Payments

Direct deposit payments can be set up as one-time transfers or recurring deposits, depending on the arrangement between the recipient and the paying entity. Recipients may receive direct deposit payments on a weekly, bi-weekly, or monthly basis, aligning with their payment schedule.

Flexibility in Direct Deposit Arrangements

Direct deposit arrangements offer flexibility for both recipients and paying entities. Recipients can easily update their banking information or change their deposit preferences by submitting a new bank direct deposit form. This flexibility ensures that recipients can manage their payments effectively.

Efficiency of Direct Deposit Processing

Direct deposit is known for its efficiency in processing payments. Funds are transferred electronically, reducing the time and resources required for manual check processing. This efficiency benefits both recipients and paying entities by streamlining the payment process and reducing administrative costs.

Advantages and Disadvantages of Direct Deposit

Advantages of Direct Deposit

- Convenience: Direct deposit offers recipients the convenience of accessing their funds quickly and securely without the need to visit a bank.

- Security: Electronic transfers reduce the risk of lost or stolen checks, providing recipients with added security for their payments.

- Efficiency: Direct deposit streamlines the payment process for paying entities, reducing administrative tasks and processing time.

- Flexibility: Recipients can customize their direct deposit arrangements to meet their financial needs and preferences.

- Cost Savings: Direct deposit eliminates the need for paper checks, saving on printing and mailing costs for paying entities.

Disadvantages of Direct Deposit

- Privacy Concerns: Some recipients may have privacy concerns about providing their personal and banking information on a direct deposit form.

- Dependency on Technology: Direct deposit relies on electronic systems, which may pose challenges for individuals without access to digital banking services.

- Lack of Physical Check: Some recipients prefer the physical act of depositing a paper check over electronic transfers.

- Account Verification: Recipients must ensure that their banking information is accurate and up-to-date to prevent payment errors.

- Unexpected Changes: Changes in banking information or payment schedules may require recipients to update their direct deposit arrangements promptly.

What Do You Need for Direct Deposit?

Recipient Information for Direct Deposit

To set up direct deposit, recipients must provide the paying entity with their full name, address, social security number, bank account number, routing number, and a signed authorization statement. This information is essential for processing the direct deposit request securely.

Bank Account Details for Direct Deposit

Recipients should ensure that they provide accurate and up-to-date bank account details on the direct deposit form. Account and routing numbers must be entered correctly to prevent payment delays or errors. Verifying this information is crucial for a successful direct deposit setup.

Authorization Statement for Direct Deposit

The authorization statement on a direct deposit form confirms that the recipient agrees to have their funds deposited directly into their bank account. By signing this statement, recipients authorize the paying entity to initiate electronic transfers on their behalf securely.

Verification of Direct Deposit Information

Before submitting the direct deposit form, recipients should verify all information provided, including their personal and banking details. Mistakes in account numbers or routing numbers can lead to payment errors, so double-checking the information is essential for a smooth direct deposit process.

Retention of Direct Deposit Documentation

After setting up direct deposit, recipients should retain a copy of the documentation for their records. This includes the completed direct deposit form and any confirmation receipts provided by the paying entity. Keeping a record of the direct deposit documentation can help recipients track their payments, verify deposit amounts, and address any discrepancies that may arise in the future.

Communication with Paying Entity for Direct Deposit

Recipients should maintain open communication with the paying entity regarding their direct deposit arrangements. If there are any changes to personal or banking information, recipients should promptly notify the entity to update their direct deposit details. Clear communication ensures that payments are processed accurately and efficiently.

Accessibility of Direct Deposit Information

Recipients should ensure that their direct deposit information is easily accessible for reference. Keeping copies of the direct deposit form, confirmation receipts, and any communication with the paying entity in a secure and organized manner can help recipients manage their payments effectively.

Review of Direct Deposit Transactions

Recipients should regularly review their direct deposit transactions to ensure that payments are processed correctly and promptly. Monitoring account activity, checking deposit amounts, and verifying payment dates can help recipients identify any discrepancies and address them promptly with the paying entity.

Security Measures for Direct Deposit Information

To protect sensitive direct deposit information, recipients should take necessary security measures. This includes keeping physical copies of direct deposit forms in a secure location, safeguarding online access to banking accounts, and being cautious when sharing personal or banking information with third parties.

Update of Direct Deposit Preferences

If recipients wish to make changes to their direct deposit preferences, such as updating banking information or altering payment amounts, they should submit a new direct deposit form to the paying entity. Keeping direct deposit preferences current ensures that payments are directed to the correct account securely.

Seeking Assistance with Direct Deposit Setup

If recipients encounter any difficulties or have questions about setting up direct deposit, they should seek assistance from the paying entity’s human resources department, financial services team, or customer support. Clear guidance and support can help recipients navigate the direct deposit process effectively.

How Long Does Direct Deposit Take?

The processing time for direct deposit can vary depending on the paying entity’s schedule and banking practices. In general, direct deposit payments are usually processed and deposited into recipients’ accounts on the designated payment date, providing quick access to funds.

Conclusion

Direct deposit offers recipients a convenient, secure, and efficient way to access their funds electronically. By understanding the process of setting up direct deposit, completing a bank direct deposit form, and managing direct deposit arrangements, recipients can benefit from faster payment processing and improved financial management.

With the flexibility and reliability of direct deposit, individuals can streamline their payment methods and enjoy the convenience of electronic fund transfers.

Bank Direct Deposit Form Template – DOWNLOAD