Are you a small business owner looking to keep track of your finances more effectively? Do you want to understand how your company is performing financially? One useful tool that can help you achieve these goals is a profit and loss account.

In this comprehensive guide, we will delve into what a profit and loss account is, why it is important, how to create one, and provide some examples and tips for successful implementation.

What is a Profit and Loss Account?

A profit and loss account, also known as an income statement, is a financial statement that shows a company’s revenues, expenses, and net income over a specific period of time. It provides valuable insights into how well a business is performing financially and can help identify areas for improvement. The profit and loss account is an essential tool for small business owners to monitor their financial health and make informed decisions.

Creating a profit and loss account may seem overwhelming at first, but with the right tools and guidance, it can be a straightforward process. By organizing your revenue and expenses into categories, you can easily track your company’s financial performance and identify any trends or patterns that may impact your bottom line.

Why the Profit and Loss Account is Important

A profit and loss account is important for several reasons. First and foremost, it provides a snapshot of your company’s financial performance over a specific period of time. By comparing your revenues and expenses, you can determine whether your business is making a profit or operating at a loss. This information is crucial for making strategic decisions about your company’s future and ensuring its long-term success.

Additionally, a profit and loss account can help you identify areas where you can cut costs or increase revenue. By analyzing your expenses and revenue streams, you can pinpoint areas of inefficiency or opportunities for growth. This insight can help you optimize your company’s financial performance and improve its overall profitability.

How to Create a Profit and Loss Account

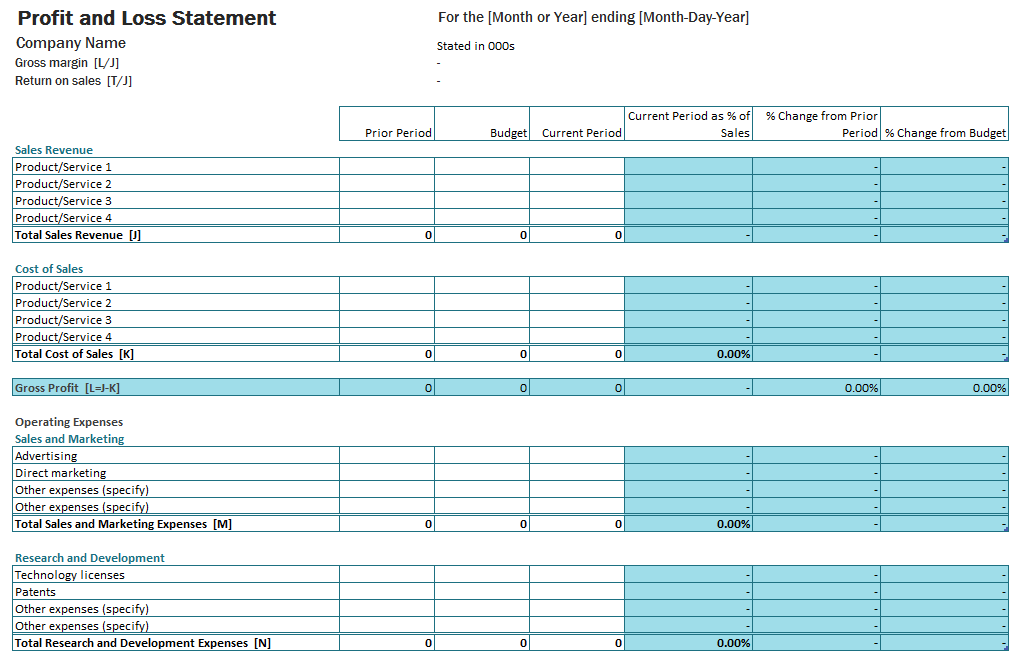

Creating a profit and loss account involves several steps. First, you will need to gather all relevant financial data, including your company’s revenue and expenses for the specific period you are analyzing. Next, organize this data into categories, such as sales, operating expenses, and taxes. Once you have categorized your financial data, you can calculate your net income by subtracting your expenses from your revenue.

To create a profit and loss account, you can use accounting software or templates available online. These tools can streamline the process and ensure accuracy in your financial statements. Make sure to review your profit and loss account regularly to track your company’s financial performance and make informed decisions about its future.

Examples of Profit and Loss Account

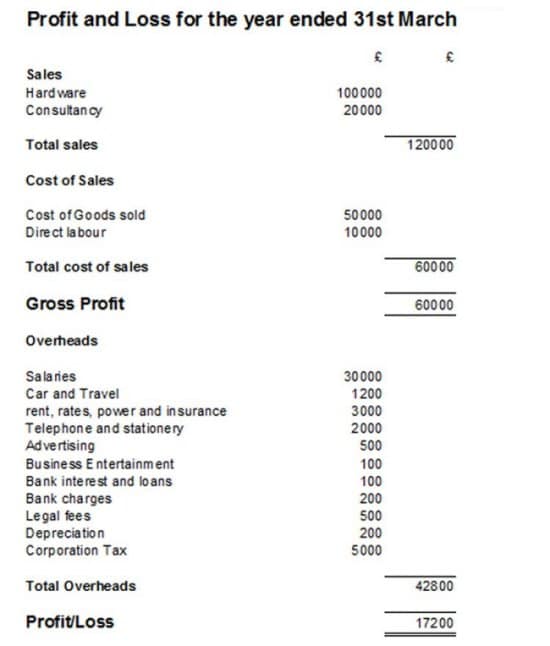

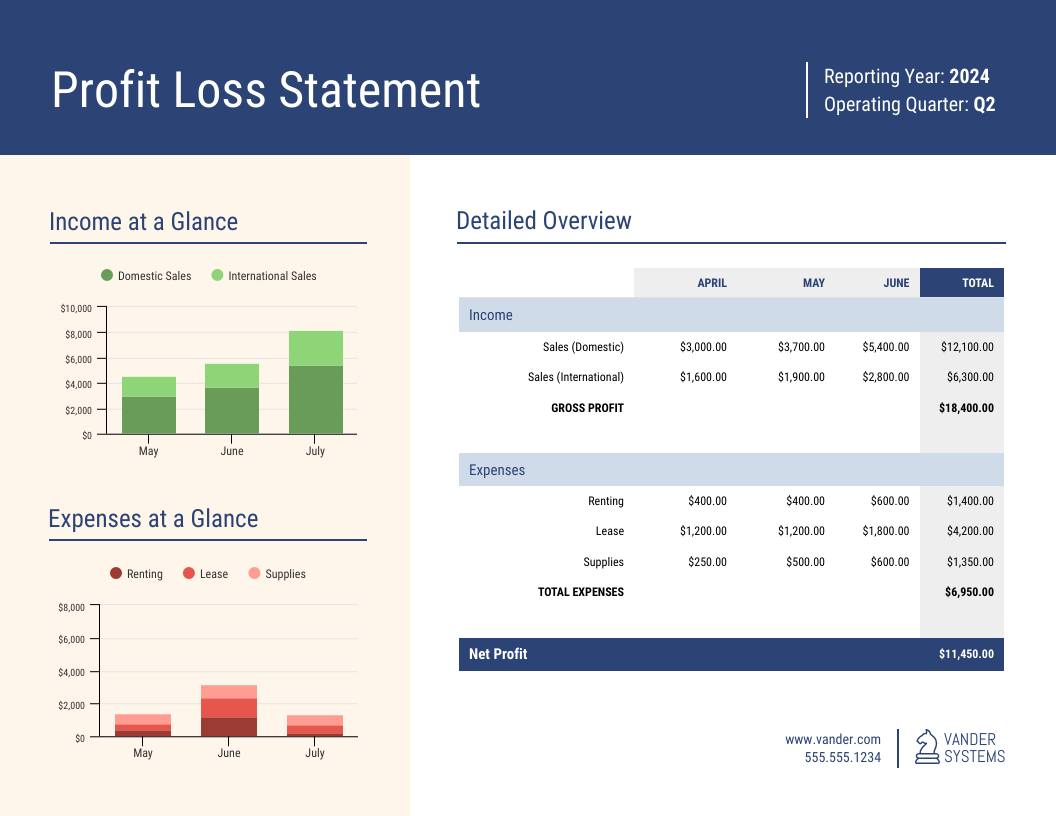

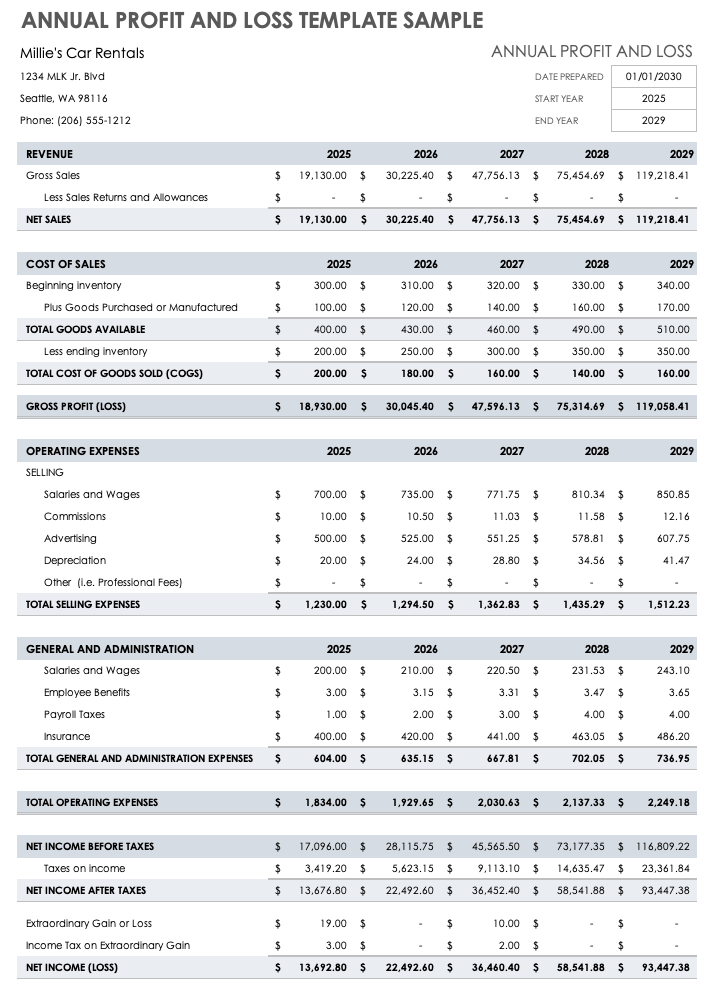

To better understand how a profit and loss account works, let’s look at some examples. Suppose you run a small retail business and want to analyze your financial performance for the first quarter of the year. Your profit and loss account may include categories such as sales revenue, cost of goods sold, operating expenses, and net income.

- Sales Revenue. This category includes all revenue generated from the sale of goods or services.

- Cost of Goods Sold. This category includes the direct costs associated with producing the goods or services sold.

- Operating Expenses. This category includes all other expenses incurred in the operation of the business, such as rent, utilities, and salaries.

- Net Income. This category represents the difference between your total revenue and total expenses, indicating whether your business is profitable.

Tips for a Successful Profit and Loss Account

Creating a profit and loss account can be a valuable tool for small business owners, but it is essential to follow some tips for success. Here are a few tips to help you effectively manage your finances and make informed decisions:

- Keep accurate records. Make sure to maintain detailed records of all your financial transactions to ensure the accuracy of your profit and loss account.

- Review your profit and loss account regularly. By reviewing your financial statements regularly, you can track your company’s performance and make adjustments as needed.

- Seek professional advice. If you are unsure about creating a profit and loss account, consider seeking advice from a financial advisor or accountant.

- Use accounting software. Utilize accounting software to streamline the process of creating and managing your profit and loss account.

- Set financial goals. Establish clear financial goals for your business and use your profit and loss account to track your progress towards achieving them.

In Conclusion

In conclusion, a profit and loss account is a valuable tool for small business owners to monitor their financial performance and make informed decisions about their company’s future. By understanding what a profit and loss account is, why it is important, how to create one, and following some examples and tips for success, you can effectively manage your finances and ensure the long-term success of your business. Take control of your company’s financial health today by implementing a profit and loss account.

Profit And Loss Account Template – Download