In the world of business, understanding financial performance is crucial for making informed decisions and ensuring long-term success. One key tool that helps companies evaluate their financial health and profitability is the Profit and Loss (P&L) report.

This report provides a comprehensive summary of a company’s revenues, costs, and expenses over a specific period, offering valuable insights into the company’s financial performance.

What is a Profit and Loss Report?

A Profit and Loss report, also known as an income statement, is a financial statement that summarizes a company’s revenues, costs, and expenses over a specific period, typically on a monthly, quarterly, or annual basis.

The main goal of a P&L report is to show whether a company is generating a profit or incurring a loss during the period under review. It provides a snapshot of the company’s financial performance and helps stakeholders assess its overall health and profitability.

Why are Profit and Loss Reports Important?

Profit and Loss reports play a crucial role in helping businesses and stakeholders evaluate the financial health and performance of a company. Here are some reasons why P&L reports are important:

- Financial Health: P&L reports provide a clear picture of a company’s financial performance, showing whether the company is profitable or incurring losses.

- Decision Making: Businesses use P&L reports to make informed decisions about pricing, costs, and growth strategies based on their financial performance.

- Budgeting and Forecasting: P&L reports serve as a basis for budgeting and forecasting future financial performance, helping companies plan for the future.

- Lender and Investor Evaluation: External parties, such as lenders and investors, use P&L reports to assess a company’s ability to generate income and repay debts, influencing investment decisions.

What to Include in a Profit and Loss Report?

When creating a Profit and Loss report for your business, it’s essential to include the following key components:

- Revenue: This section should detail all sources of income generated by the company during the period under review, such as sales revenue, service revenue, and interest income.

- Cost of Goods Sold (COGS): These are the direct costs associated with producing goods or services sold by the company, including materials, labor, and overhead expenses.

- Gross Profit: Calculated by subtracting the COGS from the total revenue, the gross profit represents the company’s profitability before deducting operating expenses.

- Operating Expenses: These include all costs incurred in the day-to-day operations of the business, such as salaries, rent, utilities, marketing expenses, and depreciation.

- Net Income/Loss: The final section of the P&L report shows the company’s overall profitability or loss after deducting all expenses from the gross profit.

How to Analyze a Profit and Loss Report

Analyzing a Profit and Loss report involves interpreting the data to gain insights into the company’s financial performance and profitability. Here are some key steps to effectively analyze a P&L report:

Comparing Periods for Financial Trend Analysis

One effective way to analyze a Profit and Loss report is to compare the current period’s financial data with data from previous periods. By analyzing trends in revenue, expenses, and profitability over time, businesses can identify patterns, forecast future financial performance, and make informed decisions based on historical data. Comparing periods helps companies understand how their financial performance has evolved, identify areas for improvement, and set realistic financial goals for the future. It also enables businesses to track progress towards financial objectives and adjust strategies as needed to achieve sustainable growth and profitability.

Utilizing Financial Ratios for Performance Evaluation

Financial ratios are essential tools for analyzing a company’s financial health and performance based on data from the Profit and Loss report. By calculating ratios such as gross profit margin, net profit margin, and return on investment, businesses can assess profitability, operational efficiency, and overall financial performance. Financial ratios help companies benchmark their performance against industry standards, identify areas of strength and weakness, and make strategic decisions to improve financial outcomes. By monitoring key financial ratios regularly, businesses can track progress towards financial goals, make informed decisions, and optimize their financial performance for long-term success.

Identifying and Addressing Cost Drivers

Analyzing a Profit and Loss report involves identifying the main cost drivers that impact a company’s profitability and financial performance. By categorizing expenses, tracking spending patterns, and analyzing cost data, businesses can pinpoint areas where costs are high or increasing rapidly. Identifying cost drivers helps companies understand the factors influencing their expenses, implement cost-saving measures, and improve operational efficiency. By addressing cost drivers effectively, businesses can reduce expenses, increase profitability, and allocate resources more efficiently to support sustainable growth and financial success.

Monitoring Key Performance Indicators for Financial Progress

Key performance indicators (KPIs) are essential metrics used to track a company’s financial progress and performance based on data from the Profit and Loss report. By monitoring KPIs related to revenue, expenses, profitability, and other financial metrics, businesses can assess their financial health, set targets for improvement, and measure success against predefined objectives. KPIs provide valuable insights into the company’s financial performance, highlight areas of concern or opportunity, and guide decision-making to enhance financial outcomes. By establishing and monitoring KPIs regularly, businesses can stay informed about their financial position, make proactive adjustments to their strategies, and achieve sustainable growth and profitability.

Tips for Creating an Effective Profit and Loss Report

When preparing a Profit and Loss report for your business, consider the following tips to ensure its accuracy and effectiveness:

Maintaining Consistent Accounting Practices

Consistency is key when creating a Profit and Loss report for your business. It’s essential to use consistent accounting methods, reporting formats, and categorization criteria to ensure that your financial data is accurate, reliable, and comparable over time. By maintaining consistent accounting practices, businesses can track financial performance effectively, identify trends, and make informed decisions based on reliable data. Consistency also promotes transparency, accountability, and trust among stakeholders, enhancing the credibility of the financial information presented in the P&L report.

Providing Detailed Descriptions for Improved Understanding

Including detailed descriptions for each revenue and expense item in the Profit and Loss report enhances understanding and transparency for stakeholders. By providing clear explanations of revenue sources, expense categories, and cost components, businesses can ensure that financial data is interpreted correctly and decision-making is informed by accurate information. Detailed descriptions also help stakeholders identify key drivers of financial performance, assess the impact of various factors on profitability, and track changes in revenue and expenses over time. Clarity and specificity in financial reporting contribute to better decision-making, improved financial management, and long-term business success.

Regularly Reviewing and Analyzing Financial Performance

Regular review and analysis of the Profit and Loss report are essential for tracking financial performance, identifying trends, and making timely adjustments to your business strategy. By reviewing the P&L report on a regular basis, businesses can stay informed about their financial position, monitor progress towards financial goals, and address any emerging challenges or opportunities promptly. Analyzing financial data enables companies to understand their financial performance, evaluate the effectiveness of their strategies, and make informed decisions to improve profitability and sustainability. Regular review and analysis of the P&L report help businesses adapt to changing market conditions, optimize financial outcomes, and achieve long-term success.

Seeking Professional Guidance for Financial Expertise

If you’re unsure about creating a Profit and Loss report or interpreting the data effectively, consider seeking the help of a financial advisor or accountant for expert guidance. Financial professionals can provide valuable insights, expertise, and recommendations to help businesses create accurate P&L reports, analyze financial data, and make informed decisions based on sound financial principles. By consulting with experts in financial management, businesses can enhance their financial literacy, improve financial reporting practices, and optimize their financial performance for sustainable growth and success. Seeking professional help ensures that your Profit and Loss report is accurate, reliable, and aligned with best practices in financial management and reporting.

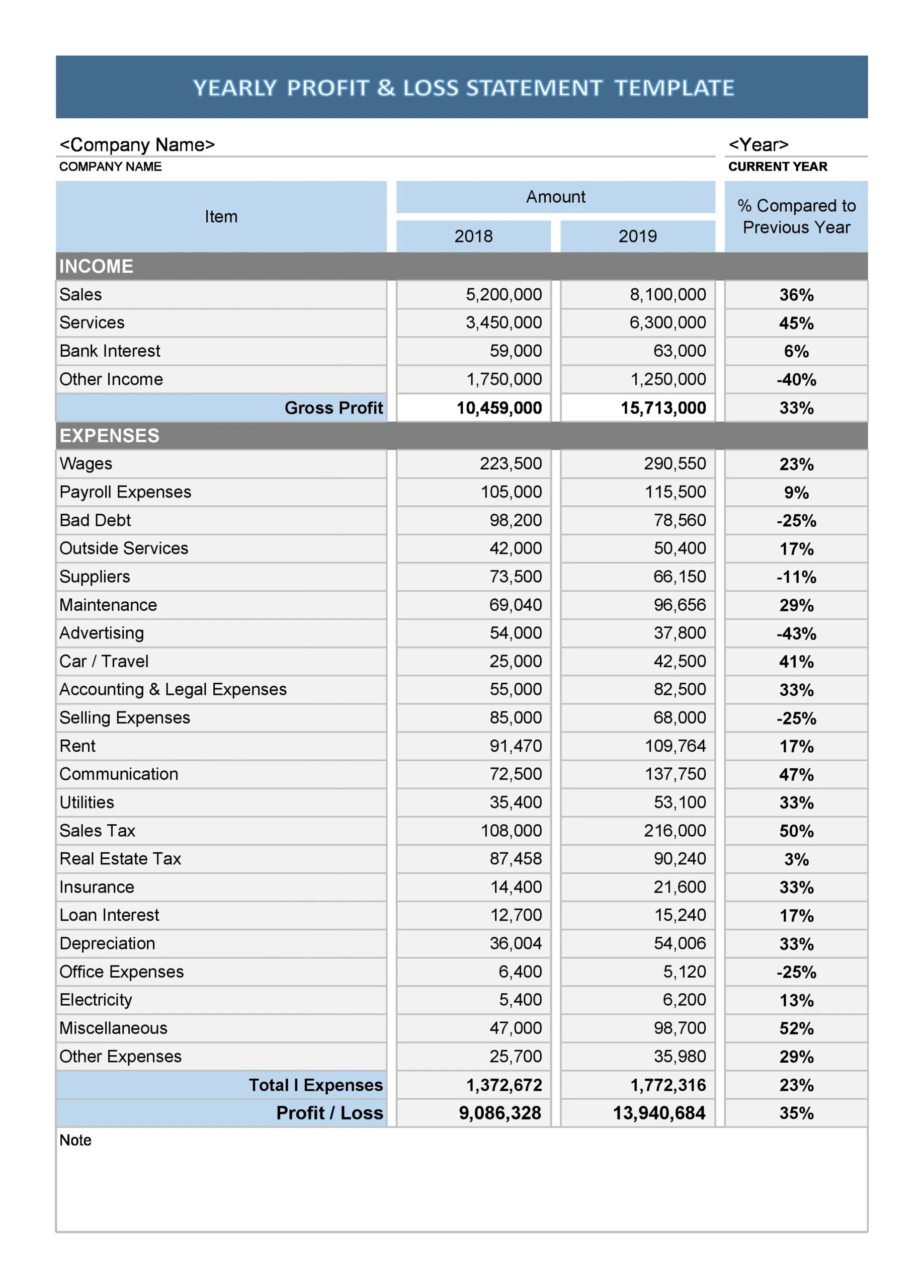

Profit And Loss Report Template

In conclusion, a Profit and Loss Report helps you track revenue, expenses, and net profit to gain a clear picture of your business’s financial performance.

Make informed decisions and improve profitability—download our Profit and Loss Report Template today to manage your business finances with confidence!

Profit And Loss Report Template – DOWNLOAD